Technological Advancements

Technological advancements play a pivotal role in shaping the Pharmacy Automation Devices Market. Innovations such as robotic dispensing systems, automated medication storage, and advanced software solutions are revolutionizing pharmacy practices. These technologies not only enhance the accuracy of medication dispensing but also facilitate better inventory management and tracking. The introduction of artificial intelligence and machine learning algorithms into pharmacy automation devices is expected to further enhance operational efficiency. Market data indicates that the adoption of these advanced technologies is likely to increase, with a projected market value reaching several billion dollars by 2030. As pharmacies continue to embrace these innovations, the overall landscape of the pharmacy automation sector is poised for transformation.

Rising Demand for Efficiency

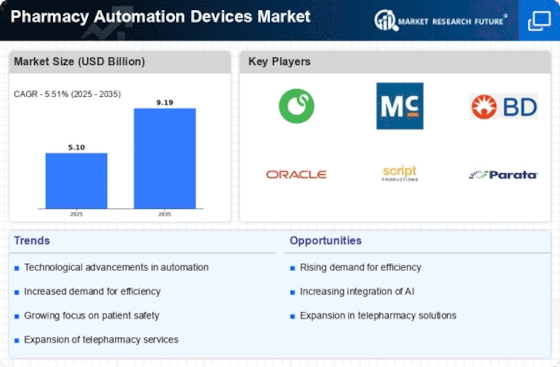

The Pharmacy Automation Devices Market is experiencing a notable surge in demand for efficiency within pharmacy operations. As healthcare systems strive to optimize workflows, automation devices are increasingly viewed as essential tools. These devices streamline medication dispensing, inventory management, and prescription processing, thereby reducing human error and enhancing operational speed. According to recent data, the market for pharmacy automation devices is projected to grow at a compound annual growth rate of approximately 7.5% over the next five years. This growth is driven by the need for pharmacies to manage increasing prescription volumes while maintaining high standards of accuracy and patient safety. Consequently, the integration of automation technologies is becoming a strategic priority for pharmacies aiming to improve service delivery and patient outcomes.

Expansion of Pharmacy Networks

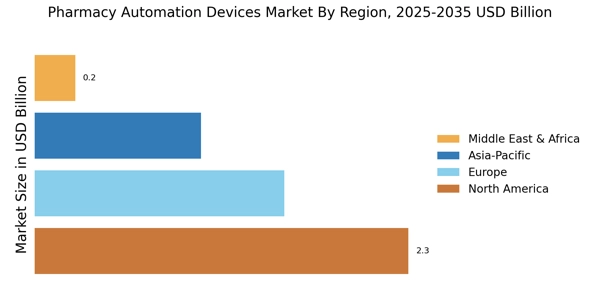

The Pharmacy Automation Devices Market is witnessing a notable expansion of pharmacy networks, which is driving the demand for automation solutions. As pharmacies consolidate and expand their services, the need for efficient and scalable automation devices becomes paramount. Larger pharmacy networks require robust systems to manage increased prescription volumes and maintain consistency across multiple locations. Automation devices provide the necessary infrastructure to support these operations, ensuring that pharmacies can deliver timely and accurate services. Market projections indicate that the expansion of pharmacy networks could lead to a significant increase in the adoption of automation technologies, potentially doubling the market size within the next decade. This trend highlights the critical role of automation in supporting the evolving landscape of pharmacy services.

Increasing Regulatory Compliance

The Pharmacy Automation Devices Market is significantly influenced by the increasing emphasis on regulatory compliance. Regulatory bodies are imposing stringent guidelines to ensure the safety and efficacy of pharmaceutical products. As a result, pharmacies are compelled to adopt automation devices that not only streamline operations but also ensure adherence to these regulations. Automation technologies assist in maintaining accurate records, tracking medication usage, and ensuring proper storage conditions, thereby mitigating compliance risks. The market is expected to witness a steady growth trajectory as pharmacies invest in automation solutions to meet regulatory demands. This trend is likely to drive the overall market value, with estimates suggesting a potential increase in market size by over 20% in the coming years.

Growing Focus on Patient-Centric Care

The Pharmacy Automation Devices Market is increasingly aligning with the growing focus on patient-centric care. As healthcare providers prioritize patient outcomes, the demand for automation devices that enhance service delivery is on the rise. These devices facilitate personalized medication management, improve patient adherence, and enable better communication between pharmacists and patients. By automating routine tasks, pharmacists can devote more time to patient consultations and care management. Market analysis suggests that the shift towards patient-centric models is likely to propel the adoption of pharmacy automation devices, with a projected increase in market penetration. This trend underscores the importance of integrating technology into pharmacy practices to enhance the overall patient experience.