Aging Population

The aging population is a significant driver of the Global Nutricosmetics Industry, as older consumers seek effective solutions to maintain their youthful appearance. With a growing demographic of individuals over 50, there is an increasing demand for products that address age-related skin concerns such as wrinkles and sagging. Nutricosmetics Market that offer anti-aging benefits, such as those containing hyaluronic acid and antioxidants, are particularly appealing. This trend is likely to bolster market growth, as the industry adapts to cater to the needs of this demographic, contributing to a projected CAGR of 6.05% from 2025 to 2035.

E-commerce Growth

The rise of e-commerce significantly influences the Global Nutricosmetics Industry, providing consumers with convenient access to a wide range of products. Online platforms enable brands to reach a global audience, facilitating the distribution of nutricosmetics to diverse markets. This trend is particularly beneficial for niche brands that may struggle to establish a physical presence. The convenience of online shopping, coupled with targeted marketing strategies, enhances consumer engagement and drives sales. As e-commerce continues to expand, it is expected to play a pivotal role in the market's growth trajectory, contributing to the industry's overall expansion.

Market Growth Projections

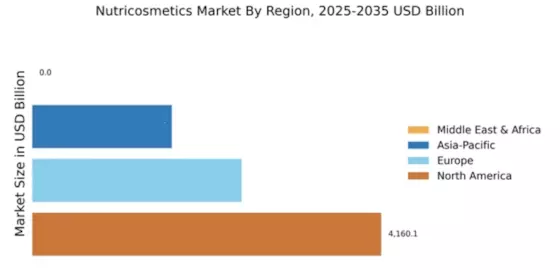

The Global Nutricosmetics Industry is poised for substantial growth, with projections indicating a market size of 8320.1 USD Billion in 2024 and an anticipated increase to 15879.8 USD Billion by 2035. This growth trajectory reflects a compound annual growth rate (CAGR) of 6.05% from 2025 to 2035. Such figures underscore the increasing consumer interest in nutricosmetics, driven by factors such as rising awareness, innovative product offerings, and the aging population. The market's expansion is indicative of a broader shift towards integrating nutrition and beauty, suggesting a promising future for the industry.

Rising Consumer Awareness

The Global Nutricosmetics Industry experiences a notable increase in consumer awareness regarding the benefits of beauty-from-within products. As individuals become more informed about the link between nutrition and skin health, the demand for nutricosmetics rises. This trend is evident in the growing interest in supplements that promote skin elasticity and hydration. For instance, products containing collagen peptides are gaining traction, as consumers seek natural solutions to enhance their beauty regimen. This heightened awareness is projected to contribute to the market's growth, with the industry expected to reach 8320.1 USD Billion in 2024.

Health and Wellness Trends

The increasing focus on health and wellness is a driving force in the Global Nutricosmetics Industry, as consumers prioritize holistic approaches to beauty. This trend encompasses a growing interest in products that support overall well-being, including those that promote skin health, hair vitality, and nail strength. As consumers seek to integrate nutricosmetics into their daily routines, brands are responding by offering comprehensive solutions that align with health-conscious lifestyles. This shift towards wellness-oriented products is likely to propel market growth, as the industry adapts to meet the evolving demands of consumers.

Innovative Product Development

Innovation plays a crucial role in the Global Nutricosmetics Industry, as companies continuously develop new formulations to meet evolving consumer preferences. The introduction of plant-based ingredients and advanced delivery systems enhances the efficacy of nutricosmetic products. For example, brands are increasingly incorporating adaptogens and superfoods into their formulations, appealing to health-conscious consumers. This focus on innovation not only attracts new customers but also retains existing ones, driving market growth. As a result, the industry is anticipated to expand significantly, with projections indicating a market size of 15879.8 USD Billion by 2035.