Aging Population

The demographic shift towards an aging population significantly influences the Global Gastrointestinal Drugs Market Industry. Older adults are more susceptible to gastrointestinal disorders due to age-related physiological changes. According to demographic studies, the global population aged 65 and older is projected to double by 2050, leading to an increased prevalence of conditions such as gastroesophageal reflux disease and constipation. This demographic trend underscores the necessity for effective gastrointestinal treatments, thereby driving market growth. As the market is expected to grow at a CAGR of 5.06% from 2025 to 2035, the aging population will likely remain a critical driver of demand for gastrointestinal drugs.

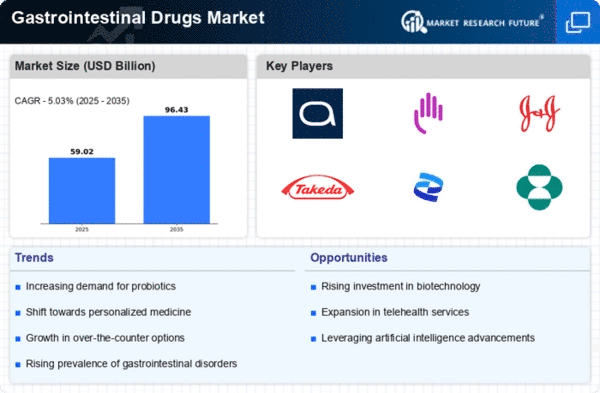

Market Growth Projections

The Global Gastrointestinal Drugs Market Industry is poised for substantial growth, with projections indicating a market value of 56.2 USD Billion in 2024 and an anticipated increase to 96.7 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate (CAGR) of 5.06% from 2025 to 2035. Such figures underscore the expanding demand for gastrointestinal medications driven by various factors, including the rising prevalence of gastrointestinal disorders, advancements in drug development, and increased healthcare expenditure. The market's evolution reflects a dynamic landscape, where ongoing research and innovation play pivotal roles in shaping future trends.

Rising Healthcare Expenditure

The upward trend in global healthcare expenditure is a significant driver for the Global Gastrointestinal Drugs Market Industry. Governments and private sectors are investing more in healthcare, leading to improved access to medications and treatments. According to health expenditure reports, many countries are allocating larger portions of their GDP to healthcare, which enhances the availability of gastrointestinal drugs. This financial commitment supports research and development, fostering innovation in drug therapies. As a result, the market is poised for growth, with projections indicating a rise to 96.7 USD Billion by 2035, reflecting the increasing prioritization of gastrointestinal health in healthcare budgets.

Advancements in Drug Development

Innovations in drug development are pivotal for the Global Gastrointestinal Drugs Market Industry. The emergence of biologics and targeted therapies has transformed treatment paradigms for various gastrointestinal conditions. These advancements not only enhance efficacy but also improve patient compliance. For example, the introduction of monoclonal antibodies has shown promising results in treating inflammatory bowel diseases. As the market evolves, the integration of technology in drug formulation and delivery systems is expected to further propel growth. This trend aligns with the market's anticipated expansion to 96.7 USD Billion by 2035, indicating a robust pipeline of new therapeutic options.

Increased Awareness and Diagnosis

Growing awareness regarding gastrointestinal health and advancements in diagnostic techniques are crucial for the Global Gastrointestinal Drugs Market Industry. Enhanced public knowledge about gastrointestinal disorders leads to earlier diagnosis and treatment, which is essential for effective management. The proliferation of health campaigns and educational initiatives has contributed to this awareness. Furthermore, improved diagnostic tools, such as endoscopy and imaging technologies, facilitate timely intervention. This trend is expected to boost the market as more individuals seek treatment, contributing to the projected market value of 56.2 USD Billion in 2024. Increased diagnosis correlates with higher demand for gastrointestinal medications.

Rising Prevalence of Gastrointestinal Disorders

The increasing incidence of gastrointestinal disorders globally drives the Global Gastrointestinal Drugs Market Industry. Conditions such as irritable bowel syndrome, Crohn's disease, and ulcerative colitis are becoming more prevalent, affecting millions. For instance, the World Health Organization reports that gastrointestinal diseases account for a significant portion of healthcare expenditures. This rising burden necessitates effective treatment options, contributing to the market's growth. As the market is projected to reach 56.2 USD Billion in 2024, the demand for innovative gastrointestinal drugs is likely to escalate, reflecting the urgent need for effective management of these conditions.