Advancements in Biologics

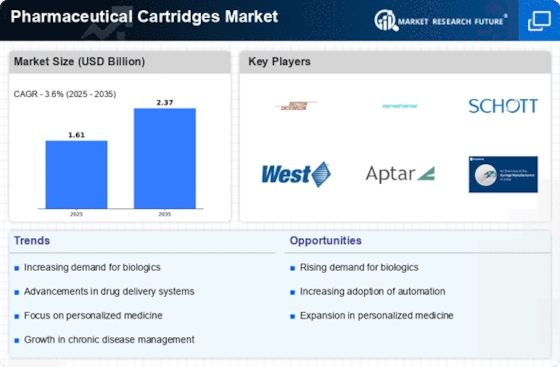

The Pharmaceutical Cartridges Market is significantly influenced by the advancements in biologics, which are increasingly being utilized for treating various diseases. Biologics often require specialized delivery systems to ensure stability and efficacy, making pharmaceutical cartridges an attractive option. The market for biologics is expected to grow substantially, with estimates suggesting a compound annual growth rate of over 10% in the coming years. This growth is likely to drive demand for pharmaceutical cartridges that can accommodate the unique requirements of biologic drugs, thereby enhancing their market presence and relevance.

Increase in Chronic Diseases

The rise in chronic diseases such as diabetes, cancer, and cardiovascular disorders is a primary driver for the Pharmaceutical Cartridges Market. As the prevalence of these conditions escalates, there is a growing demand for efficient drug delivery systems. Pharmaceutical cartridges facilitate precise dosing and enhance patient compliance, which is crucial for managing chronic illnesses. According to recent data, the global burden of chronic diseases is projected to increase, necessitating innovative solutions in medication administration. This trend underscores the importance of pharmaceutical cartridges in providing tailored therapies that meet the needs of patients with long-term health issues.

Focus on Patient-Centric Approaches

The Pharmaceutical Cartridges Market is experiencing a shift towards patient-centric approaches in drug delivery. Pharmaceutical companies are increasingly recognizing the importance of designing products that prioritize patient experience and adherence. This focus on patient-centricity is driving innovation in pharmaceutical cartridges, leading to the development of systems that enhance usability and comfort. Market Research Future suggests that patient adherence to medication regimens improves with the use of more intuitive delivery systems, thereby fostering a favorable environment for the growth of pharmaceutical cartridges tailored to meet these evolving patient needs.

Growing Demand for Home Healthcare Solutions

The shift towards home healthcare solutions is reshaping the Pharmaceutical Cartridges Market. With an increasing number of patients preferring to manage their health at home, there is a rising need for user-friendly drug delivery systems. Pharmaceutical cartridges offer convenience and ease of use, making them ideal for home administration of medications. Market data indicates that the home healthcare market is expected to expand significantly, driven by an aging population and a preference for personalized care. This trend is likely to propel the demand for pharmaceutical cartridges that cater to home healthcare needs.

Regulatory Support for Innovative Drug Delivery

Regulatory bodies are increasingly supporting innovative drug delivery systems, which is a key driver for the Pharmaceutical Cartridges Market. Initiatives aimed at expediting the approval process for advanced drug delivery technologies are becoming more common. This regulatory environment encourages pharmaceutical companies to invest in the development of new cartridge systems that improve patient outcomes. As a result, the market is witnessing a surge in the introduction of novel pharmaceutical cartridges designed to meet stringent regulatory standards, thereby enhancing their adoption in clinical settings.