Emergence of Healthcare Technologies

The emergence of advanced healthcare technologies is driving growth in the optoelectronics market. Innovations such as telemedicine, diagnostic imaging, and wearable health devices are increasingly reliant on optoelectronic components. The US healthcare technology market is anticipated to exceed $500 billion by 2026, with optoelectronic devices being integral to enhancing patient care and monitoring. For instance, optical sensors and imaging systems are crucial for non-invasive diagnostics and real-time health monitoring. This trend suggests that as healthcare continues to evolve, the demand for optoelectronic solutions will likely expand, providing significant opportunities for growth within the industry.

Surge in Consumer Electronics Adoption

The increasing adoption of consumer electronics in the US is a pivotal driver for the optoelectronics market. With the proliferation of devices such as smartphones, tablets, and smart home products, the demand for optoelectronic components is on the rise. In 2025, the consumer electronics sector is projected to reach a valuation of approximately $400 billion, with optoelectronic devices playing a crucial role in enhancing functionality and user experience. This trend indicates a robust growth trajectory for the optoelectronics market, as manufacturers seek to integrate advanced optical technologies into their products. Furthermore, the shift towards high-definition displays and augmented reality applications is likely to further fuel demand, suggesting a vibrant future for the industry as it adapts to evolving consumer preferences.

Growth in Automotive Sector Innovations

Innovations within the automotive sector are emerging as a significant driver for the optoelectronics market. The shift towards electric vehicles (EVs) and autonomous driving technologies necessitates advanced optoelectronic components for various applications, including LiDAR systems, camera sensors, and display technologies. The US automotive market is projected to reach $1 trillion by 2026, with a substantial portion of this growth attributed to the integration of optoelectronic solutions. As manufacturers prioritize safety and efficiency, the demand for high-performance optoelectronic devices is likely to increase, indicating a promising outlook for the industry. This trend underscores the critical role that optoelectronics will play in shaping the future of transportation.

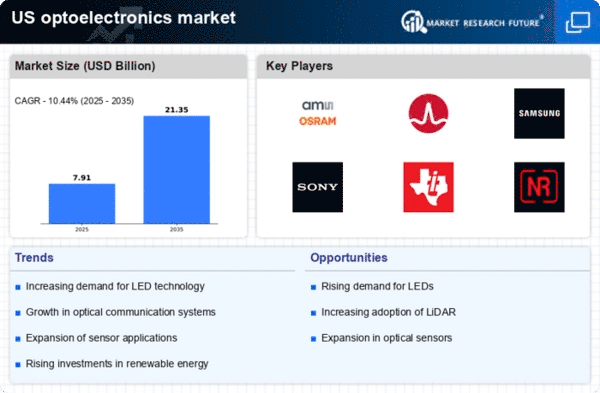

Increased Focus on Renewable Energy Solutions

The growing emphasis on renewable energy solutions is a notable driver for the optoelectronics market. As the US transitions towards sustainable energy sources, technologies such as solar power are gaining traction. The solar energy market is projected to reach $200 billion by 2026, with optoelectronic components playing a vital role in the efficiency of solar panels and energy conversion systems. Photovoltaic cells, which rely on optoelectronic principles, are essential for harnessing solar energy effectively. This shift towards renewable energy not only aligns with environmental goals but also suggests a robust demand for optoelectronic technologies, indicating a promising future for the industry as it adapts to the changing energy landscape.

Expansion of Telecommunications Infrastructure

The ongoing expansion of telecommunications infrastructure in the US significantly impacts the optoelectronics market. As 5G technology continues to roll out, the need for high-speed data transmission and improved connectivity is paramount. The telecommunications sector is expected to invest over $100 billion in infrastructure upgrades by 2026, which will likely drive demand for optoelectronic components such as lasers and photodetectors. These components are essential for enabling faster data rates and enhancing network performance. Consequently, the optoelectronics market stands to benefit from this investment, as telecommunications companies increasingly rely on advanced optical technologies to meet consumer demands for seamless connectivity and high-quality services.