Market Growth Projections

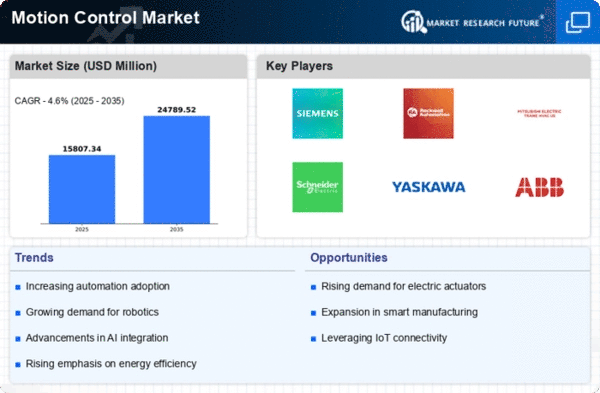

The Global Motion Control Market Industry is projected to experience substantial growth, with estimates indicating a market size of 15.1 USD Billion in 2024 and a potential increase to 24.8 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 4.6% from 2025 to 2035. The increasing adoption of automation, advancements in technology, and the rising demand for energy-efficient solutions are likely to drive this expansion. As industries continue to evolve and adapt to changing market dynamics, the motion control sector is expected to play a pivotal role in shaping the future of manufacturing and automation.

Technological Advancements

The Global Motion Control Market Industry is experiencing rapid technological advancements that enhance automation and precision in various sectors. Innovations such as advanced robotics, artificial intelligence, and IoT integration are driving demand for motion control solutions. For instance, the adoption of smart manufacturing practices is leading to increased efficiency and reduced operational costs. As industries seek to optimize their processes, the market is projected to reach 15.1 USD Billion in 2024, indicating a robust growth trajectory. These advancements not only improve productivity but also enable manufacturers to respond swiftly to market changes, thereby solidifying the industry's relevance in the global economy.

Rising Demand for Automation

The Global Motion Control Market Industry is significantly influenced by the rising demand for automation across various sectors, including manufacturing, automotive, and aerospace. Companies are increasingly adopting motion control systems to enhance operational efficiency and reduce labor costs. This trend is particularly evident in the manufacturing sector, where automated systems are becoming essential for maintaining competitiveness. As a result, the market is expected to grow to 24.8 USD Billion by 2035, reflecting a compound annual growth rate of 4.6% from 2025 to 2035. The shift towards automation not only streamlines production processes but also improves product quality, further driving market expansion.

Expansion of Emerging Markets

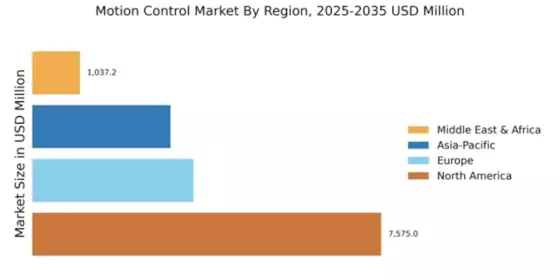

The Global Motion Control Market Industry is benefiting from the expansion of emerging markets, where industrialization and urbanization are accelerating. Countries in Asia-Pacific and Latin America are investing heavily in infrastructure and manufacturing capabilities, leading to increased demand for motion control solutions. This trend is particularly evident in sectors such as construction and transportation, where motion control technologies are essential for efficient operations. As these markets continue to grow, the Global Motion Control Market is poised for significant expansion, with projections indicating a market size of 24.8 USD Billion by 2035. The influx of investments in these regions is likely to create new opportunities for industry players.

Increased Investment in Robotics

The Global Motion Control Market Industry is witnessing increased investment in robotics, which is a key driver of market growth. As industries recognize the potential of robotics to enhance productivity and efficiency, investments in robotic systems are surging. For example, the automotive sector is increasingly integrating robotic arms for assembly lines, leading to improved precision and reduced cycle times. This trend is likely to contribute to the market's expansion, with projections indicating a growth to 24.8 USD Billion by 2035. The integration of advanced motion control technologies in robotics is expected to create new opportunities and applications, further solidifying the industry's position in the global market.

Growing Need for Energy Efficiency

The Global Motion Control Market Industry is increasingly shaped by the growing need for energy efficiency in industrial operations. Companies are under pressure to reduce energy consumption and minimize their carbon footprint, leading to the adoption of energy-efficient motion control systems. These systems not only lower operational costs but also comply with stringent environmental regulations. As industries strive for sustainability, the demand for energy-efficient solutions is expected to drive market growth. The market's trajectory suggests a potential increase to 15.1 USD Billion in 2024, as organizations prioritize energy-efficient technologies to enhance their competitiveness and meet regulatory requirements.