Market Trends

Key Emerging Trends in the Osteoporosis Drugs Market

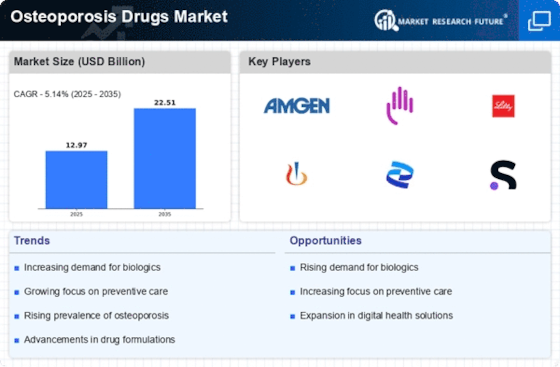

Growing older populations around the world have a big impact on the market for osteoporosis drugs. In the same age group, more and more people are getting osteoporosis. It's even more important to have medicines that can treat and stop bone loss because of this.

Using more than one treatment to help people with osteoporosis is getting a lot of attention. Some drugs, like anabolic agents and drugs that stop or slow down bone loss, work better when mixed. This keeps bones from breaking and makes them stronger.

Anabolic drug treatments for osteoporosis are becoming more popular. Parathyroid hormone analogs are one type of steroid drug that can help bones get bigger. They are becoming an important part of treating serious osteoporosis and provide options to standard treatments that break down bones.

Long-acting versions are becoming more popular in the research and creation of osteoporosis drugs. Drugs that come in extended-release forms or with longer dosing times help patients stick to their treatment plans, require less frequent administration, and lead to better treatment results.

Adding digital health options to the market is changing how it works. Involvement, monitoring, and taking medicines as directed are easier for patients with osteoporosis thanks to mobile apps, smart technology, and video platforms. This improves their overall care.

More programs are making people more aware of osteoporosis, which is growing the world market for drugs that treat it. Educating healthcare workers and the public about osteoporosis risk factors, ways to avoid getting it, and medicines that are available all help the market grow in a variety of areas.

Alternatives to oral bisphosphonates are getting interest. Intravenous versions and improved oral drugs offer choices for patients who may face issues with the long-term use of standard oral bisphosphonates.

Medication delivery in osteoporosis is moving towards patient-centric methods. Efforts to increase the comfort of drug administration, such as easy-to-use syringe devices and user-friendly formulas, add to better patient retention.

Biomarkers for bone health are getting more and more attention in research. Identifying and tracking biomarkers associated with bone turnover and fracture risk helps in tailored treatment plans, allowing healthcare workers to tailor measures based on individual patient needs.

Exploration of non-traditional treatment targets is affecting osteoporosis drug development. To make the next wave of osteoporosis drugs, scientists are looking into new pathways like Wnt signaling, sclerostin inhibition, and cathepsin K inhibition.

Leave a Comment