Focus on Patient Safety

The emphasis on patient safety is a critical driver for the Pharmaceuticals Serialization Market. As healthcare stakeholders prioritize the protection of patients from counterfeit drugs, serialization becomes an essential tool in ensuring the authenticity of pharmaceutical products. Serialization not only aids in tracking and tracing drugs but also enhances recall processes, allowing for swift action in the event of safety concerns. The World Health Organization estimates that counterfeit medicines account for approximately 10% of the global market, underscoring the urgent need for effective serialization strategies. Consequently, pharmaceutical companies are increasingly investing in serialization technologies to bolster patient safety, which is likely to propel the market forward in the coming years.

Technological Advancements

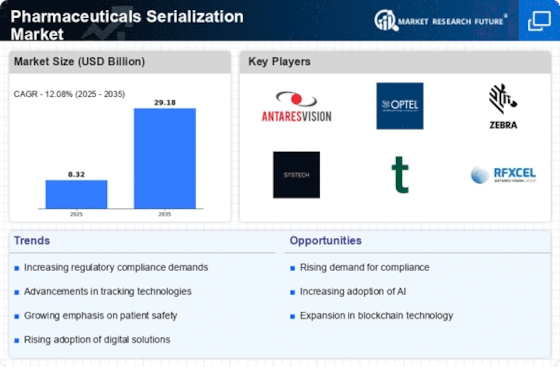

Technological advancements play a pivotal role in shaping the Pharmaceuticals Serialization Market. Innovations in software and hardware solutions, such as advanced barcode systems and RFID technology, enhance the efficiency and accuracy of serialization processes. These technologies facilitate real-time tracking and monitoring of pharmaceutical products, thereby reducing the risk of counterfeiting and ensuring product integrity. The integration of blockchain technology is also emerging as a transformative force, providing a secure and transparent method for tracking drugs throughout the supply chain. As these technologies evolve, they are expected to drive market growth, with the Pharmaceuticals Serialization Market projected to reach a valuation of USD 5 billion by 2026, reflecting the increasing adoption of advanced serialization solutions.

Rising Incidence of Counterfeit Drugs

The rising incidence of counterfeit drugs is a significant concern that drives the Pharmaceuticals Serialization Market. Counterfeit medications pose serious health risks and undermine the integrity of healthcare systems. Reports indicate that The Pharmaceuticals Serialization Market is valued at over USD 200 billion, prompting regulatory bodies to enforce stricter serialization requirements. This alarming trend has led pharmaceutical companies to adopt serialization as a proactive measure to combat counterfeiting. By implementing robust serialization systems, companies can enhance product traceability and ensure that consumers receive authentic medications. As awareness of counterfeit threats grows, the demand for serialization solutions is expected to surge, further fueling the growth of the Pharmaceuticals Serialization Market.

Regulatory Compliance and Standardization

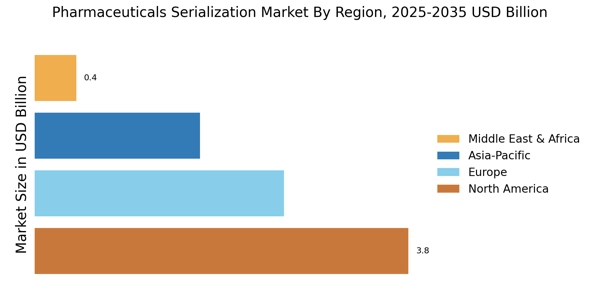

The Pharmaceuticals Serialization Market is increasingly driven by stringent regulatory requirements aimed at ensuring drug safety and authenticity. Regulatory bodies across various regions have implemented serialization mandates that require pharmaceutical companies to uniquely identify and track their products throughout the supply chain. For instance, the Drug Supply Chain Security Act (DSCSA) in the United States mandates that all prescription drugs be serialized by 2023. This regulatory landscape compels manufacturers to invest in serialization technologies, thereby expanding the Pharmaceuticals Serialization Market. As companies strive to comply with these regulations, the market is projected to grow at a compound annual growth rate (CAGR) of approximately 10% over the next few years, indicating a robust demand for serialization solutions.

Increasing Demand for Supply Chain Transparency

Increasing demand for supply chain transparency is a driving force in the Pharmaceuticals Serialization Market. Stakeholders, including consumers, healthcare providers, and regulatory agencies, are demanding greater visibility into the pharmaceutical supply chain. Serialization provides a means to achieve this transparency by enabling the tracking of products from manufacturing to the end-user. This demand is further amplified by the rise of e-commerce in pharmaceuticals, where consumers seek assurance regarding the authenticity of their medications. As companies strive to meet these transparency demands, investments in serialization technologies are likely to increase. The Pharmaceuticals Serialization Market is expected to benefit from this trend, with projections indicating a steady growth trajectory as companies enhance their supply chain practices.