-

Executive Summary

-

Market Attractiveness Analysis 13

- Global PC As A Service (PCaaS) Market, By Component 13

- Global PC As A Service (PCaaS) Market, By Organization Size 14

- Global PC As A Service (PCaaS) Market, By Industry Vertical 14

-

Global PC As A Service (PCaaS) Market, By Region 15

-

Market Introduction

-

Definition 16

-

Scope Of The Study 16

-

Market Structure 16

-

Research Methodology

-

Research Process 17

-

Primary Research 18

-

Secondary Research 19

-

Market Size Estimation 19

-

Forecast Model 20

-

List Of Assumptions 21

-

Market Insights

-

Market Dynamics

-

Introduction 24

-

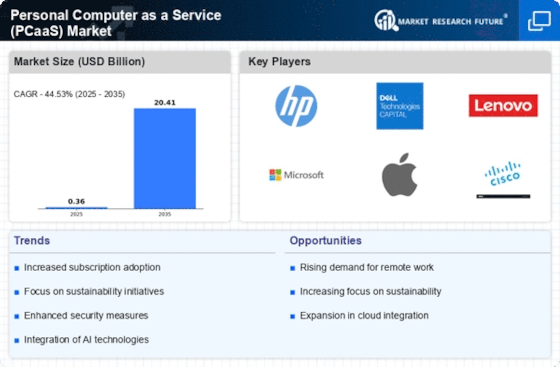

Drivers 25

- Rising Need To Reduce The Capital Expenditure (CapEx) And Operational Expenditure (OpEx) Among Enterprises 25

- Adoption Of Contract-Based Services And Solutions By SMEs 26

- Drivers Impact Analysis 26

-

Restraints 27

- Adoption Of BYOD And CYOD Policies 27

- Lack Of Technical Expertise And Security Concerns 27

- Restraints Impact Analysis 27

-

Opportunities 28

-

Increasing Adoption Of IoT 28

-

Market Factor Analysis

-

Value Chain Analysis 29

- Vendors/Service Providers 29

- Channel Partners/Value Added Sellers/ Integration Partners 30

- End Users 30

-

Porter’s Five Forces Model 31

- Threat Of New Entrants 31

- Bargaining Power Of Suppliers 32

- Threat Of Substitutes 32

- Bargaining Power Of Buyers 32

- Competitive Rivalry 32

-

Technological Trends 32

- Virtual Desktop Infrastructure 32

- Vendors Launch DaaS For Apple 32

-

Global PC As A Service (PCaaS) Market, By Component

-

Overview 33

- Hardware 33

- Solution (Software) 33

- Services 34

-

Global PC As A Service (PCaaS) Market, By Organization Size

-

Overview 37

- Large Enterprise 37

- Small And Medium Enterprise (SMEs) 37

-

Global PC As A Service (PCaaS) Market, By Industry Vertical

-

BFSI 39

-

Healthcare 39

-

IT & Telecom 39

-

Retail 39

-

Manufacturing 40

-

Education 40

-

Government 40

-

Others 40

-

Global PC As A Service (PCaaS) Market, By Region

-

Overview 42

-

North America 44

- US 48

- Canada 50

- Mexico 52

-

Asia-Pacific 54

- China 58

- India 60

- Japan 62

- Rest Of Asia-Pacific 64

-

Europe 66

- UK 70

- Germany 72

- Rest Of Europe 74

- France 76

-

Middle East And Africa 78

-

South America 82

-

Competitive Landscape

-

Competitive Overview 86

-

Vendor Share Analysis 87

-

Company Profiles

-

HP Development Company, LP 88

- Company Overview 88

- Financial Overview 89

- Products/Services/Solutions Offered 89

- Key Developments 90

- SWOT Analysis 90

- Key Strategies 91

-

Microsoft Corporation 92

- Company Overview 92

- Financial Overview 93

- Products/Services/Solutions Offered 93

- Key Developments 93

- SWOT Analysis 94

- Key Strategies 94

-

Dell Inc. 95

- Company Overview 95

- Financial Overview 96

- Products/Services/Solutions Offered 96

- Key Developments 97

- SWOT Analysis 97

- Key Strategies 98

-

Lenovo 99

- Company Overview 99

- Financial Overview 100

- Products/Services/Solutions Offered 100

- Key Developments 100

- SWOT Analysis 101

- Key Strategies 101

-

CompuCom Systems, Inc., (Office Depot, Inc.) 102

- Company Overview 102

- Financial Overview 102

- Products/Services/Solutions Offered 102

- Key Developments 103

- SWOT Analysis 103

- Key Strategies 103

-

Capgemini 104

- Company Overview 104

- Financial Overview 105

- Products/Services/Solutions Offered 105

- Key Developments 105

- SWOT Analysis 106

- Key Strategies 106

-

SHI International Corp. 107

- Company Overview 107

- Financial Overview 107

- Products/Services/Solutions Offered 107

- Key Developments 107

-

Dimension Data 108

- Company Overview 108

- Financial Overview 108

- Products/Services/Solutions Offered 108

- Key Developments 109

- SWOT Analysis 109

- Key Strategies 109

-

Softcat PLC 110

- Company Overview 110

- Financial Overview 110

- Products/Services/Solutions Offered 111

- Key Developments 111

- SWOT Analysis 111

- Key Strategies 111

-

Avaya Inc. 112

- Company Overview 112

- Financial Overview 113

- Products/Services/Solutions Offered 113

- Key Developments 113

- SWOT Analysis 114

- Key Strategies 114

-

-

List Of Tables

-

LIST OF ASSUMPTIONS 21

-

GLOBAL PC AS A SERVICE (PCAAS) MARKET, BY COMPONENT, 2022-2030 (USD MILLION) 35

-

GLOBAL PC AS A SERVICE (PCAAS) MARKET, BY SERVICE, 2022-2030 (USD MILLION) 36

-

GLOBAL PC AS A SERVICE (PCAAS) MARKET, BY ORGANIZATION SIZE, 2022-2030 (USD MILLION) 38

-

GLOBAL PC AS A SERVICE (PCAAS) MARKET, BY INDUSTRY VERTICAL, 2022-2030 (USD MILLION) 41

-

GLOBAL PC AS A SERVICE (PCAAS) MARKET, BY REGION, 2022-2030 (USD MILLION) 43

-

NORTH AMERICA: PC AS A SERVICE (PCAAS) MARKET, BY COUNTRY, 2020-2027 (USD MILLION) 44

-

NORTH AMERICA: PC AS A SERVICE (PCAAS) MARKET, BY COMPONENT, 2022-2030 (USD MILLION) 45

-

NORTH AMERICA: PC AS A SERVICE (PCAAS) MARKET, BY SERVICE, 2022-2030 (USD MILLION) 46

-

NORTH AMERICA: PC AS A SERVICE (PCAAS) MARKET, BY ORGANIZATION SIZE, 2022-2030 (USD MILLION) 46

-

NORTH AMERICA: PC AS A SERVICE (PCAAS) MARKET, BY INDUSTRY VERTICAL, 2022-2030 (USD MILLION) 47

-

US: PC AS A SERVICE (PCAAS) MARKET, BY COMPONENT, 2022-2030 (USD MILLION) 48

-

US: PC AS A SERVICE (PCAAS) MARKET, BY SERVICE, 2022-2030 (USD MILLION) 48

-

US: PC AS A SERVICE (PCAAS) MARKET, BY ORGANIZATION SIZE, 2022-2030 (USD MILLION) 49

-

US: PC AS A SERVICE (PCAAS) MARKET, BY INDUSTRY VERTICAL, 2022-2030 (USD MILLION) 49

-

CANADA: PC AS A SERVICE (PCAAS) MARKET, BY COMPONENT, 2022-2030 (USD MILLION) 50

-

CANADA: PC AS A SERVICE (PCAAS) MARKET, BY SERVICE, 2022-2030 (USD MILLION) 50

-

CANADA: PC AS A SERVICE (PCAAS) MARKET, BY ORGANIZATION SIZE, 2022-2030 (USD MILLION) 51

-

CANADA: PC AS A SERVICE (PCAAS) MARKET, BY INDUSTRY VERTICAL, 2022-2030 (USD MILLION) 51

-

MEXICO: PC AS A SERVICE (PCAAS) MARKET, BY COMPONENT, 2022-2030 (USD MILLION) 52

-

MEXICO: PC AS A SERVICE (PCAAS) MARKET, BY SERVICE, 2022-2030 (USD MILLION) 52

-

MEXICO: PC AS A SERVICE (PCAAS) MARKET, BY ORGANIZATION SIZE, 2022-2030 (USD MILLION) 53

-

MEXICO: PC AS A SERVICE (PCAAS) MARKET, BY INDUSTRY VERTICAL, 2022-2030 (USD MILLION) 53

-

ASIA-PACIFIC: PC AS A SERVICE (PCAAS) MARKET, BY COUNTRY, 2020-2027 (USD MILLION) 54

-

ASIA-PACIFIC: PC AS A SERVICE (PCAAS) MARKET, BY COMPONENT, 2022-2030 (USD MILLION) 55

-

ASIA-PACIFIC: PC AS A SERVICE (PCAAS) MARKET, BY SERVICE, 2022-2030 (USD MILLION) 56

-

ASIA-PACIFIC: PC AS A SERVICE (PCAAS) MARKET, BY ORGANIZATION SIZE, 2022-2030 (USD MILLION) 56

-

ASIA-PACIFIC: PC AS A SERVICE (PCAAS) MARKET, BY INDUSTRY VERTICAL, 2022-2030 (USD MILLION) 57

-

CHINA: PC AS A SERVICE (PCAAS) MARKET, BY COMPONENT, 2022-2030 (USD MILLION) 58

-

CHINA: PC AS A SERVICE (PCAAS) MARKET, BY SERVICE, 2022-2030 (USD MILLION) 58

-

CHINA: PC AS A SERVICE (PCAAS) MARKET, BY ORGANIZATION SIZE, 2022-2030 (USD MILLION) 59

-

CHINA: PC AS A SERVICE (PCAAS) MARKET, BY INDUSTRY VERTICAL, 2022-2030 (USD MILLION) 59

-

INDIA: PC AS A SERVICE (PCAAS) MARKET, BY COMPONENT, 2022-2030 (USD MILLION) 60

-

INDIA: PC AS A SERVICE (PCAAS) MARKET, BY SERVICE, 2022-2030 (USD MILLION) 60

-

INDIA: PC AS A SERVICE (PCAAS) MARKET, BY ORGANIZATION SIZE, 2022-2030 (USD MILLION) 61

-

INDIA: PC AS A SERVICE (PCAAS) MARKET, BY INDUSTRY VERTICAL, 2022-2030 (USD MILLION) 61

-

JAPAN: PC AS A SERVICE (PCAAS) MARKET, BY COMPONENT, 2022-2030 (USD MILLION) 62

-

JAPAN: PC AS A SERVICE (PCAAS) MARKET, BY SERVICE, 2022-2030 (USD MILLION) 62

-

JAPAN: PC AS A SERVICE (PCAAS) MARKET, BY ORGANIZATION SIZE, 2022-2030 (USD MILLION) 63

-

JAPAN: PC AS A SERVICE (PCAAS) MARKET, BY INDUSTRY VERTICAL, 2022-2030 (USD MILLION) 63

-

REST OF ASIA-PACIFIC: PC AS A SERVICE (PCAAS) MARKET, BY COMPONENT, 2022-2030 (USD MILLION) 64

-

REST OF ASIA-PACIFIC: PC AS A SERVICE (PCAAS) MARKET, BY SERVICE, 2022-2030 (USD MILLION) 64

-

REST OF ASIA-PACIFIC: PC AS A SERVICE (PCAAS) MARKET, BY ORGANIZATION SIZE, 2022-2030 (USD MILLION) 65

-

REST OF ASIA-PACIFIC: PC AS A SERVICE (PCAAS) MARKET, BY INDUSTRY VERTICAL, 2022-2030 (USD MILLION) 65

-

EUROPE: PC AS A SERVICE (PCAAS) MARKET, BY COUNTRY, 2020-2027 (USD MILLION) 66

-

EUROPE: PC AS A SERVICE (PCAAS) MARKET, BY COMPONENT, 2022-2030 (USD MILLION) 67

-

EUROPE: PC AS A SERVICE (PCAAS) MARKET, BY SERVICE, 2022-2030 (USD MILLION) 68

-

EUROPE: PC AS A SERVICE (PCAAS) MARKET, BY ORGANIZATION SIZE, 2022-2030 (USD MILLION) 68

-

EUROPE: PC AS A SERVICE (PCAAS) MARKET, BY INDUSTRY VERTICAL, 2022-2030 (USD MILLION) 69

-

UK: PC AS A SERVICE (PCAAS) MARKET, BY COMPONENT, 2022-2030 (USD MILLION) 70

-

UK: PC AS A SERVICE (PCAAS) MARKET, BY SERVICE, 2022-2030 (USD MILLION) 70

-

UK: PC AS A SERVICE (PCAAS) MARKET, BY ORGANIZATION SIZE, 2022-2030 (USD MILLION) 71

-

UK: PC AS A SERVICE (PCAAS) MARKET, BY INDUSTRY VERTICAL, 2022-2030 (USD MILLION) 71

-

GERMANY: PC AS A SERVICE (PCAAS) MARKET, BY COMPONENT, 2022-2030 (USD MILLION) 72

-

GERMANY: PC AS A SERVICE (PCAAS) MARKET, BY SERVICE, 2022-2030 (USD MILLION) 72

-

GERMANY: PC AS A SERVICE (PCAAS) MARKET, BY ORGANIZATION SIZE, 2022-2030 (USD MILLION) 73

-

GERMANY: PC AS A SERVICE (PCAAS) MARKET, BY INDUSTRY VERTICAL, 2022-2030 (USD MILLION) 73

-

REST OF EUROPE: PC AS A SERVICE (PCAAS) MARKET, BY COMPONENT, 2022-2030 (USD MILLION) 74

-

REST OF EUROPE: PC AS A SERVICE (PCAAS) MARKET, BY SERVICE, 2022-2030 (USD MILLION) 74

-

REST OF EUROPE: PC AS A SERVICE (PCAAS) MARKET, BY ORGANIZATION SIZE, 2022-2030 (USD MILLION) 75

-

REST OF EUROPE: PC AS A SERVICE (PCAAS) MARKET, BY INDUSTRY VERTICAL, 2022-2030 (USD MILLION) 75

-

FRANCE: PC AS A SERVICE (PCAAS) MARKET, BY COMPONENT, 2022-2030 (USD MILLION) 76

-

FRANCE: PC AS A SERVICE (PCAAS) MARKET, BY SERVICE, 2022-2030 (USD MILLION) 76

-

FRANCE: PC AS A SERVICE (PCAAS) MARKET, BY ORGANIZATION SIZE, 2022-2030 (USD MILLION) 77

-

FRANCE: PC AS A SERVICE (PCAAS) MARKET, BY INDUSTRY VERTICAL, 2022-2030 (USD MILLION) 77

-

MIDDLE EAST AND AFRICA: PC AS A SERVICE (PCAAS) MARKET, BY COMPONENT, 2022-2030 (USD MILLION) 78

-

MIDDLE EAST AND AFRICA: PC AS A SERVICE (PCAAS) MARKET, BY SERVICE, 2022-2030 (USD MILLION) 79

-

MIDDLE EAST AND AFRICA: PC AS A SERVICE (PCAAS) MARKET, BY ORGANIZATION SIZE, 2022-2030 (USD MILLION) 80

-

MIDDLE EAST AND AFRICA: PC AS A SERVICE (PCAAS) MARKET, BY INDUSTRY VERTICAL, 2022-2030 (USD MILLION) 81

-

SOUTH AMERICA: PC AS A SERVICE (PCAAS) MARKET, BY COMPONENT, 2022-2030 (USD MILLION) 82

-

SOUTH AMERICA: PC AS A SERVICE (PCAAS) MARKET, BY SERVICE, 2022-2030 (USD MILLION) 83

-

SOUTH AMERICA: PC AS A SERVICE (PCAAS) MARKET, BY ORGANIZATION SIZE, 2022-2030 (USD MILLION) 84

-

SOUTH AMERICA: PC AS A SERVICE (PCAAS) MARKET, BY INDUSTRY VERTICAL, 2022-2030 (USD MILLION) 85

-

-

List Of Figures

-

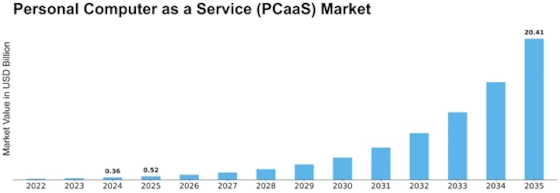

MARKET SYNOPSIS 12

-

MARKET ATTRACTIVENESS ANALYSIS: GLOBAL PC AS A SERVICE (PCAAS) MARKET 13

-

GLOBAL PC AS A SERVICE (PCAAS) MARKET ANALYSIS BY COMPONENT, 2020-2027 (USD MILLION) 13

-

GLOBAL PC AS A SERVICE (PCAAS) MARKET ANALYSIS BY ORGANIZATION SIZE, 2020-2027 (USD MILLION) 14

-

GLOBAL PC AS A SERVICE (PCAAS) MARKET ANALYSIS BY INDUSTRY VERTICAL, 2020-2027 (USD MILLION) 14

-

GLOBAL PC AS A SERVICE (PCAAS) MARKET ANALYSIS BY REGION, 2020 (%) 15

-

GLOBAL PC AS A SERVICE (PCAAS) MARKET: MARKET STRUCTURE 16

-

RESEARCH PROCESS OF MRFR 17

-

TOP DOWN & BOTTOM UP APPROACH 20

-

NORTH AMERICA MARKET SIZE & MARKET SHARE BY COUNTRY (2020 VS 2027) 22

-

ASIA-PACIFIC MARKET SIZE & MARKET SHARE BY COUNTRY (2020 VS 2027) 22

-

EUROPE MARKET SIZE & MARKET SHARE BY COUNTRY (2020 VS 2027) 23

-

DROC ANALYSIS OF GLOBAL PC AS A SERVICE (PCAAS) MARKET 24

-

TOP FACTORS LEADING TO IT BUDGET INCREASES IN 2019 25

-

DRIVERS IMPACT ANALYSIS: PC AS A SERVICE (PCAAS) MARKET 26

-

RESTRAINTS IMPACT ANALYSIS: PC AS A SERVICE (PCAAS) MARKET 27

-

IOT DEVICES CONNECTED IN 2020 AND 2025 28

-

VALUE CHAIN: GLOBAL PC AS A SERVICE (PCAAS) MARKET 29

-

GLOBAL PC AS A SERVICE (PCAAS) MARKET, BY COMPONENT, 2022-2030 (USD MILLION) 35

-

GLOBAL PC AS A SERVICE (PCAAS) MARKET, BY SERVICE, 2022-2030 (USD MILLION) 35

-

INCREASE IN IT REVENUE BY ORGANIZATION SIZE IN NORTH AMERICA AND EUROPE 37

-

GLOBAL PC AS A SERVICE (PCAAS) MARKET, BY ORGANIZATION SIZE, 2022-2030 (USD MILLION) 38

-

GLOBAL PC AS A SERVICE (PCAAS) MARKET, BY INDUSTRY VERTICAL, 2022-2030 (USD MILLION) 41

-

GLOBAL PC AS A SERVICE (PCAAS) MARKET, BY REGION, 2022-2030 (USD MILLION) 42

-

NORTH AMERICA: PC AS A SERVICE (PCAAS) MARKET, BY COUNTRY, 2020 – 2027 (USD MILLION) 44

-

NORTH AMERICA: PC AS A SERVICE (PCAAS) MARKET, BY COMPONENT, 2022-2030 (USD MILLION) 45

-

NORTH AMERICA: PC AS A SERVICE (PCAAS) MARKET, BY SERVICE, 2022-2030 (USD MILLION) 45

-

NORTH AMERICA: PC AS A SERVICE (PCAAS) MARKET SHARE, BY ORGANIZATION SIZE, 2022-2030 (USD MILLION) 46

-

NORTH AMERICA: PC AS A SERVICE (PCAAS) MARKET, BY INDUSTRY VERTICAL, 2022-2030 (USD MILLION) 47

-

ASIA-PACIFIC: PC AS A SERVICE (PCAAS) MARKET, BY COUNTRY, 2020 – 2027 (USD MILLION) 54

-

ASIA-PACIFIC: PC AS A SERVICE (PCAAS) MARKET, BY COMPONENT, 2022-2030 (USD MILLION) 55

-

ASIA-PACIFIC: PC AS A SERVICE (PCAAS) MARKET, BY SERVICE, 2022-2030 (USD MILLION) 55

-

ASIA-PACIFIC: PC AS A SERVICE (PCAAS) MARKET SHARE, BY ORGANIZATION SIZE, 2022-2030 (USD MILLION) 56

-

ASIA-PACIFIC: PC AS A SERVICE (PCAAS) MARKET, BY INDUSTRY VERTICAL, 2022-2030 (USD MILLION) 57

-

EUROPE: PC AS A SERVICE (PCAAS) MARKET, BY COUNTRY, 2020 – 2027 (USD MILLION) 66

-

EUROPE: PC AS A SERVICE (PCAAS) MARKET, BY COMPONENT, 2022-2030 (USD MILLION) 67

-

EUROPE: PC AS A SERVICE (PCAAS) MARKET, BY SERVICE, 2022-2030 (USD MILLION) 67

-

EUROPE: PC AS A SERVICE (PCAAS) MARKET SHARE, BY ORGANIZATION SIZE, 2022-2030 (USD MILLION) 68

-

EUROPE: PC AS A SERVICE (PCAAS) MARKET, BY INDUSTRY VERTICAL, 2022-2030 (USD MILLION) 69

-

MIDDLE EAST AND AFRICA: PC AS A SERVICE (PCAAS) MARKET, BY COMPONENT, 2022-2030 (USD MILLION) 78

-

MIDDLE EAST AND AFRICA: PC AS A SERVICE (PCAAS) MARKET, BY SERVICE, 2022-2030 (USD MILLION) 79

-

MIDDLE EAST AND AFRICA: PC AS A SERVICE (PCAAS) MARKET SHARE, BY ORGANIZATION SIZE, 2022-2030 (USD MILLION) 79

-

MIDDLE EAST AND AFRICA: PC AS A SERVICE (PCAAS) MARKET, BY INDUSTRY VERTICAL, 2022-2030 (USD MILLION) 80

-

SOUTH AMERICA: PC AS A SERVICE (PCAAS) MARKET, BY COMPONENT, 2022-2030 (USD MILLION) 82

-

SOUTH AMERICA: PC AS A SERVICE (PCAAS) MARKET, BY SERVICE, 2022-2030 (USD MILLION) 83

-

SOUTH AMERICA: PC AS A SERVICE (PCAAS) MARKET SHARE, BY ORGANIZATION SIZE, 2022-2030 (USD MILLION) 83

-

SOUTH AMERICA: PC AS A SERVICE (PCAAS) MARKET, BY INDUSTRY VERTICAL, 2022-2030 (USD MILLION) 84

-

VENDOR SHARE ANALYSIS IN 2020 87

Leave a Comment