Increasing Prevalence of ADHD

The rising prevalence of Attention Deficit Hyperactivity Disorder (ADHD) is a primary driver of the ADHD Therapeutics Market. Recent estimates indicate that approximately 5-10% of children are diagnosed with ADHD, with a notable increase in diagnoses among adults as awareness grows. This surge in prevalence necessitates effective therapeutic interventions, thereby propelling market growth. The increasing recognition of ADHD as a significant public health concern has led to enhanced screening and diagnostic practices, further contributing to the demand for ADHD therapeutics. As more individuals seek treatment, the market is likely to expand, with a diverse range of therapeutic options being developed to cater to varying patient needs. This trend underscores the importance of addressing ADHD comprehensively within the healthcare system.

Growing Awareness and Education

Growing awareness and education regarding ADHD are pivotal in shaping the ADHD Therapeutics Market. Increased public and professional understanding of ADHD has led to more individuals seeking diagnosis and treatment. Educational campaigns aimed at parents, educators, and healthcare providers have been instrumental in reducing stigma and promoting early intervention. As awareness rises, the demand for effective therapeutic options is expected to grow, driving market expansion. Additionally, healthcare professionals are increasingly trained to recognize ADHD symptoms, which facilitates timely referrals for treatment. This heightened awareness not only benefits patients but also encourages investment in research and development of new therapeutics, further propelling the market forward.

Integration of Behavioral Therapies

The integration of behavioral therapies into treatment plans is emerging as a significant driver in the ADHD Therapeutics Market. Evidence suggests that combining pharmacological treatments with behavioral interventions can lead to improved outcomes for individuals with ADHD. This holistic approach addresses not only the symptoms of ADHD but also the associated behavioral challenges, enhancing overall quality of life. As healthcare providers increasingly adopt this integrated model, the demand for comprehensive treatment options is expected to rise. Furthermore, the collaboration between mental health professionals and primary care providers is likely to facilitate the development of tailored therapeutic strategies, thereby expanding the market for ADHD therapeutics. This trend reflects a broader shift towards personalized medicine in the treatment of ADHD.

Regulatory Support for ADHD Treatments

Regulatory support for ADHD treatments plays a crucial role in the ADHD Therapeutics Market. Government agencies are increasingly recognizing the need for effective ADHD interventions, leading to streamlined approval processes for new medications. This regulatory environment fosters innovation and encourages pharmaceutical companies to invest in research and development. For instance, the expedited review pathways for ADHD therapeutics have resulted in faster access to new treatments for patients. Moreover, regulatory bodies are also focusing on ensuring the safety and efficacy of ADHD medications, which enhances public trust in these therapies. As a result, the market is likely to benefit from a steady influx of new and improved therapeutic options, catering to the diverse needs of individuals with ADHD.

Innovations in Pharmacological Treatments

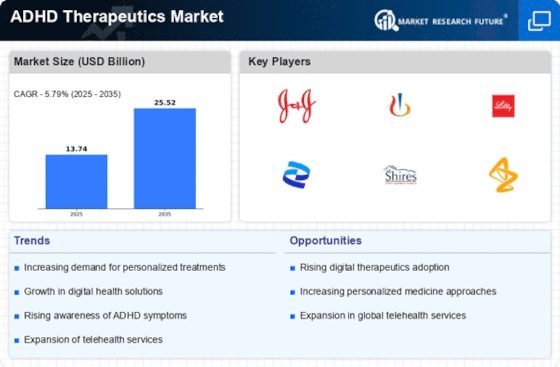

Innovations in pharmacological treatments are significantly influencing the ADHD Therapeutics Market. The development of novel medications, including long-acting stimulants and non-stimulant options, has broadened the therapeutic landscape. For instance, recent advancements have led to the introduction of medications that offer improved efficacy and reduced side effects, enhancing patient adherence to treatment regimens. The market for ADHD therapeutics is projected to reach approximately USD 20 billion by 2026, driven by these innovations. Furthermore, ongoing research into the neurobiological underpinnings of ADHD is likely to yield new therapeutic targets, potentially leading to the emergence of groundbreaking treatments. This dynamic environment fosters competition among pharmaceutical companies, encouraging continuous improvement and diversification of ADHD therapeutics.