Top Industry Leaders in the Permanent Magnet Market

*Disclaimer: List of key companies in no particular order

Top listed companies in the Permanent Magnet industry are:

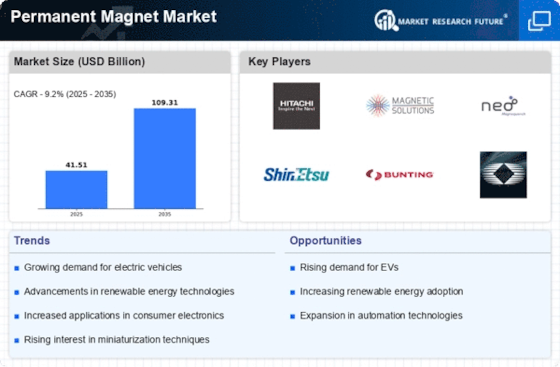

Hitachi Metals, Ltd. (Japan), TDK Corporation (Japan), Shin-Etsu Chemical Co., Ltd. (Japan), Electron Energy Corporation (US), Adams Magnetic Products Co., Inc. (US), Yantai Shougang Magnetic Materials Inc. (China), Ningbo Yunsheng Co. Ltd. (China), Chengdu Galaxy Magnets Co., Ltd. (China), Goudsmit Magnetics (US), Bunting Magnetics Co.(US), Tengam Engineering, Inc.(US), Eclipse Magnetics (UK), and Arnold Magnetic Technologies(US)

The global permanent magnet market is projected to witness consistent growth in the coming years, driven by the increasing adoption of electric vehicles, renewable energy technologies, and advanced electronics. This dynamic landscape attracts established players and new entrants alike, leading to an intense and ever-evolving competitive scenario. Analyzing the strategies, trends, and key players in this market is crucial for understanding the current and future dynamics.

Key Player Strategies:

- Market Concentration vs. Diversification: Leading players like Hitachi Metals, Shin-Etsu Chemical, and TDK Corporation hold significant market shares, leveraging their economies of scale and established distribution networks. However, smaller players are emerging, targeting niche applications and geographic markets.

- Material Expertise: Rare-earth-based magnets like Neodymium-Iron-Boron (NdFeB) dominate the market due to their superior strength. However, concerns about supply chain security and environmental impact are driving research into alternative materials like Samarium-Cobalt (SmCo) and ferrite magnets. Companies like SEG Magnetics and Magnequench are at the forefront of this innovation.

- Vertical Integration: Some players are integrating upstream to secure raw material supplies and downstream to offer customized magnet solutions for specific applications. For example, Sumitomo Special Metals controls its entire NdFeB production chain, offering stability and reliability to customers.

- Technological advancements: Continuous research and development are improving magnet efficiency, reducing size and weight, and lowering production costs. Players like Arnold Magnetic Technologies and Magnequench are investing heavily in R&D, aiming to gain a competitive edge.

Factors for Market Share Analysis:

- Product Portfolio: Offering a diverse range of permanent magnets catering to various applications and industries contributes to market share dominance.

- Geographical Presence: A strong global presence with manufacturing facilities and distribution networks across key regions like Asia, Europe, and North America is crucial for reaching a wider customer base.

- Cost Competitiveness: Optimizing production processes and securing sustainable raw material sources plays a vital role in maintaining competitive pricing and gaining market traction.

- Sustainability Initiatives: Implementing environmentally conscious practices to address concerns about rare-earth mining and recycling used magnets is becoming increasingly important for market reputation and attracting eco-conscious customers.

New and Emerging Trends:

- Focus on Recycling and Circular Economy: Companies are investing in recycling technologies to extract valuable materials from used magnets, promoting resource efficiency and reducing reliance on virgin raw materials.

- Development of Rare-Earth Free Magnets: Research into alternatives like ferrite magnets and PrNdDy alloys is gaining momentum to mitigate supply chain risks and environmental concerns associated with rare-earth mining.

- Integration with Artificial Intelligence (AI): AI-powered design tools and simulation software are being used to optimize magnet performance and develop custom solutions for specific applications, leading to greater efficiency and innovation.

- Rise of Miniaturization and Lightweighting: The demand for smaller and lighter magnets is increasing in fields like medical devices and wearable electronics, prompting companies to develop high-performance magnets with smaller footprints.

The permanent magnet market is characterized by intense competition, with established players facing challenges from niche players and disruptive technologies. Innovation, strategic diversification, and commitment to sustainability are key for companies to thrive in this dynamic market. Understanding the evolving trends and player strategies is crucial for navigating the complex competitive landscape and achieving success in this vital segment of the global economy.

This analysis provides a comprehensive overview of the competitive landscape of the permanent magnet market. By understanding the key strategies, factors for market share analysis, emerging trends, and the overall scenario, businesses can make informed decisions and capitalize on the exciting growth opportunities in this sector.

Latest Company Updates:

Hitachi Metals, Ltd. (Japan) is a major producer of rare-earth permanent magnets. In 2021, the company announced that it had developed a new type of neodymium-iron-boron (NdFeB) magnet with a maximum energy product of 51 MGOe, which is the strongest commercially available NdFeB magnet. (Source: Hitachi Metals press release, dated 2021-06-21)

TDK Corporation (Japan) is another major producer of permanent magnets. In 2022, the company announced that it had developed a new type of samarium-cobalt (SmCo) magnet with a maximum energy product of 34 MGOe. (Source: TDK press release, dated 2022-03-01)

Shin-Etsu Chemical Co., Ltd. (Japan) is a supplier of rare-earth metals used in the production of permanent magnets. In 2021, the company announced that it had expanded its production capacity for dysprosium, a rare-earth metal that is critical for the production of high-performance NdFeB magnets. (Source: Shin-Etsu Chemical press release, dated 2021-04-01)

Electron Energy Corporation (US) is a developer of new technologies for the production of permanent magnets. In 2022, the company announced that it had received a $15 million grant from the US Department of Energy to develop a new process for recycling rare-earth metals from used magnets. (Source: Electron Energy press release, dated 2022-01-10)