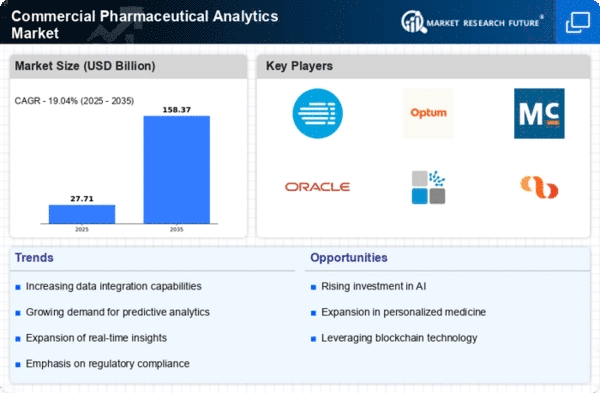

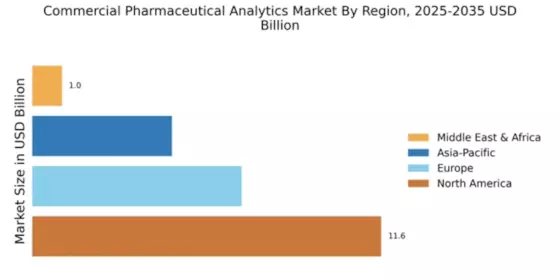

North America : Market Leader in Analytics

North America continues to lead the Commercial Pharmaceutical Analytics Market, holding a significant market share of 11.64 in 2024. The region's growth is driven by advanced healthcare infrastructure, increasing demand for data-driven decision-making, and stringent regulatory frameworks that promote transparency and efficiency. The rise of personalized medicine and the integration of AI technologies further catalyze market expansion, making it a hub for innovation and investment. The competitive landscape in North America is robust, featuring key players such as IQVIA, Optum, and McKesson. These companies leverage their extensive data resources and technological capabilities to offer comprehensive analytics solutions. The U.S. remains the largest market, supported by favorable government policies and a strong focus on research and development. As pharmaceutical companies seek to optimize their operations, the demand for analytics services is expected to grow, solidifying North America's position as a market leader.

Europe : Emerging Analytics Powerhouse

Europe is witnessing a significant transformation in the Commercial Pharmaceutical Analytics Market, with a market size of 6.98. The region benefits from a strong regulatory environment that encourages innovation and collaboration among stakeholders. Increasing investments in healthcare technology and a growing emphasis on patient-centric approaches are driving demand for analytics solutions. Additionally, the rise of digital health initiatives is expected to further enhance market growth in the coming years. Leading countries such as Germany, France, and the UK are at the forefront of this growth, hosting major players like Cegedim and PharmaLex. The competitive landscape is characterized by a mix of established firms and emerging startups, all vying for market share. As European pharmaceutical companies increasingly adopt data analytics to improve operational efficiency and patient outcomes, the region is poised for continued expansion in this sector. "The European market is evolving rapidly, with analytics becoming integral to pharmaceutical strategies."

Asia-Pacific : Rapidly Growing Market

The Asia-Pacific region is emerging as a rapidly growing market for Commercial Pharmaceutical Analytics, with a market size of 4.66. Factors such as increasing healthcare expenditure, a rising population, and a growing focus on healthcare digitization are driving demand for analytics solutions. Governments in countries like India and China are implementing policies to enhance healthcare infrastructure, which further supports market growth. The region's diverse demographics also present unique opportunities for tailored analytics services. Key players like Wipro and Medidata Solutions are expanding their presence in Asia-Pacific, capitalizing on the region's growth potential. Countries such as China and India are leading the charge, with significant investments in healthcare technology and analytics. As pharmaceutical companies in these nations seek to improve efficiency and patient care, the demand for analytics services is expected to surge, positioning Asia-Pacific as a key player in the global market.

Middle East and Africa : Emerging Market Potential

The Middle East and Africa (MEA) region is gradually developing its Commercial Pharmaceutical Analytics Market, currently valued at 0.99. The growth is driven by increasing healthcare investments, a rising prevalence of chronic diseases, and a growing awareness of the importance of data analytics in healthcare decision-making. Governments are focusing on improving healthcare systems, which is expected to create opportunities for analytics providers in the region. Countries like South Africa and the UAE are leading the way in adopting analytics solutions, supported by initiatives aimed at enhancing healthcare delivery. The competitive landscape is still evolving, with both local and international players exploring opportunities in this market. As the region continues to invest in healthcare infrastructure and technology, the demand for pharmaceutical analytics is anticipated to grow, paving the way for future advancements. "The MEA region is on the brink of a healthcare analytics revolution, driven by investment and innovation."