Top Industry Leaders in the PC as a Service Market

Competitive Landscape of Personal Computer as a Service Market:

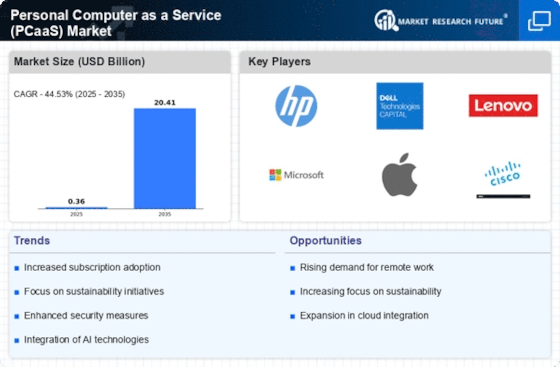

The Personal Computer as a Service (PCaaS) market has been experiencing significant growth in recent years, driven by factors such as increasing adoption of cloud computing, growing demand for flexible and scalable IT solutions, and the need to optimize operational costs. As a result, the competitive landscape is becoming increasingly saturated with a wide range of players offering various service models and solutions.

Key Players:

- HP Development Company (US)

- Microsoft Corporation (US)

- Dell Inc (US)

- Lenovo (Hong Kong)

- CompuCom Systems Inc (US)

- Capgemini (France)

- SHI International Corp. (US)

- Dimension Data (South Africa)

- Softcat PLC (UK)

- Avaya Inc (US)

Strategies Adopted by Leading Players:

Key players in the PCaaS market are adopting various strategies to gain market share and differentiate themselves from the competition. These include:

- Expanding Service Offerings: Many players are expanding their service offerings beyond basic PC provisioning to include additional services such as device management, security, data backup and recovery, and application management.

- Partnerships and Collaborations: Partnerships and collaborations with other technology vendors such as software providers and cloud providers are becoming increasingly common, allowing players to offer more comprehensive solutions and broaden their reach.

- Verticalization: Some players are focusing on specific vertical markets such as healthcare, education, and finance, tailoring their offerings to meet the unique needs of these industries.

- Technological Advancements: Continuous innovation and integration of new technologies such as AI, IoT, and automation are crucial for staying ahead of the curve and providing efficient and cost-effective solutions.

- Focus on Subscription-Based Models: The shift towards subscription-based models is becoming increasingly popular, providing customers with predictable costs and flexibility.

Factors for Market Share Analysis:

Several factors are critical for analyzing market share in the PCaaS market:

- Service Portfolio: The breadth and depth of services offered, including hardware, software, management, and support.

- Customer Base: Targeting specific industries or segments with tailored solutions.

- Geographic Reach: Availability of services in different regions and countries.

- Financial Performance: Revenue growth, profitability, and market capitalization.

- Brand Reputation: Customer satisfaction, industry recognition, and brand awareness.

New and Emerging Companies:

Several new and emerging companies are entering the PCaaS market, offering innovative solutions and disrupting the established players. These companies often focus on niche markets, leverage disruptive technologies, and prioritize agility and customer-centricity.

Current Company Investment Trends:

PCaaS companies are currently investing in various areas to ensure their growth and success in the competitive market. Key investment areas include:

- R&D: Developing new technologies and features to enhance the PCaaS experience.

- Sales and Marketing: Building brand awareness, expanding reach, and attracting new customers.

- Partnerships: Collaborating with other technology providers to offer integrated solutions.

- Talent Acquisition: Attracting and retaining skilled professionals to support growth.

- Customer Support: Improving customer service and addressing customer needs effectively.

Latest Company Updates:

NetApp has stated that Spot PC will be generally available in 2022. With features like security, automation, observability, and optimisation, this new managed cloud Desktop-as-a-Service (DaaS) solution is built to meet the demands of distributed and remote work settings as well as the public cloud.

Spot PC is a cloud desktop solution that is currently available. According to the company, it offers Managed Service Providers (MSPs) and their clients an optimised solution for security, privacy, and infrastructure efficiency. Its predictable pricing minimises support burdens and enables current staff to deliver and support more desktops, thereby increasing profitability.