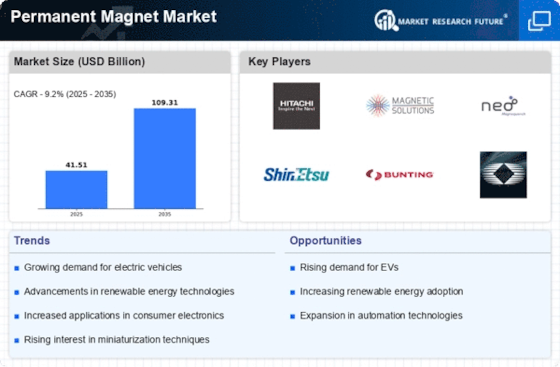

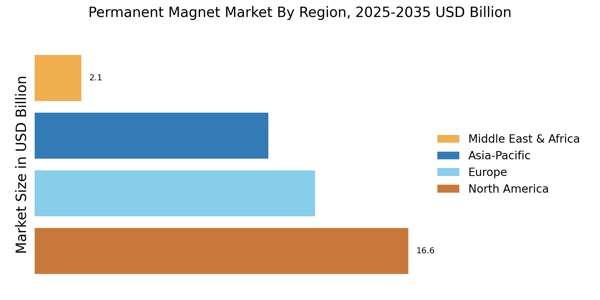

North America : Innovation and Demand Surge

North America is the largest market for permanent magnets, supported by a strong manufacturing ecosystem that includes established permanent magnet manufacturers, advanced R&D capabilities, and growing investments across the magnet industry. The region's growth is driven by increasing demand in automotive, electronics, and renewable energy sectors. Regulatory support for clean energy initiatives and technological advancements in magnet manufacturing are key catalysts for this growth. The U.S. is the primary contributor, followed by Canada, which is also witnessing a rise in magnet applications in various industries.

The competitive landscape in North America is robust, featuring key players like Hitachi, Neodymium Magnetics, and Bunting Magnetics. These companies are investing heavily in R&D to enhance magnet performance and sustainability. The presence of advanced manufacturing facilities and a skilled workforce further strengthens the market. Additionally, partnerships and collaborations among industry leaders are fostering innovation and expanding market reach.

Europe : Sustainable Growth and Innovation

Europe is witnessing significant growth in the permanent magnet market, with sustainability-focused policies encouraging innovation across the magnet market and collaboration among leading magnetic corp stakeholders. The region's demand is primarily driven by the automotive and renewable energy sectors, with a strong emphasis on sustainability and eco-friendly technologies. Regulatory frameworks, such as the European Green Deal, are promoting the use of permanent magnets in electric vehicles and wind turbines, further boosting market growth. Germany and France are the largest markets, leading in innovation and production capabilities.

The competitive landscape in Europe is characterized by the presence of established players like VACUUMSCHMELZE and Shin-Etsu Chemical. These companies are focusing on developing high-performance magnets to meet the growing demand for energy-efficient solutions. Additionally, collaborations between manufacturers and research institutions are enhancing technological advancements in magnet production. The region's commitment to sustainability is driving investments in recycling and circular economy initiatives.

Asia-Pacific : Rapid Expansion and Demand

Asia-Pacific continues to expand rapidly, driven by large-scale production capacity and strong export activity, positioning the region as a global hub for the magnet industry and high-volume permanent magnet manufacturer operations. The region's growth is fueled by increasing industrialization, urbanization, and a rising demand for consumer electronics. Countries like China and Japan are leading the market, with China being the largest producer of permanent magnets globally. Government initiatives to support manufacturing and innovation are also contributing to market expansion.

The competitive landscape in Asia-Pacific is dominated by key players such as Ningbo Yunsheng and JPMF. These companies are leveraging advanced technologies to enhance production efficiency and product quality. The region is also witnessing a surge in startups focusing on innovative magnet solutions, further intensifying competition. As the demand for electric vehicles and renewable energy solutions grows, the Asia-Pacific market is expected to continue its upward trajectory in the coming years.

Middle East and Africa : Emerging Market with Potential

The Middle East and Africa region is gradually emerging in the permanent magnet market, currently holding about 5% of the global share. The growth is primarily driven by increasing investments in renewable energy projects and industrial applications. Countries like South Africa and the UAE are leading the way, with government initiatives aimed at boosting manufacturing capabilities and attracting foreign investments. The region's potential for growth is significant, especially in sectors like automotive and electronics. The competitive landscape in the Middle East and Africa is still developing, with a few local players and international companies exploring opportunities. The presence of key players is limited, but there is a growing interest in establishing manufacturing facilities to cater to local demand. As infrastructure improves and regulatory frameworks become more supportive, the market is expected to attract more investments and partnerships, paving the way for future growth.