Increased Focus on Personalized Medicine

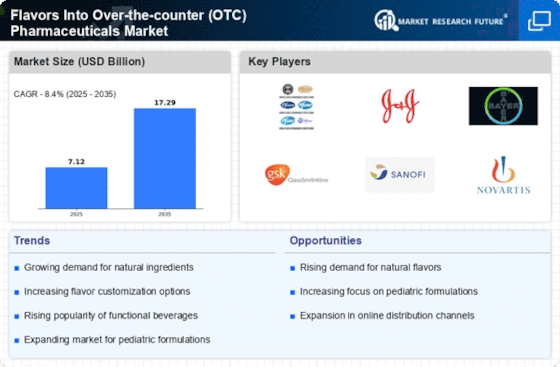

The Flavors Into Over-the-counter (OTC) Pharmaceuticals Market is witnessing a shift towards personalized medicine, which is influencing flavor selection in OTC products. As healthcare moves towards tailored solutions, the demand for customized flavor options is likely to rise. This trend is particularly relevant in the context of chronic disease management, where patients may require long-term medication adherence. Flavors that cater to individual preferences can enhance the overall experience and compliance. The market is expected to see an increase in offerings that allow consumers to choose flavors that suit their tastes, thereby fostering a more personalized approach to OTC pharmaceuticals.

Consumer Awareness of Health and Wellness

The Flavors Into Over-the-counter (OTC) Pharmaceuticals Market is significantly influenced by the growing consumer awareness surrounding health and wellness. As individuals become more health-conscious, they are increasingly scrutinizing the ingredients in OTC products, including flavoring agents. This heightened awareness has prompted manufacturers to innovate and offer products that not only taste good but also align with health trends. For instance, the demand for sugar-free and natural flavoring options is on the rise, as consumers seek to avoid artificial additives. This shift is likely to reshape product offerings, with an emphasis on transparency and quality in flavoring, thereby impacting market dynamics.

Rising Demand for Child-Friendly Formulations

The Flavors Into Over-the-counter (OTC) Pharmaceuticals Market is experiencing a notable increase in demand for child-friendly formulations. Parents are increasingly seeking medications that are palatable for children, which has led to a surge in the incorporation of appealing flavors. This trend is particularly evident in the cough and cold segment, where flavored syrups and chewable tablets are preferred. According to recent data, the market for pediatric OTC products is projected to grow at a compound annual growth rate of 5.2% over the next five years. This growth is driven by the need for effective yet enjoyable medication options for children, thereby enhancing adherence to treatment regimens.

Expansion of E-commerce Platforms for OTC Products

The Flavors Into Over-the-counter (OTC) Pharmaceuticals Market is being propelled by the expansion of e-commerce platforms. The convenience of online shopping has made it easier for consumers to access a wide variety of flavored OTC products. This trend is particularly beneficial for niche products that may not be available in traditional retail settings. E-commerce platforms are also enabling manufacturers to reach a broader audience, thereby increasing market penetration. Recent statistics indicate that online sales of OTC pharmaceuticals are expected to grow by 15% annually, highlighting the importance of flavor variety in attracting consumers to purchase these products online.

Technological Advancements in Flavoring Techniques

The Flavors Into Over-the-counter (OTC) Pharmaceuticals Market is benefiting from technological advancements in flavoring techniques. Innovations in flavor encapsulation and microencapsulation are enabling manufacturers to enhance the stability and release of flavors in OTC products. These advancements allow for a more consistent flavor experience, which is crucial for consumer satisfaction. Furthermore, the integration of flavor technology with product formulation is leading to the development of new and exciting flavor profiles that cater to diverse consumer preferences. As a result, companies are likely to invest in research and development to leverage these technologies, thereby driving growth in the market.