Increasing Incidence of Counterfeit Products

The rising incidence of counterfeit pharmaceuticals and cosmetics is a critical driver for the Anti-Counterfeit Pharmaceuticals and Cosmetics Packaging Market. Reports indicate that counterfeit drugs account for approximately 10% of The Anti-Counterfeit Pharmaceuticals and Cosmetics Packaging, posing significant health risks to consumers. This alarming trend has prompted manufacturers and regulatory bodies to prioritize anti-counterfeit measures in packaging. The need to protect brand integrity and consumer safety is leading to increased investments in secure packaging technologies. Consequently, the Anti-Counterfeit Pharmaceuticals and Cosmetics Packaging Market is likely to witness substantial growth as stakeholders seek to implement effective solutions to mitigate the risks associated with counterfeit products.

E-commerce Growth and Supply Chain Complexity

The rapid growth of e-commerce is reshaping the landscape of the Anti-Counterfeit Pharmaceuticals and Cosmetics Packaging Market. As online shopping becomes increasingly prevalent, the complexity of supply chains intensifies, creating new challenges in product authentication. Counterfeiters are exploiting the anonymity of online platforms, making it essential for brands to implement effective anti-counterfeit measures in their packaging. The need for secure packaging solutions that can withstand the intricacies of e-commerce logistics is becoming paramount. Consequently, the Anti-Counterfeit Pharmaceuticals and Cosmetics Packaging Market is poised for growth as companies seek to enhance their packaging strategies to protect against counterfeiting in the digital marketplace.

Consumer Awareness and Demand for Authenticity

Consumer awareness regarding the dangers of counterfeit products is on the rise, significantly impacting the Anti-Counterfeit Pharmaceuticals and Cosmetics Packaging Market. As consumers become more informed about the potential health risks associated with counterfeit pharmaceuticals and cosmetics, their demand for authentic products increases. This shift in consumer behavior is prompting manufacturers to adopt advanced anti-counterfeit packaging solutions to build trust and ensure product authenticity. Surveys indicate that a substantial percentage of consumers are willing to pay a premium for products with secure packaging. This growing demand for transparency and authenticity is likely to drive innovation and investment in the Anti-Counterfeit Pharmaceuticals and Cosmetics Packaging Market.

Regulatory Frameworks and Compliance Requirements

The Anti-Counterfeit Pharmaceuticals and Cosmetics Packaging Market is significantly influenced by stringent regulatory frameworks and compliance requirements. Governments and health authorities are increasingly mandating the use of anti-counterfeit technologies in packaging to safeguard public health. For instance, regulations such as the Drug Supply Chain Security Act in the United States require manufacturers to implement serialization and track-and-trace systems. These regulations not only enhance product safety but also create a pressing need for innovative packaging solutions. As compliance becomes a necessity, the market for anti-counterfeit packaging is expected to expand, driven by the demand for solutions that meet regulatory standards.

Technological Innovations in Anti-Counterfeit Solutions

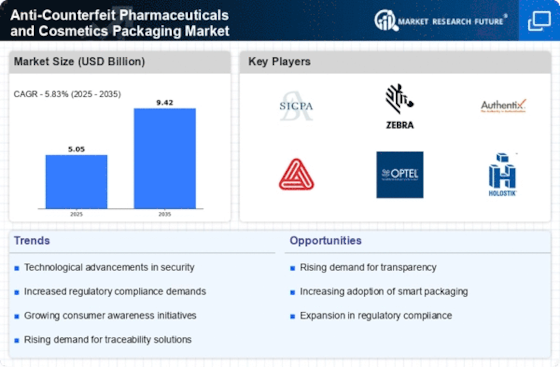

The Anti-Counterfeit Pharmaceuticals and Cosmetics Packaging Market is experiencing a surge in technological innovations aimed at enhancing product security. Advanced technologies such as RFID, QR codes, and holograms are being integrated into packaging solutions to provide robust anti-counterfeit measures. These innovations not only help in authenticating products but also facilitate real-time tracking and monitoring throughout the supply chain. As per recent estimates, the adoption of such technologies is projected to grow at a compound annual growth rate of over 15% in the coming years. This trend indicates a strong market demand for sophisticated packaging solutions that can effectively combat counterfeiting, thereby driving growth in the Anti-Counterfeit Pharmaceuticals and Cosmetics Packaging Market.