Advancements in Display Technologies

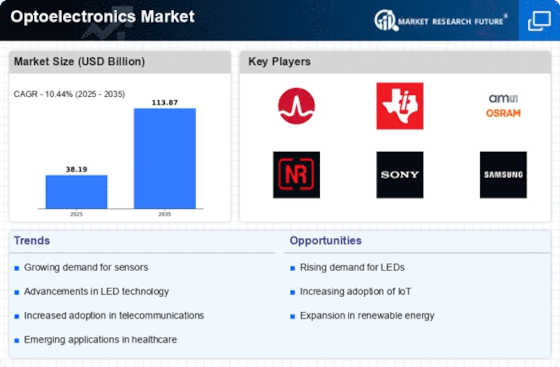

The Optoelectronics Market is significantly influenced by advancements in display technologies, particularly in the realm of consumer electronics. Innovations such as organic light-emitting diodes (OLED) and microLED displays are transforming the way visual content is presented. These technologies offer superior color accuracy, energy efficiency, and thinner form factors compared to traditional display technologies. Market data suggests that The Optoelectronics Market is expected to reach over 200 billion dollars by 2026, with a substantial portion attributed to optoelectronic components. As manufacturers continue to invest in research and development to enhance display performance, the demand for high-quality optoelectronic devices is likely to rise, further propelling the growth of the Optoelectronics Market.

Emergence of Smart Cities Initiatives

The development of smart cities is emerging as a pivotal driver for the Optoelectronics Market. As urban areas seek to enhance efficiency and sustainability, the integration of optoelectronic technologies in infrastructure is becoming increasingly prevalent. Smart lighting systems, traffic management solutions, and environmental monitoring applications rely heavily on optoelectronic components. Market forecasts indicate that investments in smart city projects are expected to reach trillions of dollars in the coming years. This trend presents a substantial opportunity for the optoelectronics sector, as it will require innovative solutions to support the infrastructure of smart cities. Consequently, the Optoelectronics Market is likely to experience robust growth as cities adopt these technologies to improve urban living conditions.

Growth in Automotive Lighting Systems

The automotive sector is witnessing a transformation with the increasing adoption of advanced lighting systems, which is a significant driver for the Optoelectronics Market. LED and laser-based lighting technologies are becoming standard in modern vehicles, providing enhanced visibility and energy efficiency. The automotive lighting market is projected to grow at a compound annual growth rate of approximately 8% over the next few years. This growth is driven by the demand for improved safety features and aesthetic enhancements in vehicles. As automakers continue to integrate optoelectronic solutions into their designs, the Optoelectronics Market is expected to benefit from this trend, leading to innovations in lighting technologies and increased market opportunities.

Rising Demand for Renewable Energy Solutions

The Optoelectronics Market is experiencing a notable surge in demand for renewable energy solutions, particularly in solar energy applications. Photovoltaic cells, which are integral to solar panels, rely heavily on optoelectronic components. As countries strive to meet renewable energy targets, the market for these components is projected to grow significantly. According to recent data, the solar energy sector is expected to expand at a compound annual growth rate of over 20% in the coming years. This growth is likely to drive innovation and investment in optoelectronic technologies, enhancing efficiency and reducing costs. Furthermore, the integration of optoelectronic devices in energy management systems is anticipated to optimize energy consumption, thereby reinforcing the importance of the Optoelectronics Market in the transition to sustainable energy solutions.

Expansion of Internet of Things (IoT) Applications

The proliferation of Internet of Things (IoT) devices is a key driver for the Optoelectronics Market. As more devices become interconnected, the demand for sensors and communication technologies that utilize optoelectronic components is increasing. These components are essential for enabling data transmission and processing in various applications, including smart homes, industrial automation, and healthcare monitoring. Market analysis indicates that the IoT sector is projected to grow exponentially, with billions of devices expected to be connected in the next few years. This growth presents a substantial opportunity for the optoelectronics sector, as it will require advanced optoelectronic solutions to support the vast network of devices. Consequently, the Optoelectronics Market is likely to see increased investment and innovation to meet the evolving needs of IoT applications.