Market Share

Pharmacy Automation Market Share Analysis

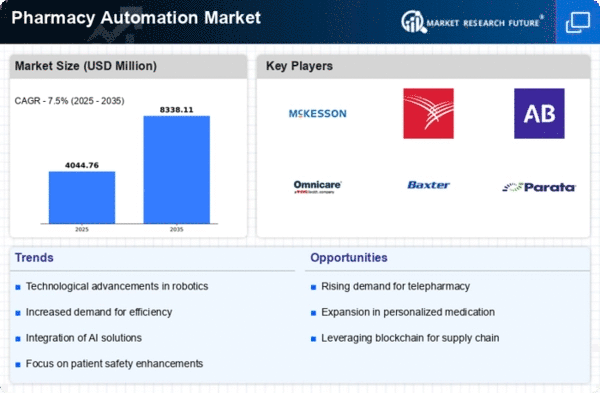

In the ever-changing Pharmacy Automation Market, players use a variety of techniques to gain market share and meet rising demands for drug dispensing and management efficiency and accuracy. Technological innovation is key to distinctiveness. Pharmacy automation vendors invest heavily in R&D to produce sophisticated systems with robotic dispensing, barcode verification, and EHR connection. These organizations provide innovative technologies to help pharmacies and healthcare institutions improve medicine dispensing and inventory management in a competitive market.

Pharmacy Automation Market cost leadership is important. Some firms provide affordable automation without sacrificing reliability or usefulness. Pharmacies and healthcare facilities need this technique to find cost-effective automation solutions. Automation providers optimise manufacturing processes, negotiate favorable supplier pricing, and implement efficient deployment models to make pharmacy automation technologies more affordable for more healthcare providers.

Pharmacy Automation Market tactics depend on market segmentation. Companies adapt their solutions to specialized niches including automated dispensing, drug packaging and labeling, and robotic prescription filling. Automation suppliers may tailor solutions to pharmacies, hospitals, and long-term care institutions' drug administration needs with this tailored approach.

Pharmaceutical automation companies often cooperate strategically. Automation providers engage with drugstore chains, hospital networks, and pharmacy software developers to improve automation system development and acceptance. Companies can identify workflow issues, reach various customers, and successfully integrate their automation technologies into pharmacy operations by building strong ties with healthcare ecosystem actors.

Branding and reputation management are crucial to Pharmacy Automation Market share positioning. Companies promote system stability, accuracy, and pharmacy efficiency to develop brand loyalty. Pharmacy and healthcare practitioners use automation technologies to improve patient safety and drug administration, thus trust and credibility are essential.

Digital marketing and presence are growing in the Pharmacy Automation Market. Automation providers employ digital marketing, user-friendly websites, and social media to target pharmacy professionals and healthcare decision-makers. Educational resources, case studies, and pharmacy automation benefits information online boost visibility, connect companies with their target audience, and raise awareness of these technologies' transformative potential.

Healthcare technology, particularly the Pharmacy Automation Market, prioritizes regulatory compliance and quality. Pharmacy automation solution companies invest in regulatory certifications, system safety, and industry standards. Regulatory compliance ensures that automation systems meet quality standards, assuring drug dispensing safety and accuracy for pharmacies and healthcare professionals.

Pharmacy Automation Market positioning requires ongoing research and development. Companies actively research new technologies, improve system connection, and advance pharmacy automation. This dedication to innovation keeps enterprises at the forefront of automation and positions them as leaders in helping pharmacies and healthcare institutions enhance prescription administration.

Leave a Comment