Top Industry Leaders in the Optoelectronics Market

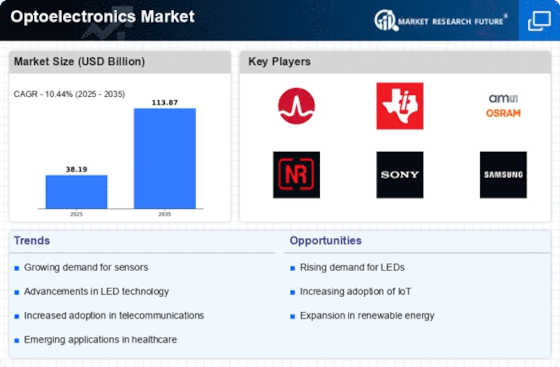

Competitive Landscape of the Optoelectronics Market:

The optoelectronics market is a vibrant arena teeming with established giants and ambitious newcomers. Competition is intense, fuelled by the market's robust growth and diverse applications across industries like consumer electronics, healthcare, communications, and automotive. To navigate this dynamic landscape, understanding the competitive strategies employed by key players and the factors influencing market share is crucial.

Key Players:

- Alfa Chemistry Materials

- OpenLight

- Veeco Instrument

- Bolite Optoelectronics

- Nisshinbo Micro Devices Inc.

- General Electric Company

- Panasonic Corporation

- Samsung Electronics

- Omnivision Technologies Inc.

- Sony Corporation

Strategies Adopted by Key Players:

- Product Diversification: Offering a wide range of optoelectronic components, from LEDs and lasers to sensors and solar cells, caters to diverse customer needs and minimizes dependence on any single segment.

- Vertical Integration: Gaining control over the supply chain, from material sourcing to manufacturing and distribution, allows for cost optimization and improved quality control.

- Strategic Partnerships: Collaborating with research institutions, universities, and startups fosters innovation and expands market reach.

Factors Influencing Market Share:

- Product Innovation: Continuous advancements in materials like gallium nitride (GaN) and micro-LED technology drive market share gains. Companies like GaNo Optoelectronics (China) with their UV detectors and Nationstar Optoelectronics (China) with their strategic partnership with Huawei exemplify this trend.

- Cost Optimization: Efficient manufacturing processes and economies of scale play a crucial role, particularly in price-sensitive segments like consumer electronics. Companies like MaxWell Technologies (Taiwan) with their vertically integrated production demonstrate this approach.

- Regional Dynamics: Growth in emerging economies like China and India presents significant opportunities. Local companies like BOE Technology Group (China) are rapidly expanding their optoelectronics offerings to capitalize on this growth.

- Vertical Integration: Integrating upstream and downstream activities offers control over the supply chain and cost advantages. Companies like Avnet with their distribution network and vertical integration in critical components leverage this strategy effectively.

Emerging Players and Technologies:

- Start-ups: Disruptive technologies like LiDAR for autonomous vehicles and microdisplays for augmented reality are attracting venture capital and spawning innovative start-ups like Quanergy (US) and Lumus (Israel). Their agility and focus on niche applications pose a challenge to established players.

- Material Advancements: New materials like perovskites with their potential for high-efficiency solar cells and organic LEDs with their flexible properties are attracting research and development efforts. Companies like Oxford PV (UK) and LG Display (South Korea) are actively involved in these developments.

Latest Company Updates:

Veeco Instruments:

- December 12, 2023: Veeco Instruments announced a definitive agreement to acquire MOCVD equipment provider SP3D for $85 million. This acquisition strengthens Veeco's position in the advanced GaN power electronics market.

- November 9, 2023: Veeco Instruments reported third-quarter 2023 financial results with revenue of $262.6 million, exceeding analyst expectations. The company also raised its full-year 2023 revenue guidance.

Bolite Optoelectronics:

- December 22, 2023: Bolite Optoelectronics announced the successful mass production of its high-brightness micro-LED displays, targeting applications in AR/VR headsets and smart wearables.

- November 15, 2023: Bolite Optoelectronics signed a strategic partnership agreement with a leading global smartphone manufacturer to supply micro-LED displays for their upcoming flagship phone.