Market Trends

Key Emerging Trends in the Phosphoric Acid Fuel Cell Market

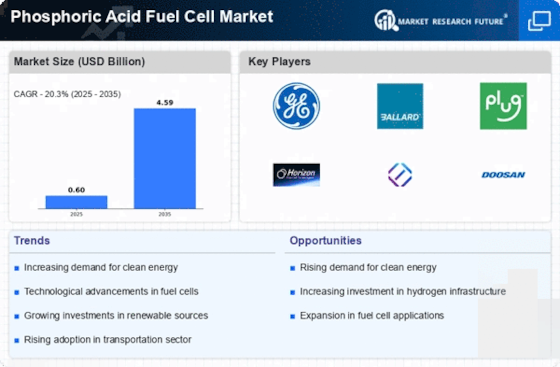

In recent years, the PAFCs market trends and developments have been quite significant. The class of fuel cell technology known as PAFCs uses phosphoric acid electrolyte. A notable market trend is the increasing interest and investments in clean energy solutions. With more attention being paid to sustainable practices, PAFCs have found their place in the market due to a rather high efficiency level and low emissions. Governments and industries are looking for alternative sources of energy that are cleaner than traditional ones, PAFCs provide one such innovation. A major trend in the market is that research and development to improve PAFCs’ performance and cost-effectiveness have gained more attention. Research is focused on designing better catalyst materials, electrode shape and system performance. This continual innovation is contributing to the commercial viability of PAFCs and making them more competitive on a broader fuel cell market. The manufacturers are interested in building state-of the art PAFC technologies that not only conform to environmental criteria, but also yield economic benefits for end users. The market is also seeing increase in demand across different industries. Application areas include stationary power generation, as PAFCs are used for decentralized energy production in buildings and factories. Second, PAFCs are being investigated by the transport section for electric vehicles especially FCV. The flexibility of PAFCs across various environments is also driving its growth in several industries, thus facilitating market expansion. Cost saving is a key concern of the phosphoric acid fuel cell market. Although PAFCs are considered very reliable, the research work done ensures that they become cost-effective relative to other form of fuel cell technologies. However, cost reduction trends driven by surging technological development in manufacturing processes as well as economies of scale and material innovation leading to a more competitive overall PAFC-based regime are likely. The market is also affected by regulatory frameworks and policies aimed at promoting the utilization of clean energy technologies. Government agencies in different parts of the world have established programs and incentives meant to promote fuel cell usage such as PAFCs, which generates less greenhouse gases limiting global warming while seeking after an ecological friendly environment. These policy interventions are fostering a conducive environment for the development of PAFC market as both businesses and users are rewarded to adopt cleaner more efficient energy products. Market players are exhibiting strong collaborations and partnerships as a preferred strategy. Companies are to partner so that they can capitalize on each other’s strengths in research, development, and commercialization. Such partnerships are aimed at hastening the adoption of PAFC through pooling technical knowledge and resources. This collaborative approach is promoting innovation, helping the market to move towards maturity.

Leave a Comment