Rising Prevalence of Eye Disorders

The increasing incidence of eye disorders, such as cataracts, glaucoma, and age-related macular degeneration, is a primary driver of the Ophthalmic Drugs Devices Market. According to recent estimates, millions of individuals are affected by these conditions, leading to a heightened demand for effective treatment options. This trend is particularly pronounced among aging populations, where the prevalence of such disorders is expected to rise significantly. As a result, pharmaceutical companies and device manufacturers are focusing on developing innovative solutions to address these challenges. The growing awareness of eye health and the importance of early diagnosis further contribute to the expansion of the market, as patients seek timely interventions to preserve their vision.

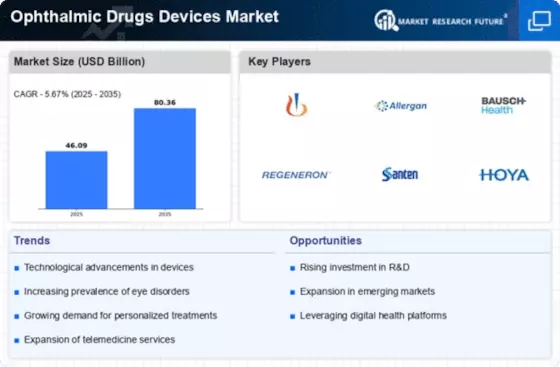

Advancements in Ophthalmic Technologies

Technological innovations in ophthalmic devices and drug delivery systems are transforming the Ophthalmic Drugs Devices Market. Recent advancements include the development of minimally invasive surgical techniques, improved diagnostic tools, and novel drug formulations that enhance therapeutic efficacy. For instance, the introduction of sustained-release drug delivery systems has shown promise in managing chronic eye conditions, potentially improving patient compliance and outcomes. Furthermore, the integration of artificial intelligence in diagnostic imaging is streamlining the detection of eye diseases, allowing for earlier and more accurate interventions. These technological strides not only enhance treatment options but also drive market growth by attracting investments and fostering collaborations among industry stakeholders.

Growing Demand for Personalized Medicine

The shift towards personalized medicine is significantly influencing the Ophthalmic Drugs Devices Market. Patients are increasingly seeking tailored treatment plans that consider their unique genetic profiles and specific eye conditions. This trend is prompting pharmaceutical companies to invest in research and development of targeted therapies that can provide more effective and safer treatment options. The rise of biomarker-driven approaches in ophthalmology is facilitating the identification of patient subgroups that may benefit from specific interventions. As a result, the market is witnessing a surge in the development of personalized ophthalmic drugs and devices, which are expected to enhance patient outcomes and satisfaction.

Rising Awareness and Education on Eye Health

The growing awareness and education regarding eye health are pivotal in shaping the Ophthalmic Drugs Devices Market. Public health campaigns and educational programs are effectively informing individuals about the importance of regular eye examinations and the early detection of eye diseases. This heightened awareness is encouraging patients to seek medical advice and treatment, thereby increasing the demand for ophthalmic drugs and devices. Furthermore, collaborations between healthcare organizations and community groups are fostering a culture of proactive eye care, which is expected to sustain market growth. As more individuals prioritize their eye health, the market is likely to experience a positive trajectory.

Increased Investment in Eye Care Infrastructure

Investment in eye care infrastructure is a crucial driver of the Ophthalmic Drugs Devices Market. Governments and private entities are recognizing the importance of accessible eye care services, leading to the establishment of specialized clinics and hospitals. This expansion is accompanied by the procurement of advanced ophthalmic devices and technologies, which are essential for accurate diagnosis and effective treatment. Additionally, initiatives aimed at training healthcare professionals in ophthalmology are enhancing the quality of care provided to patients. As the infrastructure improves, the demand for ophthalmic drugs and devices is likely to increase, further propelling market growth.