Enhanced Security Features

The Blockchain Distributed Ledger Market is experiencing a surge in demand for enhanced security features. As cyber threats become increasingly sophisticated, organizations are seeking robust solutions to protect sensitive data. Blockchain technology offers a decentralized approach, which inherently reduces the risk of data breaches. According to recent studies, the market for blockchain security solutions is projected to grow at a compound annual growth rate of 30% over the next five years. This growth is driven by the need for secure transactions and the protection of digital assets. Furthermore, industries such as finance and healthcare are particularly focused on implementing blockchain to ensure compliance with stringent regulatory requirements. The emphasis on security is likely to propel the Blockchain Distributed Ledger Market forward, as businesses prioritize safeguarding their operations against potential vulnerabilities.

Regulatory Support and Frameworks

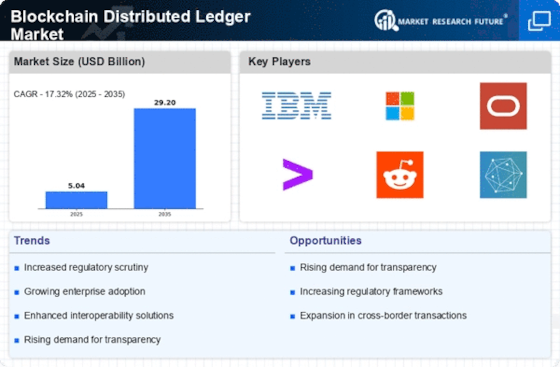

Regulatory support is becoming a pivotal driver for the Blockchain Distributed Ledger Market. Governments and regulatory bodies are increasingly recognizing the potential of blockchain technology to enhance transparency and efficiency in various sectors. For instance, several jurisdictions have begun to establish clear regulatory frameworks that facilitate the adoption of blockchain solutions. This regulatory clarity is essential for businesses to invest confidently in blockchain technologies. In 2025, it is estimated that over 60% of countries will have implemented some form of blockchain regulation, which could significantly boost market growth. The establishment of these frameworks not only encourages innovation but also fosters trust among stakeholders, thereby enhancing the overall credibility of the Blockchain Distributed Ledger Market.

Increased Investment in Blockchain Startups

Investment in blockchain startups is significantly influencing the Blockchain Distributed Ledger Market. Venture capitalists and institutional investors are increasingly recognizing the potential of blockchain technology to disrupt traditional business models. In 2025, it is projected that investments in blockchain-related startups will exceed USD 30 billion, driven by the promise of innovative applications across various sectors. This influx of capital not only accelerates the development of new solutions but also fosters a competitive landscape that encourages innovation. As startups introduce novel applications of blockchain, established companies are likely to collaborate or acquire these entities to enhance their own offerings. This dynamic is expected to further stimulate growth within the Blockchain Distributed Ledger Market, as new technologies and solutions emerge to meet evolving market demands.

Growing Demand for Supply Chain Transparency

The demand for supply chain transparency is a critical driver for the Blockchain Distributed Ledger Market. As consumers become more conscious of product origins and ethical sourcing, businesses are compelled to adopt technologies that provide traceability. Blockchain technology enables real-time tracking of goods, ensuring that all parties in the supply chain have access to accurate information. This capability is particularly valuable in industries such as food and pharmaceuticals, where safety and authenticity are paramount. Recent market analyses indicate that the blockchain supply chain market is expected to reach USD 9 billion by 2026, reflecting a growing recognition of the technology's potential to enhance operational efficiency. Consequently, the Blockchain Distributed Ledger Market is likely to expand as organizations seek to leverage blockchain for improved transparency and accountability.

Rising Interest in Decentralized Finance (DeFi)

The rising interest in decentralized finance (DeFi) is a transformative driver for the Blockchain Distributed Ledger Market. DeFi platforms leverage blockchain technology to provide financial services without traditional intermediaries, thereby reducing costs and increasing accessibility. As of October 2025, the total value locked in DeFi protocols has surpassed USD 100 billion, indicating a robust appetite for decentralized financial solutions. This trend is attracting both retail and institutional investors, who are drawn to the potential for higher returns and greater financial autonomy. The proliferation of DeFi applications is likely to catalyze further innovation within the Blockchain Distributed Ledger Market, as developers seek to create more sophisticated financial products and services that cater to diverse user needs.