Regulatory Support

Regulatory support is emerging as a key driver for the Precision fermentation ingredients Market. Governments and regulatory bodies are increasingly recognizing the potential of precision fermentation to contribute to food security and sustainability. Initiatives aimed at fostering innovation in biotechnology are being implemented, which may include funding for research and development, as well as streamlined approval processes for new ingredients. This supportive regulatory environment encourages investment in precision fermentation technologies, facilitating market entry for new players. As regulations evolve to accommodate these advancements, the Precision Fermentation Ingredients Market is likely to experience accelerated growth, as companies can more readily bring innovative products to market. This trend underscores the importance of collaboration between industry stakeholders and regulatory agencies to ensure the safe and effective use of precision fermentation.

Technological Innovations

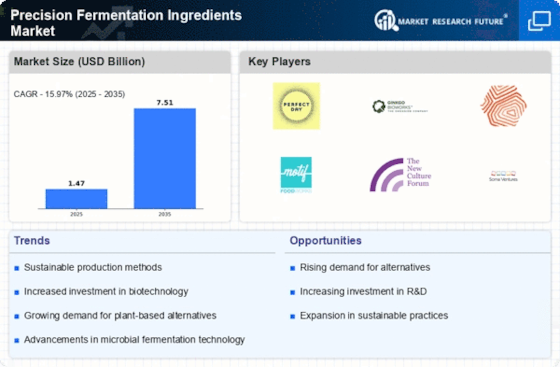

Technological innovations play a pivotal role in shaping the Precision Fermentation Ingredients Market. Advances in biotechnology, such as synthetic biology and metabolic engineering, have enhanced the efficiency and scalability of fermentation processes. These innovations enable the production of complex ingredients that were previously difficult to obtain through traditional fermentation. For example, the development of novel microbial strains can lead to higher yields and reduced production costs. According to recent estimates, the market for precision fermentation is projected to reach USD 25 billion by 2030, driven by these technological advancements. As research continues to evolve, the Precision Fermentation Ingredients Market is likely to witness an influx of new products and applications, further expanding its reach and impact across various sectors.

Sustainability Initiatives

The Precision Fermentation Ingredients Market is increasingly driven by sustainability initiatives. As consumers become more environmentally conscious, there is a growing demand for sustainable food production methods. Precision fermentation offers a way to produce ingredients with lower carbon footprints compared to traditional methods. For instance, it is estimated that precision fermentation can reduce greenhouse gas emissions by up to 90% in certain applications. This shift towards sustainability is not only a response to consumer preferences but also aligns with regulatory pressures aimed at reducing environmental impact. Companies that adopt precision fermentation technologies are likely to gain a competitive edge, as they can market their products as eco-friendly alternatives. This trend is expected to propel the Precision Fermentation Ingredients Market forward, as more businesses seek to innovate and meet the demands of a sustainability-focused consumer base.

Health and Nutrition Trends

The Precision Fermentation Ingredients Market is significantly influenced by health and nutrition trends. As consumers increasingly prioritize health-conscious choices, there is a rising demand for ingredients that offer functional benefits. Precision fermentation allows for the creation of bioactive compounds, probiotics, and other health-promoting ingredients that cater to this demand. The market for functional foods is expected to grow substantially, with projections indicating a compound annual growth rate of over 8% in the coming years. This trend is particularly relevant in the context of plant-based diets, where precision fermentation can provide essential nutrients and flavors that enhance the overall nutritional profile of products. Consequently, the Precision Fermentation Ingredients Market is well-positioned to capitalize on these evolving consumer preferences, driving innovation and product development.

Consumer Awareness and Education

Consumer awareness and education are crucial drivers of the Precision Fermentation Ingredients Market. As consumers become more informed about food production methods, there is a growing interest in understanding the benefits of precision fermentation. Educational campaigns and transparency in labeling can enhance consumer trust and acceptance of products derived from precision fermentation. This increased awareness is likely to lead to higher demand for such products, as consumers seek alternatives that align with their values regarding health, sustainability, and ethical considerations. Market Research Future indicates that products labeled as using precision fermentation are often perceived as higher quality, which can influence purchasing decisions. Therefore, as consumer education efforts continue to expand, the Precision Fermentation Ingredients Market is expected to benefit from a more engaged and informed customer base.