Market Analysis

In-depth Analysis of Pharmacy Automation Market Industry Landscape

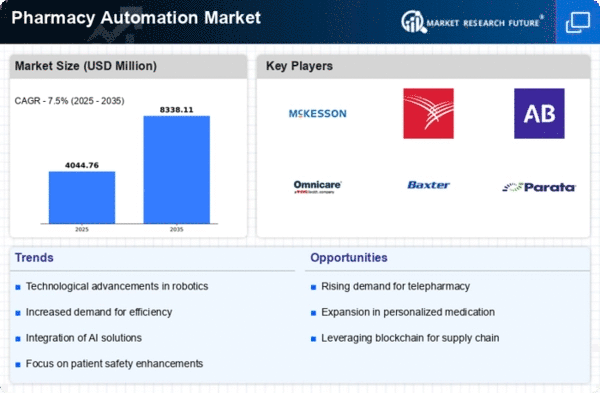

The pharmacy automation industry is growing rapidly due to many reasons that are changing medication dispensing and administration. Demand for drug administration efficiency and accuracy is a major motivator. Pharmacy automation technology can improve workflows and patient safety as healthcare organizations worldwide face increased prescription volumes and the requirement for error-free drug delivery.

Pharmacy automation market dynamics depend on technology. Robotic dispensing, drug storage and retrieval, and automated packaging systems evolve to satisfy pharmacies' different demands. The addition of artificial intelligence and machine learning improves inventory management, mistake reduction, and operational efficiency. Comprehensive automated systems for drug management, from prescription fulfillment to patient counseling, are emerging.

Partnerships between pharmacy automation system vendors and healthcare organizations boost industry growth. These collaborations customize and integrate automation technology into pharmaceutical procedures for smooth installation and user uptake. Partnerships with pharmaceutical producers and distributors improve supply chain efficiency, lowering lead times and assuring medicine availability. Pharmacies in varied healthcare settings need industry and healthcare provider collaboration to meet their changing demands.

Regulatory concerns and pharmaceutical safety focus affect market dynamics. Pharmacy operations are regulated, hence automation systems that meet these criteria are adopted. Pharmacies invest in error-reducing and regulatory-compliant technology to assure traceability, accountability, and drug safety. These expectations are met by market solutions that automate and improve drug management quality and safety.

Pharmaceutical automation benefits are becoming more widely known, affecting market dynamics. As healthcare stakeholders realize automation improves patient outcomes, they invest more in these technologies. Automated methods prevent medication mistakes and free up pharmacy professionals to advise patients. This awareness is encouraging pharmacy operations to improve continuously, driving automation solutions in retail pharmacies, hospitals, and long-term care institutions.

Research and development are driving pharmacy automation innovation. Automation solutions stay ahead of the continually changing healthcare industry by pursuing cutting-edge technology like robots, AI, and data analytics. Industry stakeholders are investing in user friendly interfaces, interoperable systems, and scalable solutions to help pharmacies adapt to changing healthcare delivery models.

Leave a Comment