Market Trends

Key Emerging Trends in the Ophthalmic Drugs Devices Market

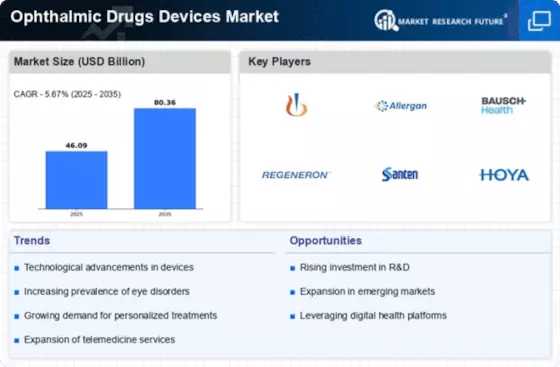

| The market trends of the Ophthalmic Drugs and Devices industry have been witnessing significant developments in recent times. With a growing global prevalence of eye disorders and an aging population, the demand for innovative and advanced solutions in ophthalmic healthcare has surged. One notable trend is the increasing focus on personalized medicine and targeted therapies, aiming to address specific eye conditions with greater precision and efficacy. This shift towards precision medicine has led to the development of novel drugs and devices tailored to individual patient needs, enhancing treatment outcomes and minimizing adverse effects. Technological advancements have played a pivotal role in shaping the market landscape. The integration of cutting-edge technologies such as artificial intelligence (AI) and telemedicine into ophthalmic devices has revolutionized diagnostics and patient care. AI-powered diagnostic tools have improved the accuracy and speed of disease detection, enabling early intervention and better management of eye disorders. Additionally, telemedicine platforms have expanded access to ophthalmic care, especially in remote or underserved areas, contributing to the overall growth of the market. In terms of drug development, there has been a notable increase in the number of biopharmaceuticals and gene therapies targeting ophthalmic conditions. The advent of gene editing technologies has paved the way for innovative treatment modalities, offering potential cures for genetic eye disorders. This trend is indicative of a paradigm shift towards more targeted and durable therapeutic options. Moreover, the rise of regenerative medicine in ophthalmology, involving the use of stem cells and tissue engineering, holds promise for restoring vision and repairing damaged ocular tissues. Another key trend is the emphasis on sustainability and eco-friendly practices in the production and packaging of ophthalmic drugs and devices. As environmental awareness continues to grow, companies in the industry are adopting greener manufacturing processes and eco-friendly packaging materials, aligning with the global push towards sustainable healthcare solutions. This commitment to environmental responsibility not only meets consumer expectations but also contributes to the overall positive perception of companies within the market. Furthermore, collaborations and partnerships between pharmaceutical companies, medical device manufacturers, and research institutions have become increasingly prevalent. These collaborations aim to leverage collective expertise and resources for the development of groundbreaking therapies and devices. By fostering a collaborative ecosystem, stakeholders in the ophthalmic market can accelerate the pace of innovation and bring transformative products to market more efficiently. The COVID-19 pandemic has also influenced market trends in the ophthalmic sector. The pandemic has underscored the importance of telehealth and remote monitoring in ophthalmology, as patients sought alternative ways to receive eye care without physical visits to healthcare facilities. This has led to a greater acceptance and integration of digital health solutions within the ophthalmic landscape, shaping the future of patient-doctor interactions and follow-up care. |

Leave a Comment