Pharmacy Automation Size

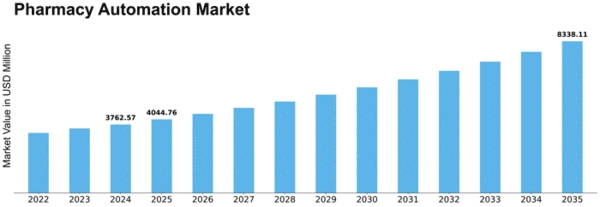

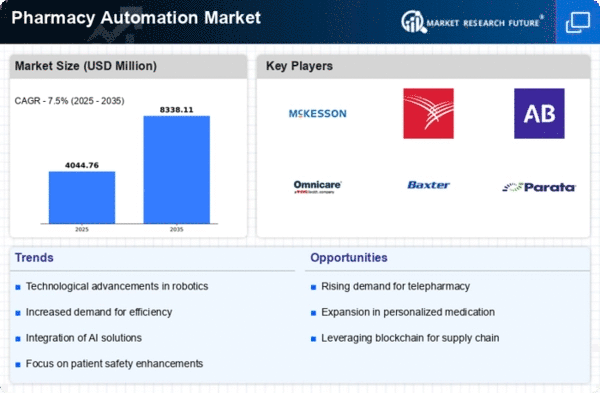

Pharmacy Automation Market Growth Projections and Opportunities

Pharmacy Automation Market valued USD 6.3 Billion with 7.5% CAGR 2023-2032. Several variables shape the Pharmacy Automation Market and drive its growth. The requirement for pharmacy medicine dispensing efficiency and accuracy is a major driving. Pharmacy automation technologies are needed to address increased prescription volumes, pharmaceutical mistakes, and simplified processes in healthcare systems globally. Technological advances like robotic dispensing, automated medicine packing, and inventory management systems simplify modern pharmacy operations, fueling this trend.

The Pharmacy Automation Market is shaped by regulations that ensure the safety, accuracy, and compliance of automated pharmacy systems. These technologies are approved, validated, and used under strict rules, ensuring industry responsibility and patient safety. Compliance with these laws maintains pharmacy automation solutions' dependability and builds trust among healthcare professionals and patients using them for drug management.

Pharmacy automation technology changes market dynamics. Pharmacy automation solutions are improved by new robotic dispensers, automated prescription verification systems, and electronic drug administration records (eMAR). Technological advances aim to enhance productivity, eliminate pharmaceutical mistakes, and increase patient safety, boosting market innovation.

Healthcare budgets, pharmacy automation technology affordability, and prescription management cost reductions affect adoption of these systems. Pharmacy automation technologies can improve operational efficiency, labor costs, and prescription mistakes, making them appealing to healthcare providers and pharmacies despite their initial expenditures. Economic variables influence market trends and advanced pharmacy automation technology availability.

The Pharmacy Automation Market is competitive with firms offering pharmacy automation solutions. Competition drives innovation, with businesses building technologies to increase medicine dispensing accuracy, inventory management, and EHR integration. A diverse offering allows pharmacies to pick automation solutions that meet their operational demands, creating a vibrant industry.

Healthcare professionals and pharmacy workers learn about pharmacy automation's benefits through educational programs, which affect market dynamics. Automation improves drug safety, operational efficiency, and patient outcomes, according to training, educational campaigns, and industry conferences. These efforts promote pharmacy automation as a useful tool for modernizing operations.

Demographic variables like aging and chronic disease prevalence affect market patterns. Medication management solutions are needed as the population ages and prescription quantities rise. Pharmacy staff must manage complicated prescription regimens due to the growth in chronic illnesses, prompting the development of automated solutions to assure accuracy and patient adherence.

Leave a Comment