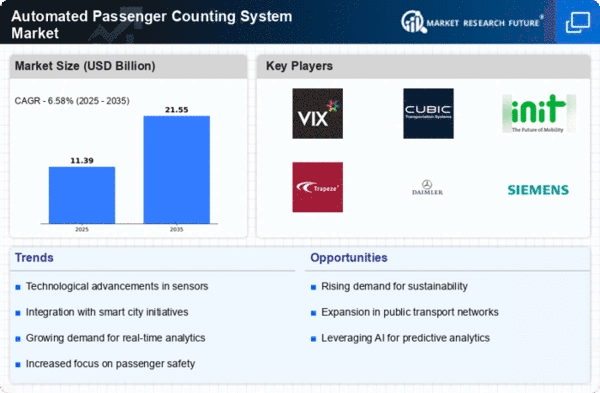

Market Growth Projections

The Global Automated Passenger Counting System Market Industry is projected to witness substantial growth in the coming years. With a market value expected to reach 10.7 USD Billion in 2024 and further expand to 21.6 USD Billion by 2035, the industry is on a promising trajectory. This growth is underpinned by a compound annual growth rate of 6.58% from 2025 to 2035, reflecting the increasing adoption of automated systems across various transit agencies. The upward trend in market value indicates a strong demand for innovative solutions that enhance operational efficiency and improve passenger experiences.

Technological Advancements

Technological innovations are a pivotal driver in the Global Automated Passenger Counting System Market Industry. The advent of sophisticated sensors and artificial intelligence has revolutionized the way passenger data is collected and analyzed. These advancements facilitate more accurate counting and reporting, which is essential for transit agencies aiming to improve operational efficiency. For instance, the implementation of infrared and video-based counting systems has shown to increase accuracy rates significantly. As technology continues to evolve, the market is expected to grow, with projections indicating a value of 21.6 USD Billion by 2035, underscoring the importance of adopting cutting-edge solutions.

Environmental Sustainability Goals

The Global Automated Passenger Counting System Market Industry is also being driven by the increasing focus on environmental sustainability. As cities worldwide aim to reduce their carbon footprints, there is a growing need for efficient public transportation systems. Automated passenger counting systems contribute to this goal by enabling transit agencies to optimize their services, thereby reducing unnecessary emissions. By accurately monitoring passenger loads, agencies can adjust service frequency and capacity, leading to more environmentally friendly operations. This alignment with sustainability objectives is likely to enhance the market's appeal, as stakeholders prioritize eco-friendly solutions in their transit planning.

Government Initiatives and Funding

Government initiatives play a crucial role in propelling the Global Automated Passenger Counting System Market Industry. Various governments are recognizing the importance of data-driven decision-making in public transportation. Consequently, they are allocating funds to enhance transit infrastructure and implement automated systems. For example, initiatives aimed at reducing congestion and improving air quality often include provisions for advanced passenger counting technologies. This support not only fosters market growth but also aligns with broader sustainability goals. As a result, the market is poised for a compound annual growth rate of 6.58% from 2025 to 2035, driven by these supportive policies.

Focus on Data-Driven Decision Making

The emphasis on data-driven decision-making is increasingly influencing the Global Automated Passenger Counting System Market Industry. Transit authorities are leveraging data analytics to enhance operational efficiency and improve service quality. By utilizing automated passenger counting systems, agencies can gather valuable insights into passenger behavior and travel patterns. This information aids in optimizing resource allocation and improving route planning. As cities strive to become smarter and more efficient, the demand for these systems is expected to rise. The growing reliance on data analytics is likely to contribute to the market's expansion, as stakeholders seek to harness the power of information.

Growing Demand for Public Transportation

The Global Automated Passenger Counting System Market Industry is experiencing a surge in demand for public transportation solutions. As urbanization accelerates, cities are increasingly investing in efficient transit systems to accommodate rising populations. This trend is reflected in the projected market value of 10.7 USD Billion in 2024, indicating a robust growth trajectory. Enhanced passenger counting technologies enable transit authorities to optimize routes and schedules, thereby improving service delivery. Furthermore, the integration of real-time data analytics into these systems allows for better decision-making, ultimately enhancing the overall passenger experience.