Advancements in Material Science

The Plasma Etching Equipment Market is benefiting from advancements in material science, which are driving innovation in etching technologies. The development of new materials, such as 2D materials and advanced polymers, necessitates the use of precise etching techniques to achieve desired properties and functionalities. In 2025, the materials market is projected to experience substantial growth, with an increasing emphasis on nanotechnology and advanced composites. Plasma etching plays a critical role in the fabrication of these materials, enabling researchers and manufacturers to explore new applications and enhance product performance. As the demand for innovative materials continues to rise, the plasma etching equipment market is likely to expand, reflecting the ongoing evolution in material science.

Expansion of the Electronics Sector

The Plasma Etching Equipment Market is significantly influenced by the expansion of the electronics sector. With the proliferation of consumer electronics, including smartphones, tablets, and wearables, the demand for advanced manufacturing processes has intensified. In 2025, the electronics market is anticipated to surpass 1 trillion USD, creating a robust environment for plasma etching equipment. This equipment plays a crucial role in the fabrication of electronic components, enabling manufacturers to achieve higher precision and efficiency. As companies strive to enhance product performance and reduce production costs, the adoption of plasma etching technology is likely to increase. Furthermore, the integration of smart technologies and the Internet of Things (IoT) into everyday devices is expected to further drive the need for advanced etching solutions, thereby bolstering the market.

Growth in Renewable Energy Technologies

The Plasma Etching Equipment Market is poised for growth due to the increasing focus on renewable energy technologies. As the world shifts towards sustainable energy solutions, the demand for solar cells and other renewable energy components is on the rise. In 2025, the solar energy market is projected to reach approximately 200 billion USD, which will likely stimulate the need for advanced manufacturing processes, including plasma etching. This technology is essential for the production of photovoltaic cells, where precision etching is required to enhance efficiency and energy conversion rates. As manufacturers seek to optimize production and reduce costs, the adoption of plasma etching equipment is expected to grow, aligning with the global push for cleaner energy solutions.

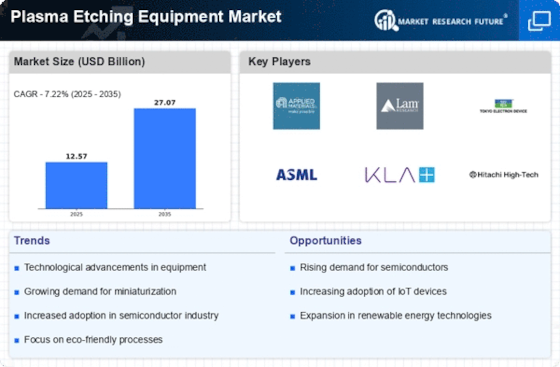

Rising Demand in Semiconductor Manufacturing

The Plasma Etching Equipment Market is experiencing a surge in demand, primarily driven by the semiconductor manufacturing sector. As the industry continues to evolve, the need for precision and miniaturization in electronic components has become paramount. In 2025, the semiconductor market is projected to reach a valuation of approximately 600 billion USD, which directly correlates with the increased utilization of plasma etching equipment. This technology is essential for creating intricate patterns on silicon wafers, thereby enhancing the performance and efficiency of semiconductor devices. The ongoing advancements in chip technology, including the transition to smaller nodes, further necessitate the adoption of sophisticated plasma etching solutions. Consequently, manufacturers are investing heavily in innovative etching technologies to meet the growing requirements of the semiconductor industry.

Increased Investment in Research and Development

The Plasma Etching Equipment Market is witnessing increased investment in research and development (R&D) activities. As industries strive to innovate and improve manufacturing processes, companies are allocating significant resources to R&D initiatives. In 2025, the global R&D expenditure is expected to reach over 2 trillion USD, with a substantial portion directed towards advanced manufacturing technologies, including plasma etching. This investment is likely to foster the development of next-generation etching equipment that offers enhanced capabilities and efficiency. Furthermore, collaboration between academic institutions and industry players is expected to accelerate technological advancements, thereby driving the plasma etching equipment market forward. As new applications and technologies emerge, the market is poised for sustained growth.