Top Industry Leaders in the Photolithography Market

The Competitive Landscape of the Photolithography Market

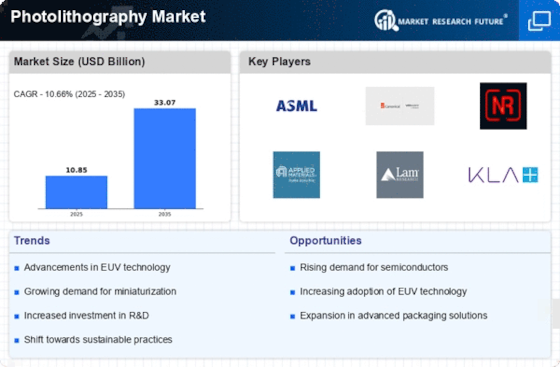

The photolithography market plays a pivotal role in the semiconductor industry, enabling the creation of intricate patterns on microchips. This complex technology is dominated by established players, but new entrants and disruptive innovations are shaping the competitive landscape. This analysis delves into the key players, their adopted strategies, factors influencing market share, emerging companies, and the overall competitive scenario.

Key Player:

- Samsung Electronics

- Carl Zeiss AG

- ASML Holding NV

- Applied Materials Inc.

- Taiwan Semiconductor Manufacturing Company Limited

- JEOL Ltd

- Rudolph Technologies Inc.

- NIL TECHNOLOGY

- Shanghai Micro Electronics Equipment (Group) Co. Ltd

- EV Group (EVG)

Strategies Adopted by Key Players:

- Technological Innovation: Leading players invest heavily in R&D to develop next-generation lithography technologies like EUV and High-NA (high numerical aperture) systems, pushing the boundaries of miniaturization.

- Geographic Expansion: Established players are expanding their presence in emerging markets like China and Southeast Asia, driven by the growing demand for semiconductors in these regions.

- Strategic Partnerships: Collaborations with material suppliers, research institutions, and chipmakers are crucial for technological advancements and market access.

- Mergers and Acquisitions: Consolidation through mergers and acquisitions is a common strategy to gain market share and access new technologies.

Factors Influencing Market Share Analysis:

- Technological Leadership: The ability to deliver cutting-edge lithography systems, particularly EUV and High-NA, is crucial for gaining market share.

- Cost-Effectiveness: Balancing performance with affordability is essential, especially for DUV systems catering to mature technology nodes.

- Customer Service and Support: Providing reliable after-sales service and technical support is vital for building long-term customer relationships.

- Geographic Reach: A strong presence in key markets, particularly Asia Pacific, is crucial for market share growth.

New and Emerging Companies:

- TEL: A leading provider of photoresist coaters and developers, TEL is expanding its portfolio to include lithography equipment and aims to challenge established players.

- Krϋss GmbH: This German company develops innovative mask inspection and cleaning technologies, offering alternatives to established players in this niche segment.

- NuFlare Technology: This Chinese company focuses on developing next-generation high-power lasers for EUV lithography systems, potentially disrupting the market dominated by ASML.

Latest Company Updates:

Samsung Electronics:

- EUV Expansion: Samsung announced plans to invest $17 billion to expand its EUV production capacity in Pyeongtaek, South Korea, by 2025.

- Gate-All Around (GAA) Transistors: Samsung is reportedly developing GAA transistors, which require advanced EUV lithography for patterning.

- Partnerships: Samsung has partnered with ASML and imec on joint research and development projects for advanced lithography technologies.

Carl Zeiss AG:

- High-NA Lenses: Zeiss is a leading supplier of high-NA immersion lenses for advanced lithography systems. They recently announced a new generation of immersion lenses with improved resolution and performance.

- EUV Mask Inspection: Zeiss offers solutions for EUV mask inspection, a critical step in ensuring the quality of EUV masks used in lithography.

- Digital Twins: Zeiss is developing digital twins of lithography systems to improve process optimization and control.