Market Analysis

In-depth Analysis of Phosphoric Acid Fuel Cell Market Industry Landscape

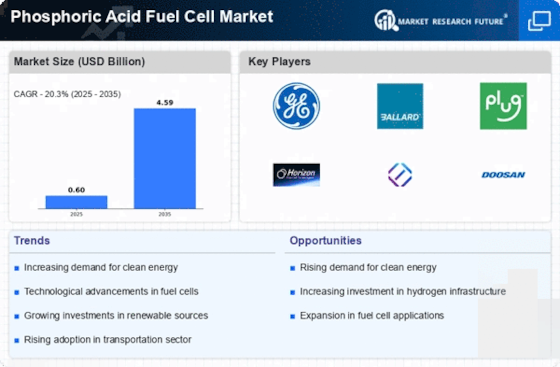

The phosphoric acid fuel cell market is set to reach US$ 2.1 BN by 2032, at a 20.30% CAGR between years 2023-2032. The market is in a state of constant change due to the increasing integration of PAFC in the Fuel cell technology for its efficiency and reliability in generating power. A very important factor that determines the market is increasing global concern about sustainable energy solutions. Governments and industries are currently trying to find cleaner sources of power, and PAFCs support this goal. PAFC market dynamics is shaped by technological advancements. Various research and development activities emphasize the improvement of performance economics in these fuel cells. When innovations occur then the market exhibits a shift in terms of competition as well as share for manufacturers. Research and innovation provide a competitive advantage to firms that invest in these activities which influences the overall ecosystem of PAFC market. Market dynamics are also dependent on the energy landscape. The growing interest in fuel cell technologies is not only related to the volatility of fossil fuels prices but also emissions and energy independence. With their potential to effectively convert chemical energy into electricity, PAFCs are poised to gain from such trends. The market dynamics are also influenced by regulatory policy and incentives to adopt cleaner energy technologies, the resulting market opportunities provide an avenue for PAFC manufacturers. The dynamics of the PAFC market are also affected by global economic elements. Factors such as the economic growth, industrialization and increasing demand for power especially in developing economies have led to expansion of this market. In addition, international partnerships and collaborations have cross-border effects on technology transfer that affect competition and market dynamics. End-user industries also impact the adoption of PAFCs. Industry segments like telecommunication, transportation and fixed power generation are gradually understanding the advantages of PAFC technology. The capacity of PAFCs to produce consistent and steady power means that they can be used in different applications. With the changing requirements of end-users, market dynamics in PAFCs are influenced by emerging energy needs for industries that dictate sustainable and efficient solutions. However, not only demand affects the dynamics of a market but supply chain and manufacturing processes. Price and availability of raw materials, as well as production technologies improvement influence the overall cost structure PAFCs. The ones capable of supply chain and process optimization get an advantage over their competitors, shaping the market dynamics regarding prices as well as share.

Leave a Comment