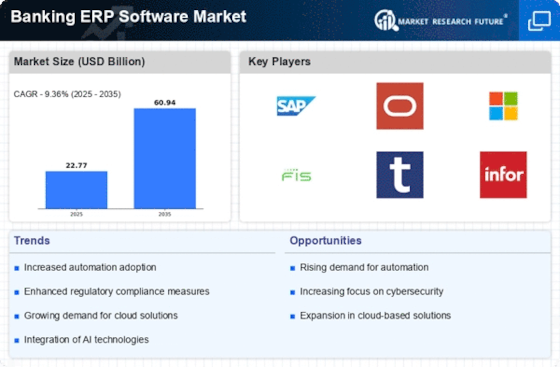

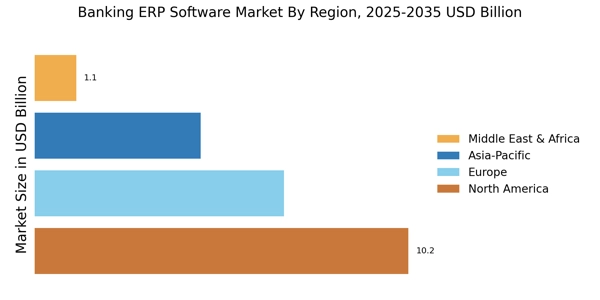

North America : Innovation and Leadership Hub

North America remains the largest market for Banking ERP software, holding approximately 45% of the global market share. The region's growth is driven by technological advancements, increasing demand for digital banking solutions, and stringent regulatory requirements. The presence of major financial institutions and a robust IT infrastructure further catalyze market expansion. Regulatory bodies are pushing for enhanced compliance and security measures, which are vital for market growth. The United States leads the North American market, followed by Canada, with significant contributions from key players like Oracle, Microsoft, and SAP. The competitive landscape is characterized by continuous innovation and strategic partnerships among these firms. The focus on cloud-based solutions and AI integration is reshaping the market, making it more agile and responsive to customer needs. As a result, North America is set to maintain its leadership in the Banking ERP sector.

Europe : Regulatory Compliance and Growth

Europe is the second-largest market for Banking ERP software, accounting for approximately 30% of the global market share. The region's growth is fueled by increasing regulatory compliance requirements, digital transformation initiatives, and a rising demand for integrated financial solutions. The European Union's regulations, such as PSD2, are driving banks to adopt advanced ERP systems to enhance customer experience and operational efficiency. This regulatory landscape is a significant catalyst for market growth. Leading countries in Europe include Germany, the UK, and France, where major players like SAP and Temenos are well-established. The competitive landscape is marked by a mix of local and international firms, all vying for market share through innovation and customer-centric solutions. The focus on sustainability and data protection is also shaping the market, as banks seek to align with EU regulations and consumer expectations. This dynamic environment positions Europe as a key player in the Banking ERP software market.

Asia-Pacific : Rapid Growth and Adoption

Asia-Pacific is witnessing rapid growth in the Banking ERP software market, holding approximately 20% of the global market share. The region's expansion is driven by increasing financial inclusion, a surge in digital banking, and government initiatives promoting fintech innovations. Countries like India and China are at the forefront, with their large populations and growing middle class fueling demand for advanced banking solutions. Regulatory support for digital transformation is also a key growth driver in this region. India and China are the leading countries in the Asia-Pacific market, with significant contributions from local players like TCS and Wipro, alongside global giants like Oracle and SAP. The competitive landscape is evolving, with a focus on cloud-based solutions and AI-driven analytics. As banks in this region strive to enhance operational efficiency and customer engagement, the demand for Banking ERP software is expected to continue its upward trajectory, making Asia-Pacific a vital market for future growth.

Middle East and Africa : Emerging Market Potential

The Middle East and Africa (MEA) region is emerging as a potential market for Banking ERP software, currently holding about 5% of the global market share. The growth in this region is driven by increasing investments in banking infrastructure, a rise in mobile banking adoption, and government initiatives aimed at enhancing financial services. Countries like South Africa and the UAE are leading the charge, with a focus on modernizing their banking systems to meet international standards and customer expectations. In the MEA region, the competitive landscape is characterized by a mix of local and international players, with firms like FIS and Temenos making significant inroads. The focus on digital transformation and regulatory compliance is reshaping the market, as banks seek to leverage technology for improved service delivery. As the region continues to develop, the demand for Banking ERP solutions is expected to grow, presenting numerous opportunities for both established and emerging players.