Rising Security Concerns

The increasing concerns regarding safety and security in residential and commercial areas appear to drive the Outdoor Motion Sensor Lights Market. As crime rates fluctuate, homeowners and businesses are likely to invest in security measures, including motion sensor lights. These lights not only deter potential intruders but also enhance visibility during nighttime. According to recent data, the demand for outdoor lighting solutions has surged, with a notable increase in sales of motion sensor lights. This trend suggests that consumers are prioritizing safety, thereby propelling the growth of the Outdoor Motion Sensor Lights Market. Furthermore, municipalities are also adopting these technologies in public spaces to improve safety, indicating a broader acceptance of motion sensor lighting solutions.

Technological Advancements

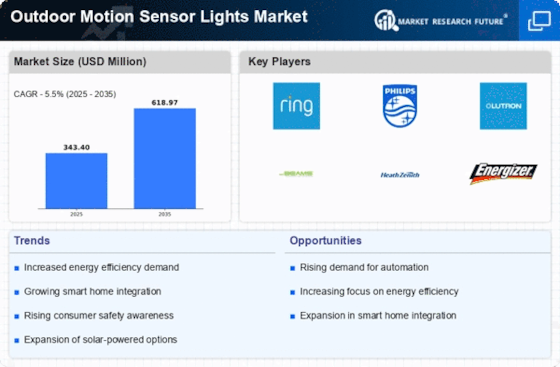

Technological advancements in the Outdoor Motion Sensor Lights Market are likely to play a pivotal role in its expansion. Innovations such as smart sensors, integration with home automation systems, and energy-efficient LED technology are becoming increasingly prevalent. These advancements not only enhance the functionality of motion sensor lights but also improve user experience. For instance, the incorporation of mobile app controls allows users to manage their outdoor lighting remotely. Market data indicates that the adoption of smart outdoor lighting solutions is on the rise, with a projected growth rate of over 10% annually. This suggests that consumers are becoming more inclined towards technologically advanced lighting solutions, thereby driving the Outdoor Motion Sensor Lights Market forward.

Increased Outdoor Living Spaces

The trend towards creating outdoor living spaces appears to be a significant driver for the Outdoor Motion Sensor Lights Market. As homeowners invest in patios, gardens, and outdoor entertainment areas, the need for effective lighting solutions becomes paramount. Motion sensor lights provide both functionality and ambiance, making them an attractive option for enhancing outdoor aesthetics. Recent market data indicates that the outdoor lighting segment is experiencing a growth rate of approximately 8% annually, driven by this trend. This suggests that as more individuals seek to utilize their outdoor spaces, the demand for motion sensor lighting solutions will likely continue to rise, further propelling the Outdoor Motion Sensor Lights Market.

Regulatory Support and Incentives

Regulatory support and incentives for energy-efficient products appear to be fostering growth in the Outdoor Motion Sensor Lights Market. Governments and local authorities are increasingly implementing policies that encourage the adoption of energy-saving technologies. These initiatives often include tax rebates, grants, and subsidies for consumers who invest in energy-efficient lighting solutions. Market data suggests that regions with such incentives have seen a marked increase in the sales of motion sensor lights, indicating a positive correlation between regulatory support and market growth. This trend suggests that as more consumers become aware of available incentives, the Outdoor Motion Sensor Lights Market may experience accelerated growth, driven by both consumer demand and supportive policies.

Environmental Sustainability Initiatives

The growing emphasis on environmental sustainability appears to influence the Outdoor Motion Sensor Lights Market significantly. As consumers become more environmentally conscious, there is a marked shift towards energy-efficient lighting solutions. Motion sensor lights, particularly those utilizing LED technology, consume less energy and have a longer lifespan compared to traditional lighting options. This shift aligns with global sustainability initiatives aimed at reducing carbon footprints. Market analysis indicates that the energy-efficient lighting segment is expected to witness substantial growth, potentially reaching a market share of 40% within the next few years. This trend suggests that the Outdoor Motion Sensor Lights Market is adapting to meet the demands of eco-conscious consumers, thereby enhancing its appeal.