Phosphoric Acid Fuel Cell Size

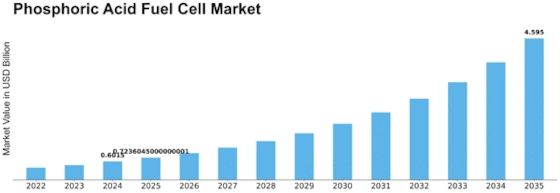

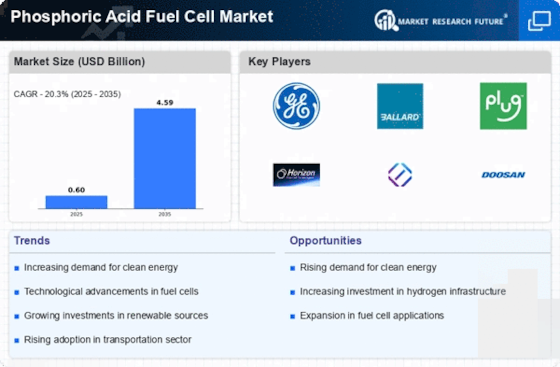

Phosphoric Acid Fuel Cell Market Growth Projections and Opportunities

The PAFC market is propelled by several factors that form the environment for its development and dynamics. The growing need for renewable and green energy sources is one of the major factors that contribute to the market’s growth. With various environmental issues, the global population is making attempts to cut carbon emissions and shift towards clean technologies. Being consistent with this trend of sustainable advancement, PAFCs are characterized by high efficiency and low emissions, promoting its development. At the same time, it is worth noting that government policies and regulations significantly contribute towards defining the phosphoric acid fuel cell market. Various countries have enacted policies to support the use of fuel cells as part of their energy. The evolution of the market can be influenced by incentives, subsidies and regulatory practices that encourage use of fuel cell technology. If governments across the globe plan on reaching the green energy objectives and minimise dependence on fossil fuels, they should encourage new innovative technologies such as PAFC. Technological developments are another factor contributing to the evolution of phosphoric acid fuel cell market. Comprehensive research and development efforts strive to promote the performance, longevity, as well as cost effectiveness of PAFC systems. Materials science, catalyst development and manufacturing advances are likely to endow phosphoric acid fuel cells with an edge in the energy market. The rapid innovation the sector enables a positive approach for growth of PAFC market. Economics, specifically the cost of creation and market competitiveness in general contribute to phosphoric acid fuel cells adoption. Technology is improving the manufacturing processes and as economies of scale are achieved, PAFC systems become less expensive allowing a wider market to purchase them. Furthermore, the competitive nature of PAFCs as compared to other fuel cell applications and alternative energy sources is an important consideration when defining market share and growth opportunities. The factors of the market associated with infrastructure construction and technologies for energy storage systems also affect phosphoric acid fuel cell markets. The necessary supporting infrastructure such as hydrogen production and distribution networks should be available for the popularization of PAFCs. In addition to this, the fact that phosphoric acid fuel cells can act as effective energy storage systems capable of supporting intermittent renewable sources such as solar and wind power makes them even more relevant in terms of market success.

Leave a Comment