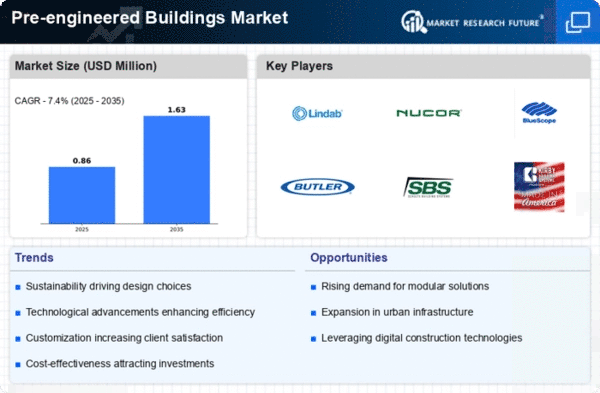

Market Growth Projections

The Global Pre-engineered Buildings Market Industry is projected to experience robust growth in the coming years. With a market valuation of 15.1 USD Billion in 2024, the industry is anticipated to reach 57.5 USD Billion by 2035. This growth trajectory reflects a compound annual growth rate of 12.96% from 2025 to 2035, indicating strong demand across various sectors. Factors contributing to this expansion include increasing urbanization, technological advancements, and the growing emphasis on sustainable construction practices. The market's potential is underscored by its ability to adapt to evolving industry needs and consumer preferences.

Cost Efficiency and Time Savings

Cost efficiency remains a pivotal driver in the Global Pre-engineered Buildings Market Industry. Pre-engineered buildings typically require fewer materials and less labor compared to traditional construction methods, resulting in significant cost savings. Furthermore, the expedited construction timelines associated with these structures enable developers to capitalize on market opportunities more swiftly. This efficiency is particularly appealing in sectors such as commercial real estate, where time-to-market can significantly impact profitability. As a result, the market is poised for substantial growth, with projections indicating a valuation of 15.1 USD Billion in 2024, driven by these economic advantages.

Diverse Applications Across Industries

The versatility of pre-engineered buildings is a key driver in the Global Pre-engineered Buildings Market Industry. These structures find applications across various sectors, including agriculture, manufacturing, and retail. For example, agricultural facilities benefit from customizable designs that cater to specific operational needs, while retail spaces leverage the aesthetic flexibility of pre-engineered solutions. This adaptability not only meets diverse client requirements but also enhances market penetration. As industries continue to recognize the benefits of pre-engineered buildings, the market is expected to expand significantly, potentially reaching 57.5 USD Billion by 2035.

Technological Advancements in Construction

Technological innovations are reshaping the Global Pre-engineered Buildings Market Industry, enhancing design and construction processes. Advanced software tools and Building Information Modeling (BIM) facilitate precise planning and execution, reducing errors and construction time. Additionally, the integration of smart technologies into pre-engineered buildings allows for improved energy management and occupant comfort. As these technologies evolve, they are likely to attract more investors and developers, further expanding the market. The anticipated compound annual growth rate of 12.96% from 2025 to 2035 underscores the potential for growth driven by technological advancements.

Growing Demand for Sustainable Construction

The Global Pre-engineered Buildings Market Industry experiences a surge in demand for sustainable construction solutions. As environmental concerns escalate, builders and developers increasingly favor pre-engineered buildings due to their energy efficiency and reduced waste. For instance, these structures often utilize recyclable materials and can be designed to incorporate renewable energy sources. This trend aligns with global initiatives aimed at reducing carbon footprints, potentially leading to a market valuation of 15.1 USD Billion in 2024. The emphasis on sustainability is likely to drive innovation and adoption in the pre-engineered sector, contributing to a projected growth trajectory.

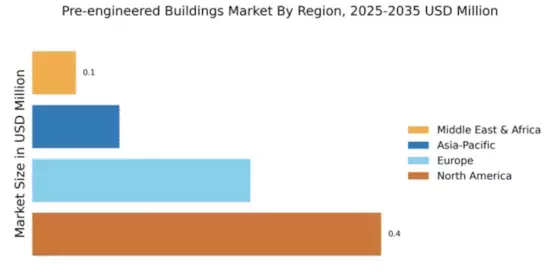

Rapid Urbanization and Infrastructure Development

Urbanization continues to accelerate globally, resulting in heightened infrastructure development needs. The Global Pre-engineered Buildings Market Industry benefits from this trend as pre-engineered solutions offer quick assembly and cost-effectiveness, making them ideal for urban settings. Countries experiencing rapid population growth, such as India and Nigeria, are increasingly adopting these structures for residential and commercial purposes. This demand is expected to propel the market to an estimated 57.5 USD Billion by 2035. The ability to meet urgent housing and infrastructure needs efficiently positions pre-engineered buildings as a viable solution in urban planning.