Photolithography Size

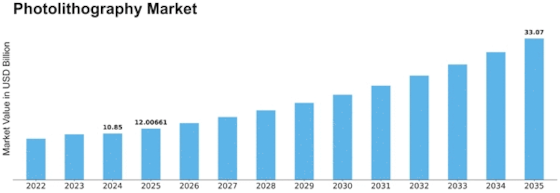

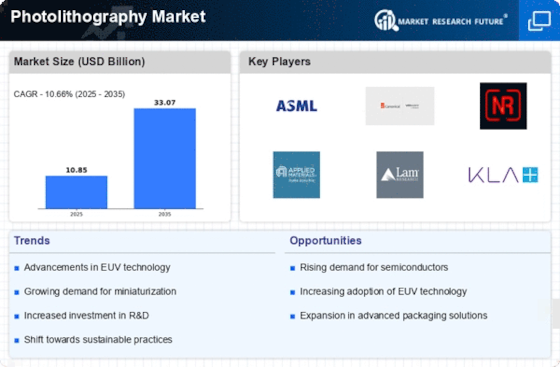

Photolithography Market Growth Projections and Opportunities

The semiconductor manufacturing sector relies on the photolithography market, which is heavily driven by market forces. Advances in technology are important. The industry invests in cutting-edge photolithography technologies to improve resolution and precision as demand for smaller, more efficient electronics rises. This breakthrough drives the development of more advanced photolithography equipment, which impacts the market.

Another important factor is worldwide semiconductor demand. Semiconductor demand has increased as automotive, healthcare, and telecoms integrate technologies. This need drives the photolithography market as semiconductor makers strive to make more advanced and powerful processors.

Economic conditions also shape the photolithography market. Semiconductor manufacturers may invest in new equipment and facilities depending on the economy. During recessions, corporations may curtail spending, lowering photolithography equipment demand. Investments rise with economic growth, increasing need for improved photolithography technologies.

Geopolitics and trade policies affect market dynamics. International manufacturers and suppliers serve the photolithography market. Trade disputes and policy changes can affect goods and technology flow, market accessibility, and pricing. Export limits and intellectual property protection also shape photolithography market competition.

In addition, environmental concerns have grown in importance. Regulations and industry initiatives to reduce manufacturing processes' environmental impact affect the photolithography business as the world embraces sustainability and environmental consciousness. Market companies are implementing eco-friendly operations and creating equipment that meets strict environmental criteria.

Key market participants compete fiercely for market share. Research and development, product differentiation, and cost-effectiveness affect competition. Companies that spend in R&D to stay ahead in technology and innovation generally thrive in photolithography.

Supply chain dynamics affect the market. Raw materials, components, and skilled personnel affect photolithography equipment manufacturing capability and cost. Natural disasters or geopolitical crises can disrupt the supply chain, affecting market dynamics.

Leave a Comment