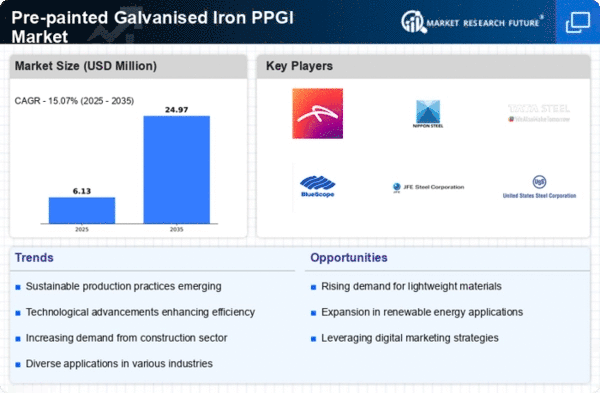

Market Growth Projections

The Global Pre-painted galvanised iron (PPGI) market industry is projected to experience substantial growth over the next decade. With an estimated market value of 153.8 USD Billion in 2024, the industry is expected to reach 401.3 USD Billion by 2035. This growth trajectory indicates a robust CAGR of 9.11% from 2025 to 2035, reflecting the increasing adoption of PPGI across various sectors. The expansion is likely driven by factors such as rising construction activities, technological advancements, and the growing demand for energy-efficient materials. These projections highlight the potential for PPGI to play a crucial role in future construction and manufacturing.

Rising Construction Activities

The Global Pre-painted galvanised iron (PPGI) market industry is experiencing a surge in demand due to increasing construction activities worldwide. Urbanization and infrastructure development are driving the need for durable and aesthetically pleasing building materials. For instance, the construction sector is projected to grow significantly, contributing to the anticipated market value of 153.8 USD Billion in 2024. This growth is further fueled by government initiatives aimed at enhancing infrastructure, which often incorporate PPGI for roofing, wall cladding, and other applications. As a result, the PPGI market is likely to expand in tandem with the construction industry's growth.

Increasing Automotive Production

The Global Pre-painted galvanised iron (PPGI) market industry is also influenced by the rising production of automobiles. PPGI is increasingly utilized in the automotive sector for components such as body panels and structural parts due to its lightweight and corrosion-resistant properties. As global automotive production continues to expand, the demand for PPGI is likely to increase correspondingly. This trend is particularly evident in regions with robust automotive manufacturing bases, where PPGI serves as a preferred material. The automotive industry's growth may further bolster the PPGI market, contributing to its overall expansion in the coming years.

Growing Demand for Energy Efficiency

The Global Pre-painted galvanised iron (PPGI) market industry is witnessing an increasing emphasis on energy-efficient building materials. PPGI offers excellent thermal insulation properties, which can lead to reduced energy consumption in buildings. This trend aligns with global sustainability goals, as energy-efficient structures are becoming a priority for both governments and consumers. The demand for PPGI is expected to rise as more construction projects incorporate energy-efficient designs. This shift could contribute to the market's projected growth, reaching 401.3 USD Billion by 2035, as stakeholders seek to meet regulatory requirements and consumer preferences for sustainable building solutions.

Expanding Applications in Renewable Energy

The Global Pre-painted galvanised iron (PPGI) market industry is experiencing growth due to its expanding applications in the renewable energy sector. PPGI is increasingly used in the construction of solar panel frames and wind turbine components, owing to its lightweight and corrosion-resistant characteristics. As the global push for renewable energy sources intensifies, the demand for PPGI in these applications is expected to rise. This trend aligns with the broader shift towards sustainable energy solutions, potentially driving the market's growth as stakeholders seek materials that meet the requirements of renewable energy projects.

Technological Advancements in Coating Processes

The Global Pre-painted galvanised iron (PPGI) market industry benefits from continuous advancements in coating technologies. Innovations in paint formulations and application techniques enhance the durability and aesthetic appeal of PPGI products. These improvements not only extend the lifespan of PPGI but also reduce maintenance costs for end-users. As manufacturers adopt cutting-edge technologies, the quality of PPGI is expected to improve, thereby increasing its attractiveness in various applications. This trend may support the market's growth trajectory, with a projected CAGR of 9.11% from 2025 to 2035, as more industries recognize the advantages of high-quality PPGI.