Market Analysis

In-depth Analysis of Nylon market Industry Landscape

The nylon market is a vital sector within the global textile and polymer industries, exhibiting dynamic trends driven by a multitude of factors. One of the primary drivers of market dynamics in the nylon industry is the demand-supply equilibrium. Fluctuations in demand, influenced by factors such as fashion trends, consumer preferences, and industrial applications, directly impact market dynamics. For instance, the increasing demand for lightweight, durable materials in various end-use industries like automotive, packaging, and electronics drives the growth of nylon consumption.

the lack of technology and equipment to make optimal use of nylon for production in automobiles and the automotive sector is one factor that will restrain the Nylon Market from opting for growth from 2021 to 2027.

Moreover, technological advancements play a pivotal role in shaping market dynamics. Innovations in manufacturing processes, such as the development of bio-based nylon or recycled nylon, not only address environmental concerns but also introduce new opportunities and challenges in the market. These advancements often lead to shifts in market preferences, as environmentally conscious consumers and regulatory bodies push for sustainable alternatives.

Market dynamics in the nylon industry are also heavily influenced by geopolitical factors. Trade policies, tariffs, and geopolitical tensions can disrupt the supply chain, affecting the availability and pricing of raw materials and finished nylon products. Additionally, currency fluctuations and economic instability in key producing regions can further exacerbate market volatility.

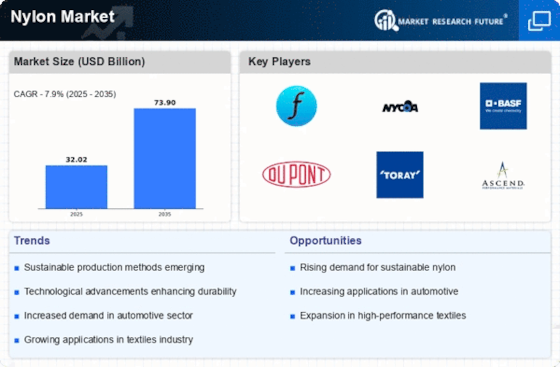

Competitive landscape and industry consolidation are significant determinants of market dynamics. The presence of key players, such as Invista, BASF, and DuPont, alongside smaller regional manufacturers, fosters intense competition. Strategies like mergers, acquisitions, and strategic partnerships are commonly employed to gain a competitive edge, consolidate market share, and expand global presence. These strategic maneuvers often result in market consolidation, reshaping the competitive landscape and influencing pricing strategies and product innovations.

Consumer behavior and preferences also play a crucial role in shaping market dynamics within the nylon industry. Changing lifestyles, fashion trends, and increasing awareness regarding sustainable and ethically sourced products drive shifts in consumer preferences. As a result, manufacturers must adapt their product offerings and marketing strategies to cater to evolving consumer demands, thereby influencing market dynamics.

Environmental regulations and sustainability initiatives are increasingly influencing market dynamics in the nylon industry. Stringent regulations aimed at reducing carbon emissions, promoting recycling, and minimizing environmental impact drive manufacturers to adopt sustainable practices and develop eco-friendly products. Consequently, there is a growing demand for bio-based, recycled, and recyclable nylon materials, leading to shifts in market dynamics and supply chain strategies.

Furthermore, market dynamics within the nylon industry are closely linked to the performance of key end-use sectors. For example, the automotive industry's demand for lightweight, high-performance materials drives innovation and investment in nylon-based composites and engineering plastics. Similarly, the growth of the packaging industry, particularly in e-commerce and food packaging segments, drives demand for nylon films and fibers, influencing market dynamics.

Leave a Comment