Rising Energy Demand

The Shale Gas Market is experiencing a surge in energy demand, driven by industrial growth and urbanization. As economies expand, the need for reliable and affordable energy sources becomes paramount. Shale gas, with its abundant reserves, offers a viable solution to meet this increasing demand. In 2025, the demand for natural gas is projected to rise by approximately 3.5% annually, indicating a robust market for shale gas. This trend is further supported by the transition towards cleaner energy sources, as shale gas emits fewer greenhouse gases compared to coal. Consequently, the Shale Gas Market is poised to benefit from this shift, as more countries seek to diversify their energy portfolios and reduce carbon footprints.

Geopolitical Influences

Geopolitical factors significantly impact the Shale Gas Market, as energy security becomes a focal point for many nations. Countries rich in shale gas reserves are strategically positioned to influence global energy dynamics. The ongoing shifts in trade policies and international relations can create both opportunities and challenges for the industry. For instance, nations seeking to reduce dependence on imported energy may invest heavily in domestic shale gas production. In 2025, it is expected that geopolitical tensions will continue to shape energy strategies, with countries prioritizing energy independence. This trend could lead to increased investments in the Shale Gas Market, as nations strive to secure their energy futures.

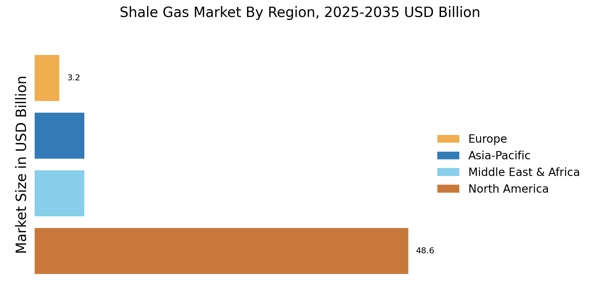

Investment Opportunities

The Shale Gas Market presents numerous investment opportunities, attracting both domestic and foreign investors. As the demand for natural gas rises, the potential for lucrative returns on investment becomes apparent. In 2025, the market is projected to grow at a compound annual growth rate of approximately 4%, driven by increasing consumption and technological advancements. Investors are particularly interested in regions with established shale formations, where production costs are lower and infrastructure is already in place. Furthermore, the ongoing development of new technologies may enhance profitability, making the Shale Gas Market an appealing prospect for investment. This influx of capital could further stimulate growth and innovation within the sector.

Technological Innovations

Technological advancements play a crucial role in the Shale Gas Market, enhancing extraction and production efficiency. Innovations such as hydraulic fracturing and horizontal drilling have revolutionized the way shale gas is harvested, significantly reducing costs and increasing output. In recent years, the average production per well has seen a notable increase, with some regions reporting up to 50% higher yields due to improved techniques. These advancements not only make shale gas more economically viable but also attract investments into the sector. As technology continues to evolve, the Shale Gas Market is likely to witness further enhancements in production capabilities, thereby solidifying its position in the energy landscape.

Environmental Considerations

The Shale Gas Market is increasingly influenced by environmental considerations, as stakeholders seek to balance energy needs with ecological impacts. The shift towards cleaner energy sources has prompted a reevaluation of shale gas's role in the energy mix. While shale gas is often touted for its lower emissions compared to coal, concerns regarding water usage and potential contamination persist. Regulatory bodies are now focusing on establishing stringent guidelines to mitigate these risks. In 2025, it is anticipated that the industry will adopt more sustainable practices, such as water recycling and reduced flaring, to address environmental concerns. This proactive approach may enhance the public perception of the Shale Gas Market, fostering greater acceptance and support.