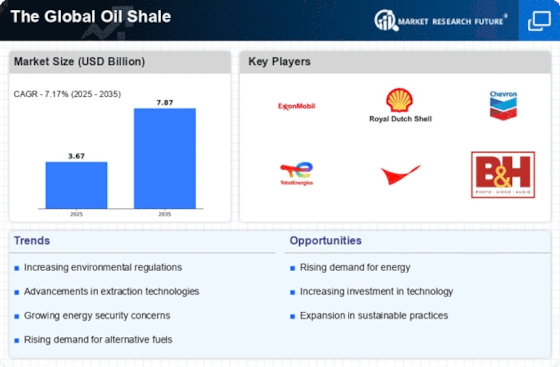

Rising Energy Demand

The increasing The Global Oil Shale Industry. As populations grow and economies expand, the need for energy sources intensifies. According to recent estimates, energy consumption is projected to rise by approximately 30% by 2040. This surge in demand compels nations to explore alternative energy sources, including oil shale, which is abundant in various regions. The Oil Shale Market is likely to benefit from this trend, as countries seek to diversify their energy portfolios and reduce reliance on conventional fossil fuels. Furthermore, the strategic importance of oil shale resources may lead to increased investments in extraction technologies, thereby enhancing production capabilities and market growth.

Government Policies and Incentives

Government policies and incentives play a crucial role in shaping the Oil Shale Market. Many countries are implementing favorable regulations to promote the development of unconventional oil resources, including oil shale. For instance, tax incentives, subsidies, and research grants are being offered to companies engaged in oil shale exploration and production. These initiatives aim to stimulate investment and innovation in extraction technologies, which could lead to more efficient and environmentally friendly methods. As a result, the Oil Shale Market is likely to experience growth driven by supportive governmental frameworks that encourage sustainable energy practices and enhance energy independence.

Investment in Research and Development

Investment in research and development is a key driver for the Oil Shale Market. As the demand for cleaner and more efficient energy sources grows, companies and governments are allocating resources to innovate and improve oil shale extraction and processing methods. This focus on R&D is likely to yield breakthroughs that enhance the economic feasibility of oil shale projects. For instance, advancements in carbon capture and storage technologies could mitigate environmental concerns associated with oil shale production. Consequently, the Oil Shale Market stands to benefit from increased investment in R&D, which may lead to more sustainable practices and greater market acceptance.

Technological Innovations in Processing

Technological innovations in processing techniques are transforming the Oil Shale Market. Advances in extraction and processing technologies, such as in-situ retorting and solvent extraction, are enhancing the efficiency and economic viability of oil shale production. These innovations not only reduce operational costs but also minimize environmental impacts associated with traditional extraction methods. The market is witnessing a shift towards more sustainable practices, which could attract investment and foster growth. As companies adopt these cutting-edge technologies, the Oil Shale Market is expected to expand, providing a reliable source of energy while addressing environmental concerns.

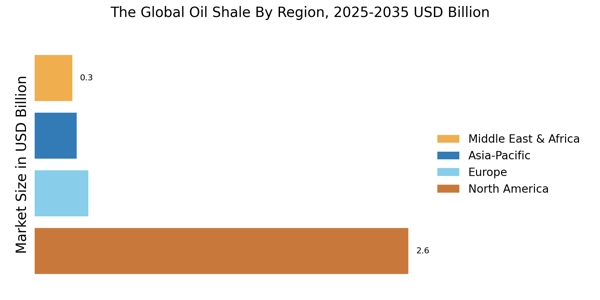

Geopolitical Factors and Resource Accessibility

Geopolitical factors significantly influence the Oil Shale Market, particularly in regions rich in oil shale deposits. The accessibility of these resources is often affected by political stability, trade relations, and regulatory environments. Countries with abundant oil shale reserves may leverage these resources to enhance their energy security and reduce dependence on imported oil. This strategic positioning can lead to increased exploration and production activities, thereby driving market growth. Additionally, geopolitical tensions may prompt nations to invest in domestic oil shale development as a means of ensuring energy independence, further bolstering the Oil Shale Market.