Increasing Safety Regulations

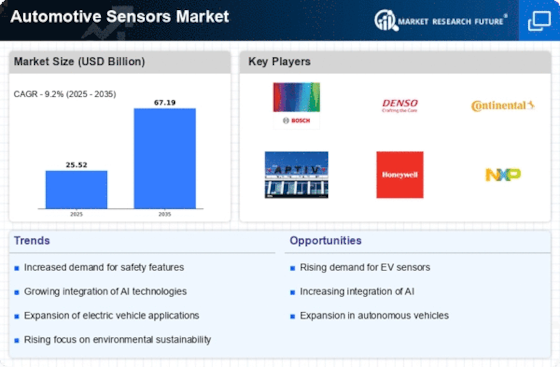

The Automotive Sensors Market is experiencing a surge in demand due to the increasing safety regulations imposed by governments worldwide. These regulations mandate the incorporation of advanced safety features in vehicles, which necessitate the use of various sensors. For instance, the implementation of collision avoidance systems and lane departure warnings requires precise sensor technology. As a result, the market for automotive sensors is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 10% in the coming years. This trend indicates that manufacturers are prioritizing safety, thereby driving the demand for innovative sensor solutions.

Expansion of Electric Vehicle Market

The expansion of the electric vehicle (EV) market is a significant driver for the Automotive Sensors Market. As the adoption of EVs accelerates, the need for specialized sensors to monitor battery performance, thermal management, and energy efficiency becomes increasingly critical. These sensors are essential for optimizing the performance and safety of electric vehicles. Market analysis indicates that the EV segment is expected to grow at a rate of over 20% annually, which will likely lead to a corresponding increase in the demand for automotive sensors tailored for electric applications. This growth presents a lucrative opportunity for sensor manufacturers to innovate and expand their product offerings.

Technological Advancements in Sensor Technology

Technological advancements play a pivotal role in the Automotive Sensors Market. Innovations in sensor technology, such as the development of MEMS (Micro-Electro-Mechanical Systems) sensors, enhance the performance and reliability of automotive applications. These advancements enable the production of smaller, more efficient sensors that can operate under extreme conditions. The market is witnessing a shift towards more sophisticated sensors, including LIDAR and radar systems, which are essential for autonomous driving applications. As these technologies evolve, they are expected to contribute to a substantial increase in sensor adoption, potentially leading to a market valuation exceeding USD 30 billion by 2027.

Integration of Internet of Things (IoT) in Vehicles

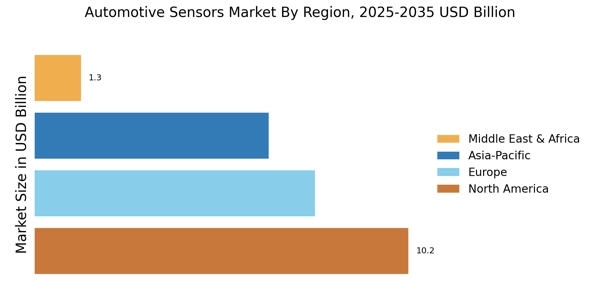

The integration of the Internet of Things (IoT) in vehicles is transforming the Automotive Sensors Market. IoT technology enables vehicles to communicate with each other and with infrastructure, enhancing safety and efficiency. This connectivity relies heavily on various sensors that collect and transmit data in real-time. The market is witnessing a rise in demand for sensors that support IoT applications, such as vehicle-to-vehicle communication and smart traffic management systems. Industry forecasts suggest that the IoT in automotive applications could reach a market size of USD 10 billion by 2025, indicating a robust growth trajectory for automotive sensors that facilitate this connectivity.

Rising Consumer Demand for Enhanced Vehicle Features

Consumer preferences are shifting towards vehicles equipped with advanced features, significantly impacting the Automotive Sensors Market. As consumers increasingly seek enhanced comfort, convenience, and safety, manufacturers are compelled to integrate more sensors into their vehicles. Features such as adaptive cruise control, parking assistance, and blind-spot detection rely heavily on sensor technology. This growing demand is reflected in market data, indicating that the automotive sensor segment is expected to account for a considerable share of the overall automotive market, with projections estimating a market size of approximately USD 25 billion by 2026. This trend underscores the importance of sensors in meeting consumer expectations.