Advancements in Genomic Technologies

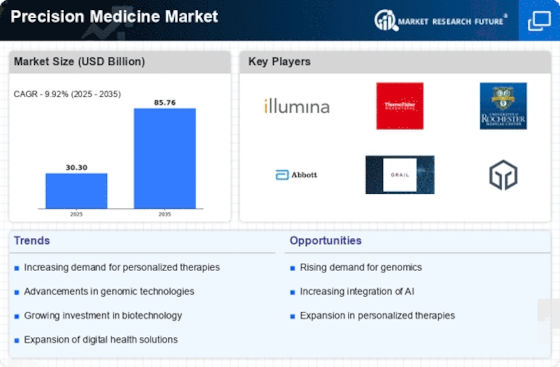

The Precision Medicine Market is experiencing a surge due to advancements in genomic technologies. Innovations in sequencing methods, such as next-generation sequencing (NGS), have significantly reduced the cost and time required for genetic analysis. This has enabled healthcare providers to offer personalized treatment plans based on individual genetic profiles. As of 2025, the market for genomic testing is projected to reach approximately 25 billion USD, reflecting a compound annual growth rate of around 10%. These advancements not only enhance the accuracy of diagnoses but also facilitate the development of targeted therapies, thereby driving growth in the Precision Medicine Market.

Growing Demand for Targeted Therapies

The demand for targeted therapies is a significant driver in the Precision Medicine Market. As healthcare providers seek more effective treatment options, targeted therapies that focus on specific genetic markers are gaining traction. This trend is particularly evident in oncology, where treatments are increasingly tailored to the genetic profile of tumors. The market for targeted therapies is projected to expand rapidly, with estimates suggesting it could reach over 50 billion USD by 2025. This growing demand not only reflects a shift towards more effective treatment modalities but also underscores the importance of precision medicine in modern healthcare, thereby propelling the Precision Medicine Market.

Increased Focus on Personalized Healthcare

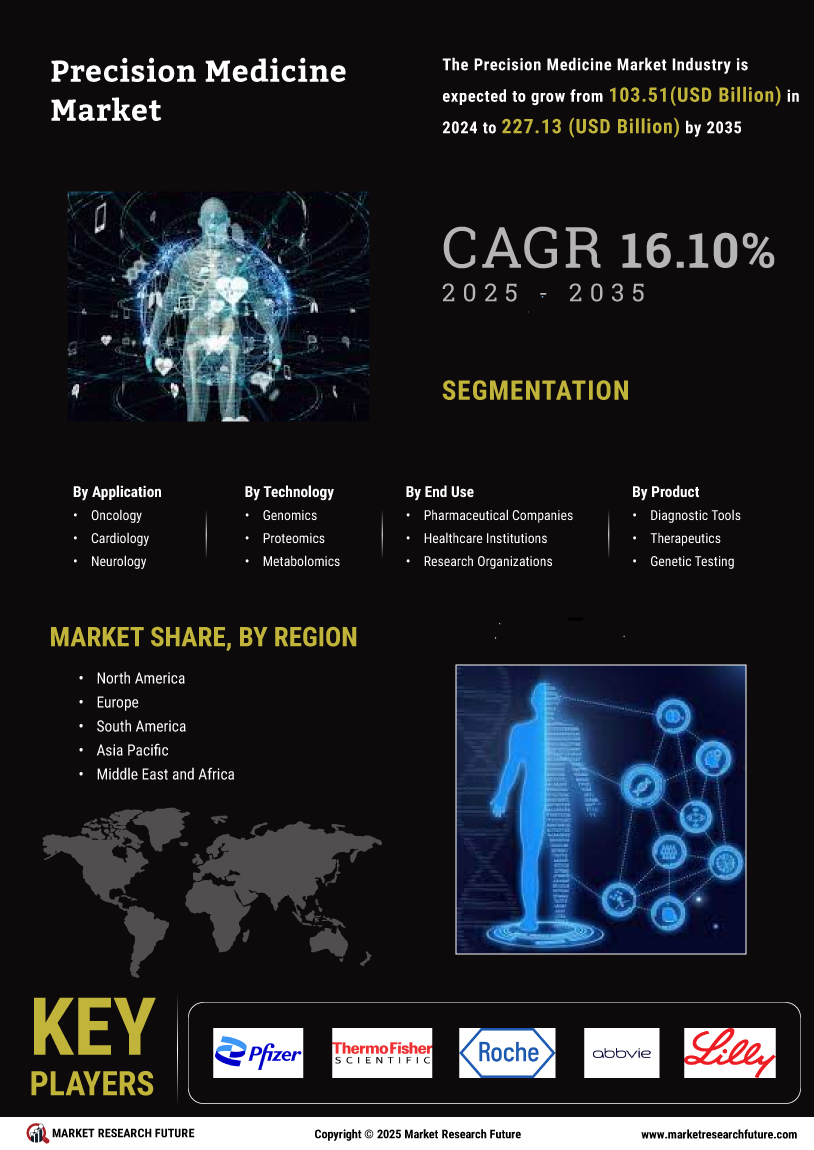

The Precision Medicine Market is witnessing an increased focus on personalized healthcare, which emphasizes tailored treatment strategies for patients. This shift is largely driven by the recognition that traditional one-size-fits-all approaches may not be effective for all individuals. As healthcare systems adopt more personalized methodologies, the demand for precision medicine solutions is expected to rise. By 2025, the market is anticipated to grow significantly, with estimates suggesting a valuation of over 100 billion USD. This trend indicates a broader acceptance of precision medicine as a standard practice in healthcare, thereby propelling the Precision Medicine Market forward.

Regulatory Support and Funding Initiatives

Regulatory support and funding initiatives play a crucial role in the growth of the Precision Medicine Market. Governments and regulatory bodies are increasingly recognizing the importance of precision medicine in improving patient outcomes. Initiatives such as grants for research and development, as well as streamlined approval processes for precision therapies, are being implemented. For instance, funding for precision medicine research has seen a notable increase, with allocations reaching several billion USD in recent years. This supportive environment fosters innovation and encourages investment in the Precision Medicine Market, ultimately enhancing the availability of personalized treatment options.

Integration of Artificial Intelligence in Healthcare

The integration of artificial intelligence (AI) in healthcare is emerging as a transformative force within the Precision Medicine Market. AI technologies are being utilized to analyze vast amounts of genomic data, enabling healthcare professionals to make more informed decisions regarding patient care. By 2025, the AI in healthcare market is expected to surpass 36 billion USD, indicating a robust growth trajectory. This integration enhances the ability to identify patterns and predict patient responses to treatments, thereby improving the efficacy of precision medicine approaches. As AI continues to evolve, its impact on the Precision Medicine Market is likely to be profound, fostering innovation and improving patient outcomes.