Growing Urban Population

The increasing urban population in the US is a pivotal driver for the passenger drones market. As cities become more congested, the demand for innovative transportation solutions rises. Urban areas are projected to house approximately 85% of the US population by 2050, leading to a pressing need for efficient mobility options. Passenger drones offer a potential solution to alleviate traffic congestion and reduce travel times. The passenger drones market is likely to benefit from this demographic shift, as urban dwellers seek alternatives to traditional ground transportation. Furthermore, the integration of passenger drones into urban transport systems could enhance accessibility, providing residents with quicker and more convenient travel options. This trend suggests a significant opportunity for growth within the passenger drones market, as urban planners and policymakers increasingly consider aerial mobility solutions to address urban challenges.

Public Acceptance and Awareness

Public acceptance and awareness are critical factors influencing the passenger drones market. As the concept of aerial mobility becomes more mainstream, consumer perceptions are evolving. Educational campaigns and demonstrations are essential in addressing safety concerns and misconceptions about passenger drones. The passenger drones market is likely to see increased adoption as public awareness grows, particularly among urban residents who may benefit from enhanced mobility options. Surveys indicate that approximately 60% of urban dwellers express interest in using passenger drones for short-distance travel, suggesting a favorable outlook for the market. Additionally, as successful pilot programs and regulatory frameworks are established, public confidence in the safety and reliability of passenger drones is expected to improve. This shift in public sentiment could play a pivotal role in driving market growth and facilitating the integration of passenger drones into everyday transportation.

Investment and Funding Opportunities

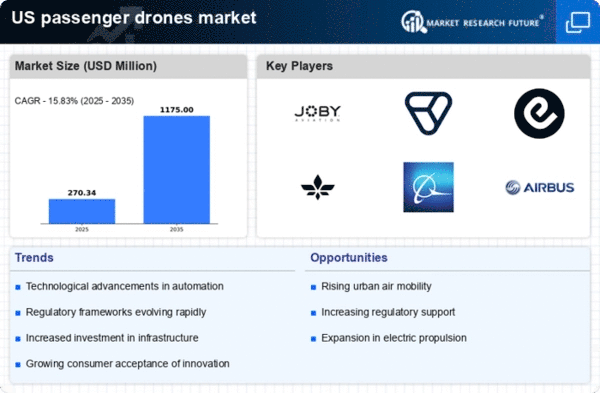

Investment and funding opportunities are rapidly expanding within the passenger drones market. Venture capital firms and private investors are increasingly recognizing the potential of aerial mobility solutions, leading to a surge in financial backing for startups and established companies in the sector. In 2025, investments in the passenger drones market are projected to reach approximately $3 billion, reflecting growing confidence in the future of urban air mobility. This influx of capital is facilitating research, development, and commercialization of innovative drone technologies. Furthermore, partnerships between technology firms and aviation companies are becoming more common, fostering collaboration that accelerates advancements in the industry. As funding continues to flow into the passenger drones market, it is likely to stimulate competition and innovation, ultimately benefiting consumers and enhancing the overall market landscape.

Environmental Sustainability Initiatives

The growing emphasis on environmental sustainability is a crucial driver for the passenger drones market. As concerns about climate change and air pollution intensify, there is a strong push for cleaner transportation alternatives. Passenger drones, particularly those powered by electric propulsion systems, present a promising solution to reduce carbon emissions associated with traditional vehicles. The passenger drones market is likely to benefit from government incentives aimed at promoting sustainable transport solutions. For example, federal and state programs are increasingly offering grants and subsidies for the development of eco-friendly transportation technologies. This trend indicates a potential market expansion, as consumers and businesses alike seek greener alternatives. The integration of passenger drones into urban air mobility systems could significantly contribute to achieving sustainability goals, making them an attractive option for environmentally conscious stakeholders.

Technological Innovations in Drone Design

Technological advancements in drone design are significantly influencing the passenger drones market. Innovations such as improved battery life, enhanced safety features, and advanced navigation systems are making passenger drones more viable for commercial use. For instance, the development of electric vertical takeoff and landing (eVTOL) aircraft is revolutionizing the industry, with several prototypes demonstrating the capability to carry passengers efficiently. The passenger drones market is witnessing investments exceeding $1 billion in research and development, indicating strong confidence in the future of aerial mobility. These technological innovations not only enhance the performance and safety of passenger drones but also contribute to reducing operational costs. As these technologies mature, they are expected to drive wider adoption and integration of passenger drones into existing transportation networks, further propelling market growth.