Regulatory Pressures

Regulatory compliance is a critical driver in the Cybersecurity in Banking Market, as financial institutions are mandated to adhere to stringent regulations aimed at protecting consumer data. Authorities have implemented various frameworks, such as the General Data Protection Regulation (GDPR) and the Payment Card Industry Data Security Standard (PCI DSS), which necessitate robust cybersecurity measures. Non-compliance can lead to severe penalties, including hefty fines and reputational damage. Consequently, banks are increasingly investing in cybersecurity solutions to ensure compliance and mitigate risks. The market is projected to expand as institutions prioritize regulatory adherence, thereby fostering a culture of security within their operations.

Rise in Cyber Threats

The Cybersecurity in Banking Market is experiencing a notable surge in cyber threats, which appears to be a primary driver for increased investment in security measures. Financial institutions are facing sophisticated attacks, including ransomware and phishing, which have escalated in frequency and complexity. According to recent data, the banking sector has reported a 30% increase in cyber incidents over the past year. This alarming trend compels banks to enhance their cybersecurity frameworks, invest in advanced technologies, and adopt proactive measures to safeguard sensitive customer data. As a result, the demand for cybersecurity solutions is likely to grow, pushing the market towards innovative approaches to combat these evolving threats.

Technological Advancements

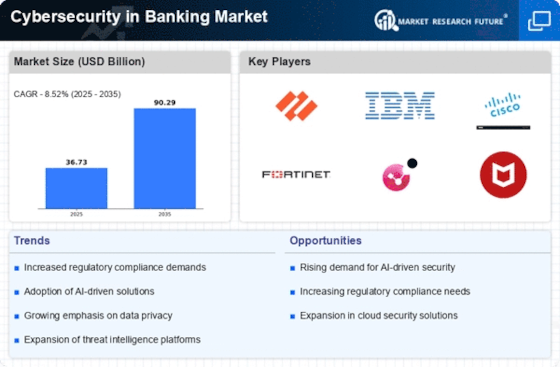

The Cybersecurity in Banking Market is significantly influenced by rapid technological advancements, which are reshaping the landscape of security solutions. Innovations such as artificial intelligence, machine learning, and blockchain technology are being integrated into cybersecurity frameworks to enhance threat detection and response capabilities. For instance, AI-driven analytics can identify anomalies in real-time, allowing banks to respond swiftly to potential breaches. The market for cybersecurity solutions is expected to grow at a compound annual growth rate (CAGR) of 12% over the next five years, driven by the adoption of these advanced technologies. This trend indicates a shift towards more sophisticated and adaptive security measures in the banking sector.

Increased Digital Banking Adoption

The shift towards digital banking is a significant driver in the Cybersecurity in Banking Market, as more consumers opt for online and mobile banking services. This transition has expanded the attack surface for cybercriminals, making robust cybersecurity measures essential for protecting customer information and maintaining trust. As digital transactions continue to rise, banks are compelled to invest in comprehensive cybersecurity strategies to safeguard their platforms. Recent statistics indicate that digital banking users have increased by 40% in the last two years, further emphasizing the need for enhanced security protocols. This growing reliance on digital services is likely to propel the demand for cybersecurity solutions in the banking sector.

Consumer Awareness and Demand for Security

Consumer awareness regarding cybersecurity risks is becoming a pivotal driver in the Cybersecurity in Banking Market. As individuals become more informed about potential threats, they are increasingly demanding higher levels of security from their financial institutions. This heightened awareness is prompting banks to prioritize cybersecurity initiatives and communicate their security measures effectively to customers. Surveys indicate that 70% of consumers consider cybersecurity a critical factor when choosing a banking service. Consequently, banks are investing in advanced cybersecurity solutions to meet these expectations and build customer trust. This trend is likely to shape the future of the market, as institutions strive to align their security offerings with consumer demands.