Rising Automation in Industries

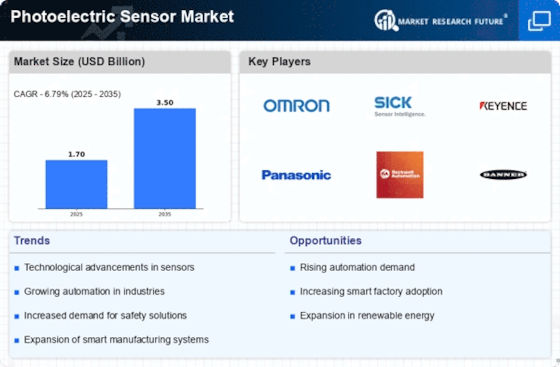

The increasing trend towards automation across various industries appears to be a primary driver for the Photoelectric Sensor Market. As manufacturers seek to enhance productivity and reduce operational costs, the demand for reliable sensing solutions has surged. In 2025, the market for photoelectric sensors is projected to reach approximately USD 2.5 billion, reflecting a compound annual growth rate of around 8%. This growth is largely attributed to the integration of photoelectric sensors in automated assembly lines, packaging, and material handling systems. The ability of these sensors to provide precise detection and control in dynamic environments makes them indispensable in modern manufacturing processes. Consequently, the Photoelectric Sensor Market is likely to witness sustained growth as industries continue to embrace automation.

Expansion of the E-commerce Sector

The rapid expansion of the e-commerce sector is driving demand for efficient logistics and inventory management solutions, thereby impacting the Photoelectric Sensor Market. As online retail continues to grow, warehouses and distribution centers are increasingly relying on automation and advanced sensing technologies to streamline operations. Photoelectric sensors are essential for applications such as package detection, sorting, and inventory tracking. The e-commerce market is projected to grow at a rate of 15% annually, which is likely to bolster the demand for photoelectric sensors in logistics applications. This trend indicates that the Photoelectric Sensor Market will benefit from the ongoing evolution of e-commerce, as companies seek to optimize their supply chain processes.

Increased Focus on Sustainable Practices

The growing emphasis on sustainability and energy efficiency is shaping the Photoelectric Sensor Market. Companies are increasingly adopting eco-friendly practices, which include the use of energy-efficient sensors that reduce power consumption and waste. Photoelectric sensors, known for their low energy requirements and high performance, align well with these sustainability goals. As industries strive to meet regulatory standards and consumer expectations regarding environmental responsibility, the demand for such sensors is expected to rise. The market for energy-efficient sensing solutions is projected to grow by 12% annually through 2025, indicating a strong correlation between sustainability initiatives and the Photoelectric Sensor Market.

Growing Demand for Safety and Security Solutions

The heightened focus on safety and security in industrial and commercial settings significantly influences the Photoelectric Sensor Market. Organizations are increasingly adopting advanced sensing technologies to ensure compliance with safety regulations and to protect personnel and assets. Photoelectric sensors play a crucial role in safety applications, such as presence detection and access control systems. The market for safety-related sensors is expected to expand, with photoelectric sensors being integral to these systems. In 2025, the demand for safety solutions is anticipated to drive the Photoelectric Sensor Market, as companies invest in technologies that enhance workplace safety and mitigate risks associated with operational hazards.

Technological Advancements in Sensor Capabilities

Technological innovations in sensor capabilities are propelling the Photoelectric Sensor Market forward. Recent advancements in sensor design, such as improved sensitivity, miniaturization, and enhanced communication interfaces, have expanded the application range of photoelectric sensors. These developments enable more efficient and accurate detection in various environments, from manufacturing to logistics. The introduction of smart sensors, which can communicate with other devices and systems, is particularly noteworthy. This trend is expected to contribute to a projected market growth of 10% annually through 2025. As industries increasingly adopt these advanced sensors, the Photoelectric Sensor Market is likely to experience a transformative shift, enhancing operational efficiency and data integration.