Growing Awareness and Advocacy

Growing awareness and advocacy for Parkinson's Disease are contributing to the expansion of the Parkinsons Disease Therapeutics Market. Increased public knowledge about the disease, its symptoms, and its impact on patients and families is fostering a supportive environment for research and treatment initiatives.

Advocacy groups are playing a crucial role in raising awareness, organizing events, and promoting fundraising efforts to support research. This heightened awareness is leading to greater demand for effective therapeutics, as patients and caregivers seek better management options.

Additionally, as more individuals become informed about the disease, there is a corresponding increase in the willingness to participate in clinical trials, which is essential for the development of new therapies.

Consequently, the advocacy efforts are not only enhancing the visibility of Parkinsons Disease but also driving growth in the therapeutics market.

Rising Prevalence of Parkinson's Disease

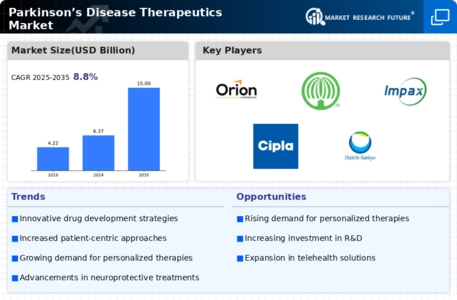

The increasing prevalence of Parkinson's Disease is a primary driver for the Parkinson's Disease Therapeutics Market.

As the population ages, the incidence of this neurodegenerative disorder is expected to rise significantly. According to recent estimates, the number of individuals diagnosed with Parkinson's Disease is projected to reach over 10 million by 2030.

This growing patient population necessitates the development and availability of effective therapeutics, thereby propelling market growth. Pharmaceutical companies are investing heavily in research and development to create innovative treatment options that address both motor and non-motor symptoms.

The rising prevalence not only highlights the urgent need for effective therapies but also encourages healthcare systems to allocate more resources towards managing this condition, further stimulating the Parkinson's Disease Therapeutics Market.

Increased Research Funding and Investment

Increased research funding and investment in Parkinson's Disease therapeutics are driving the market forward. Governments and private organizations are recognizing the need for more effective treatments and are allocating substantial resources to research initiatives.

In recent years, funding for Parkinsons Disease research has seen a notable increase, with millions of dollars directed towards clinical trials and innovative therapeutic approaches. This influx of capital is fostering collaboration between academic institutions and pharmaceutical companies, leading to the development of novel therapies.

As a result, the Parkinsons Disease Therapeutics Market is experiencing a surge in new product pipelines, which may lead to breakthroughs in treatment options. The commitment to advancing research not only enhances the understanding of the disease but also accelerates the introduction of new therapeutics into the market.

Regulatory Support for Innovative Therapies

Regulatory support for innovative therapies is a key driver in the Parkinson's Disease Therapeutics Market. Regulatory agencies are increasingly recognizing the need for expedited approval processes for novel treatments that address unmet medical needs.

Initiatives such as breakthrough therapy designations and fast-track approvals are encouraging pharmaceutical companies to invest in the development of new therapeutics. This supportive regulatory environment is particularly important for conditions like Parkinsons Disease, where traditional treatment options may be limited.

By facilitating quicker access to innovative therapies, regulatory bodies are not only enhancing patient care but also stimulating market growth. As more companies navigate the regulatory landscape successfully, the Parkinsons Disease Therapeutics Market is likely to witness an influx of new and effective treatment options, ultimately benefiting patients.

Technological Advancements in Treatment Modalities

Technological advancements in treatment modalities are significantly influencing the Parkinson's Disease Therapeutics Market. Innovations such as deep brain stimulation and advanced drug delivery systems are enhancing the efficacy of existing therapies.

For instance, the integration of wearable technology and mobile health applications is enabling real-time monitoring of patient symptoms, which can lead to more personalized treatment approaches. Furthermore, the development of gene therapy and stem cell research holds promise for potentially curative treatments.

These advancements not only improve patient outcomes but also attract investment from pharmaceutical companies eager to capitalize on cutting-edge technologies. As these technologies continue to evolve, they are likely to reshape the landscape of the Parkinsons Disease Therapeutics Market, offering new hope for patients and healthcare providers alike.