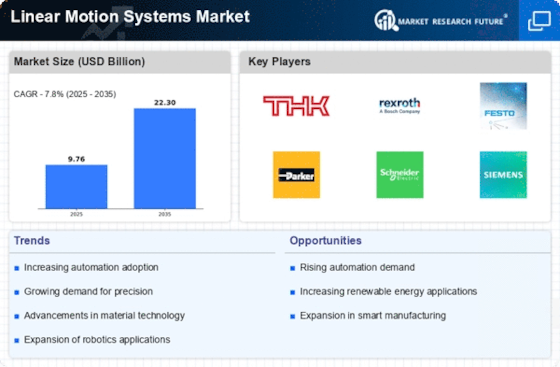

Major market players are investing a lot of money in R&D to expand their product portfolios, which will spur further market growth for the Linear Motion Systems industry. With significant industry changes, including new product releases, contractual agreements, mergers and acquisitions, increased investments, and collaboration with other organizations, market participants are also undertaking various strategic activities to expand their global presence. To grow and remain in a market that is becoming more and more competitive, Linear Motion Systems industry competitors must provide affordable products.

Manufacturing locally to cut operational costs is one of the main business tactics used by the Linear Motion Systems industry to serve customers and increase the market sector. The Linear Motion Systems industry has recently given medicine some of the most important advantages. The Linear Motion Systems markets major players such as Bosch Rexroth AG (Germany), Rollon Spa (Italy), Thomas Industries, Schneeberger AG (Switzerland), SKF AB (Sweden), Nippon Bearing Co.

Ltd (Japan), Schneider Electric Motion USA (US), Hepco Motion (England), Lintech (US), Bishop-Wisecarver (US), and others are working on expanding the Linear Motion Systems market demand by investing in research and development activities.

Engineering company Bosch Rexroth AG is situated in Germany's Lohr am Main. It is a fully owned subsidiary of Robert Bosch GmbH, and the outcome of a merger that took place on May 1, 2001, between Mannesmann Rexroth AG and the Automation Technology Business Unit of Robert Bosch GmbH.

In July Bosch Rexroth purchased Lincolnshire, Illinois-based HydraForce, Inc. (USA) to expand its hydraulics sector. HydraForce designs and manufactures tiny hydraulic valves and systems with 2,100 personnel spread over six production plants in the United States, Brazil, Great Britain, and China. The cost of the purchase won't be disclosed.

Antitrust approval is required for the transaction.

Original equipment manufacturers (OEMs) across various global sectors, including machine tools, semiconductor, solar, and electrical engineering, are served by SCHNEEBERGER®. The product and production portfolio of SCHNEEBERGER includes linear bearings, profiled linear guideways, measurement systems, gear racks, slides, positioning systems, and mineral casting. As a member of the SCHNEEBERGER Group, A.MANNESMANN. The SCHNEEBERGER Group revealed the availability of recirculating units in lengths and sizes ranging from 1 to 12 in 2019.

According to the company, the SR type of recirculating unit is best for medium to high loads, and the SK and SKD kinds are best for small to medium pressure.