Market Trends

Key Emerging Trends in the Nylon market

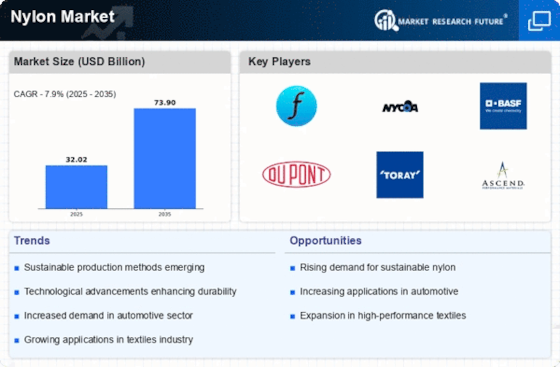

The nylon market has experienced notable trends in recent years, driven by various factors influencing supply, demand, and technological advancements. One significant trend is the growing demand for sustainable and eco-friendly nylon alternatives. With increasing environmental awareness, consumers and industries alike are seeking materials with reduced carbon footprints and less dependency on fossil fuels. This shift has prompted the development of bio-based nylons derived from renewable sources such as castor oil or biomass, offering comparable performance to traditional nylon while aligning with sustainability goals.

The automobile industry is undergoing huge growth in the APAC region and its connection with nylon is boosting the market’s operations in the region. There is large-scale infrastructural development on the way and improvisation related to the socio-economic trends are leading the Nylon Market operations towards expansion.

Moreover, the market has witnessed a surge in the adoption of recycled nylon materials. Recycling technology advancements have enabled the production of high-quality recycled nylon from post-consumer waste, such as discarded fishing nets, carpets, and plastic bottles. This trend not only addresses environmental concerns associated with plastic waste but also caters to consumer preferences for products with recycled content, driving the demand for recycled nylon across various industries including fashion, automotive, and consumer goods.

Furthermore, the nylon market has seen a shift towards customization and innovation to meet diverse industry needs. Manufacturers are increasingly focusing on developing specialty nylons tailored to specific applications, such as high-performance fibers for automotive components, durable textiles for outdoor apparel, and engineering plastics for electronic devices. This trend is fueled by advancements in polymer chemistry and manufacturing processes, enabling the production of nylons with enhanced properties such as improved strength, flexibility, and chemical resistance.

In addition to product innovation, market players are also investing in digitalization and Industry 4.0 technologies to optimize production processes and enhance operational efficiency. Automation, data analytics, and artificial intelligence are being leveraged to streamline manufacturing operations, minimize downtime, and improve product quality in the nylon industry. This trend towards digital transformation is reshaping the competitive landscape, with companies embracing smart manufacturing practices to stay agile and competitive in the global market.

Moreover, the nylon market is witnessing geographical shifts in production and consumption patterns. While traditional manufacturing hubs in North America and Europe continue to play a significant role, there is a notable expansion of nylon production capacity in emerging markets, particularly in Asia Pacific. Countries like China, India, and South Korea are becoming major players in the global nylon market, driven by factors such as rapid industrialization, urbanization, and growing consumer demand. This shift towards Asia Pacific is reshaping trade dynamics and supply chains, with implications for market participants across the value chain.

Furthermore, the nylon market is influenced by macroeconomic factors and geopolitical developments, which can impact supply availability, pricing dynamics, and market sentiment. Trade tensions, currency fluctuations, and regulatory changes can create uncertainties for market participants, influencing investment decisions and strategic planning. Additionally, factors such as energy prices, raw material availability, and transportation costs play a crucial role in shaping the competitiveness of nylon producers and their ability to meet market demand.

Leave a Comment