Rising Demand in Textiles

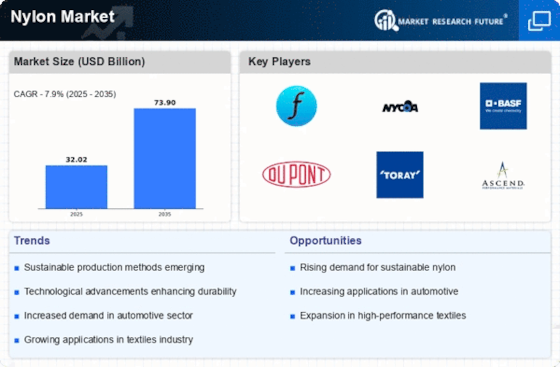

The Nylon Market is experiencing a surge in demand within the textiles sector, driven by the material's versatility and durability. Nylon Market is favored for its lightweight, strong, and elastic properties, making it an ideal choice for various applications, including apparel, upholstery, and industrial textiles. The Nylon Market is projected to grow at a rate of 5% annually, with nylon playing a crucial role in this expansion. Additionally, the increasing popularity of activewear and athleisure trends is further propelling the demand for nylon fabrics, as consumers seek high-performance materials that offer comfort and functionality. This rising demand is expected to significantly impact the nylon market, potentially leading to a market valuation exceeding 30 billion dollars by 2027.

Automotive Industry Growth

The Nylon Market is significantly influenced by the growth of the automotive sector, where nylon is increasingly utilized in various applications. The material's lightweight nature contributes to fuel efficiency, making it a preferred choice for manufacturers aiming to meet stringent emissions regulations. Nylon Market components are commonly found in interior and exterior parts, such as bumpers, trims, and under-the-hood applications. As the automotive industry shifts towards electric vehicles, the demand for lightweight materials like nylon is expected to rise. Projections indicate that the automotive nylon market could grow at a rate of 7% annually, reflecting the industry's ongoing transformation and the increasing adoption of nylon in vehicle manufacturing.

Sustainability Initiatives

The Nylon Market is increasingly influenced by sustainability initiatives as manufacturers seek to reduce their environmental footprint. The demand for eco-friendly nylon, produced from renewable resources or recycled materials, is on the rise. This shift is driven by consumer preferences for sustainable products, which has led to innovations in production processes. For instance, the introduction of bio-based nylon is gaining traction, appealing to environmentally conscious consumers. As a result, companies are investing in research and development to create sustainable nylon alternatives. This trend is expected to contribute to a compound annual growth rate of approximately 4.5% in the nylon market over the next five years, reflecting a growing commitment to sustainability within the industry.

Technological Advancements

Technological advancements play a pivotal role in shaping the Nylon Market. Innovations in manufacturing processes, such as the development of advanced polymerization techniques, enhance the efficiency and quality of nylon production. These advancements not only reduce production costs but also improve the performance characteristics of nylon products, making them more appealing to various industries. For example, the integration of automation and artificial intelligence in production lines is streamlining operations, leading to increased output and reduced waste. Furthermore, the introduction of smart textiles, which incorporate nylon fibers, is expanding the application scope of nylon in sectors like healthcare and sportswear. This technological evolution is likely to drive market growth, with projections indicating a potential increase in market size by 6% annually.

Consumer Electronics Expansion

The Nylon Market is also benefiting from the expansion of the consumer electronics sector. Nylon Market is utilized in various electronic applications, including cables, connectors, and housings, due to its excellent insulating properties and durability. As the demand for consumer electronics continues to rise, driven by technological advancements and increased connectivity, the need for high-quality nylon components is expected to grow. The consumer electronics market is projected to expand at a rate of 6% annually, which will likely bolster the nylon market as manufacturers seek reliable materials for their products. This trend indicates a promising future for nylon, as it becomes an integral part of the evolving landscape of consumer electronics.