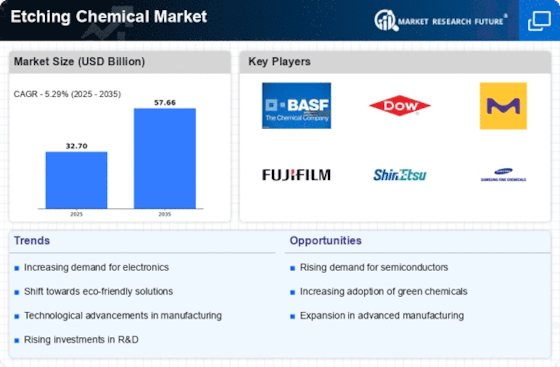

Rising Demand for Electronics

The Etching Chemical Market is experiencing a surge in demand driven by the increasing production of electronic devices. As consumer electronics become more sophisticated, the need for precise etching processes in semiconductor manufacturing intensifies. In 2025, the semiconductor market is projected to reach a valuation of approximately 600 billion USD, indicating a robust growth trajectory. This growth is likely to propel the demand for etching chemicals, which are essential for creating intricate patterns on silicon wafers. The expansion of the Internet of Things (IoT) and the proliferation of smart devices further amplify this trend, suggesting that the Etching Chemical Market will continue to thrive as manufacturers seek to enhance the performance and efficiency of their products.

Growth in Automotive Electronics

The automotive sector is increasingly integrating electronic components, which is positively impacting the Etching Chemical Market. With the rise of electric vehicles and advanced driver-assistance systems, the demand for semiconductors in automotive applications is on the rise. It is estimated that by 2025, the automotive semiconductor market will exceed 100 billion USD, reflecting a significant opportunity for etching chemical manufacturers. As automotive manufacturers seek to enhance vehicle performance and safety through advanced electronics, the need for high-quality etching chemicals becomes paramount. This trend suggests a promising outlook for the Etching Chemical Market as it aligns with the evolving needs of the automotive sector.

Advancements in Etching Technologies

Technological innovations in etching processes are significantly influencing the Etching Chemical Market. The introduction of advanced etching techniques, such as atomic layer etching and plasma etching, enhances the precision and efficiency of semiconductor fabrication. These advancements not only improve the quality of the final products but also reduce waste and operational costs. As manufacturers adopt these cutting-edge technologies, the demand for specialized etching chemicals is expected to rise. In 2025, the market for advanced etching technologies is anticipated to grow at a compound annual growth rate of around 8%, indicating a strong correlation between technological progress and the Etching Chemical Market.

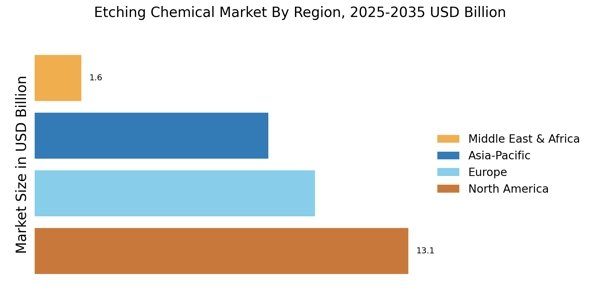

Emerging Markets and Economic Growth

Emerging markets are playing a crucial role in the expansion of the Etching Chemical Market. As economies in regions such as Asia-Pacific and Latin America continue to grow, the demand for electronic products and, consequently, etching chemicals is expected to rise. The increasing investment in semiconductor manufacturing facilities in these regions is indicative of a broader trend towards industrialization and technological advancement. By 2025, it is anticipated that the Asia-Pacific region will account for over 40% of The Etching Chemical Market, further driving the need for etching chemicals. This trend suggests that the Etching Chemical Market will benefit from the economic growth and industrial expansion in emerging markets.

Regulatory Compliance and Quality Standards

The Etching Chemical Market is increasingly influenced by stringent regulatory requirements and quality standards. As environmental concerns grow, manufacturers are compelled to adopt eco-friendly etching chemicals that comply with regulations. This shift not only addresses environmental issues but also enhances product quality and safety. In 2025, it is projected that the market for green etching chemicals will account for a significant share of the overall etching chemical market, driven by both regulatory pressures and consumer preferences. Consequently, companies that prioritize compliance and sustainability are likely to gain a competitive edge in the Etching Chemical Market.