Market Trends

Key Emerging Trends in the Permanent Magnet Market

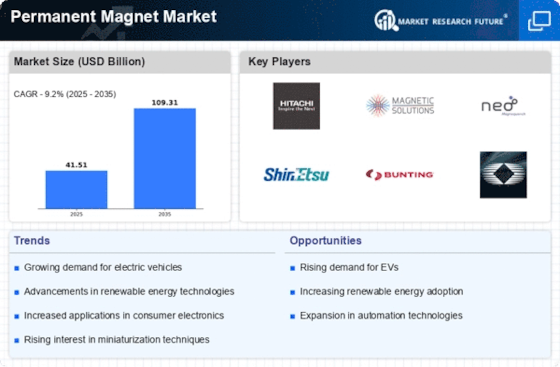

The permanent magnet market has been subjected to many significant trends that are disrupting the industry ecosystem. Among the most crucial factors propelling these trends is an elevated demand for clean energy solutions, specifically in the renewable arena. As the world is moving towards sustainability, there has been a high demand for permanent magnets in the wind turbines and also electric cars where they have proved to be a very important element of these devices’ efficacy. There are also many magnets that rely on the rare earth elements like NdFeB have become widely popular recently within the permanent magnet market. These magnets have a high magnetic strength and are absolutely vital elements in the most modern technologies. But, the market has had its own obstacles because of the rare earth elements concentration in a few countries and also supply chain vulnerabilities. In an effort to address this, R&D has been urged upon probable alternatives in the materials and magnet technologies that advocate sustainability while weaning away from the scarcity of resources. Given that electric cars are gaining alot of popularity in the automotive industry, they have significantly contributed to ushering significant development in the permanent magnet market. With governments across the world lobbying for tightened emissions standards and various incentives to accelerate electric mobility, there has been a significant rise in demand for permanent magnets from the EV manufacturers. This trend is likely to persist, as the automotive companies are making investments in high-end electric propulsion systems driving a strong permanent magnet market. In addition, permanent magnets have been driven by the market trends in the consumer electronics industry. Due to the miniaturization of electronics devices and the high-performance components, there is an enhanced use in permanent magnets used in products like smartphones, laptops,and also other audio systems. With advancements in the technology, the market will continue to innovate magnet designs and manufacturing processes that address growing demands on the electronics applications. The global drive to address the climate change and lower carbon footprint emissions has hastened the adoption of renewable energy sources such as the wind power development. Magnets play a fundamental role in the generators of wind turbines which means that they are very highly efficient and also reliable. The continued development of the wind energy projects across the globe will lead to a increased demand for permanent magnets, thereby driving trends within this market. Moreover, the industrial sector is also a great consumer of permanent magnets used as sensors; and motors and actuators. The shift to automation and Industry 4.0 has resulted in the requirement of accuracy and precision from the manufacturing industry which gave rise to the use of intelligent magnetic technologies.

Leave a Comment